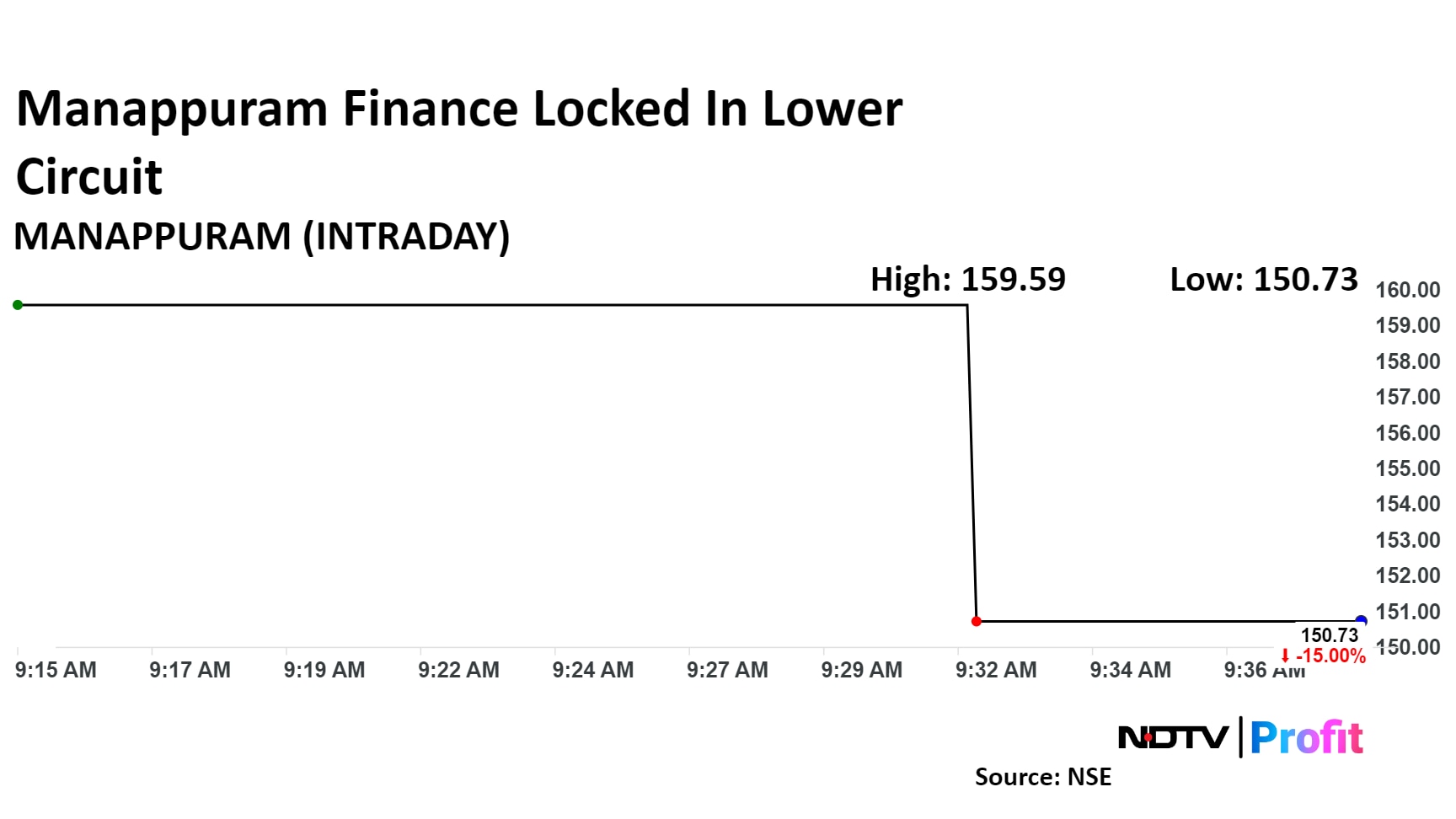

Manappuram Finance Ltd.'s share price was locked in the lower circuit on Friday, extending its decline for a seventh consecutive session to reach its lowest level since Nov. 28, 2023, after being downgraded by several brokerages.

That follows after RBI instructed the company's arm, Asirvad Micro Finance, along with three other NBFCs to 'cease and desist' sanction and disbursal of loans.

In its seven-day fall, Manappuram Finance stock has lost more than 20% of its market value. On Friday, the stock saw its worst fall since its 19.5% single-day fall on March 23, 2020.

Jefferies downgraded Manappuram Finance to 'hold' with a target price of Rs 167 apiece, implying a downside of 5.8% from the previous close.

RBI's restrictions on subsidiary Asirvad Microfinance should hurt earnings, as it accounts for 27% of consolidated assets under management, Jefferies said in a note on Oct. 17. Morgan Stanley has also downgraded the NBFC to 'equal weight' and revised the target price to Rs 170 versus Rs 262 apiece earlier.

Shares of the company fell as much as 15% to Rs 150.73 apiece, the lowest level since Nov. 8, 2023. It was locked in its lower circuit limit as of 9:43 a.m. This compares to a 0.4% decline in the NSE Nifty 50 Index.

It has fallen 12.4% on a year-to-date basis but risen 9.6% in the last 12 months. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 16.38, indicating that the stock may be oversold.

Out of the 18 analysts tracking the company, 11 maintain a 'buy' rating, five recommend a 'hold,' and two suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 34.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.