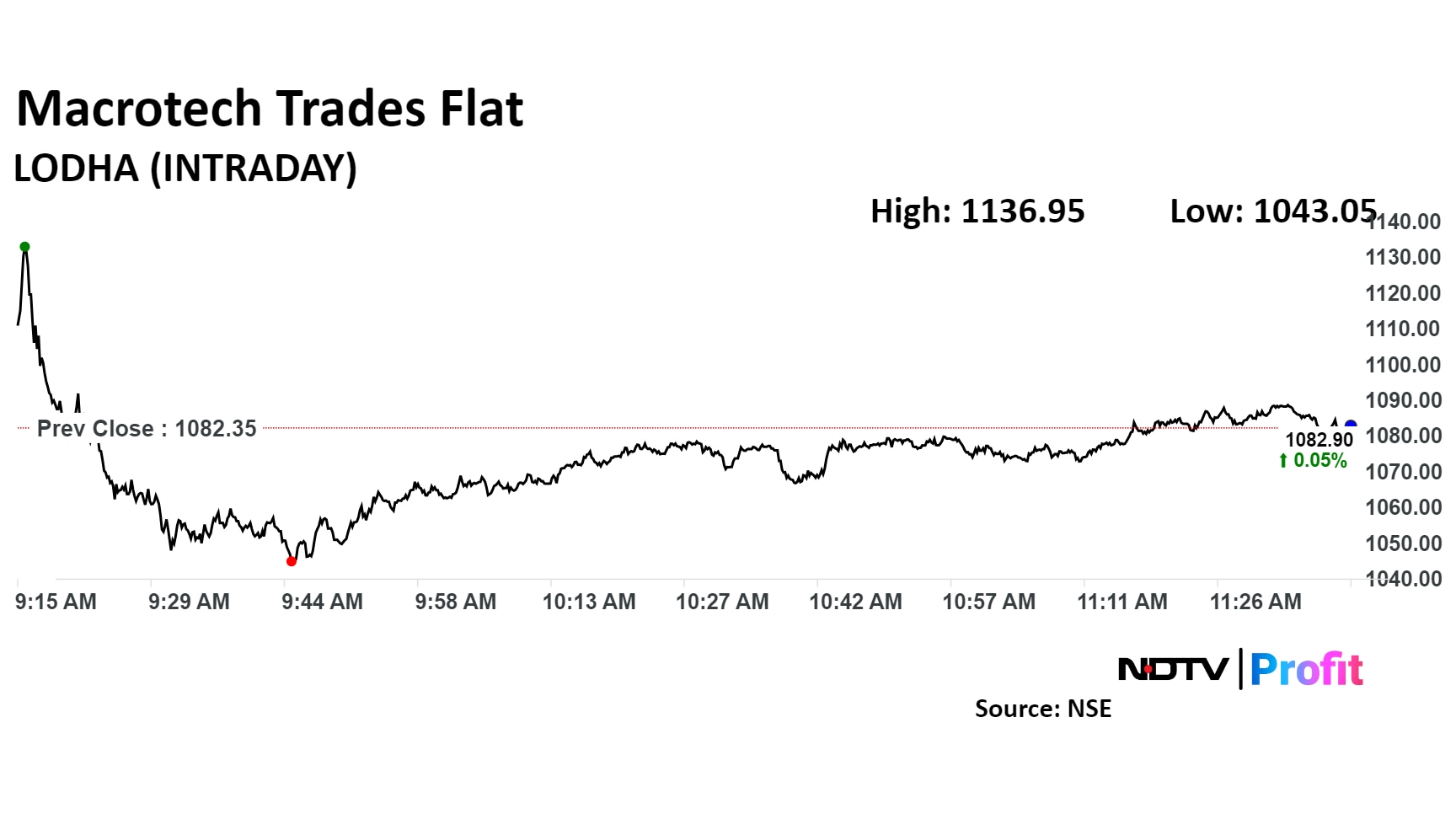

Macrotech Developers Ltd.'s share price recovered after hitting a seven-month low on Monday. The stock had opened 5% higher after reporting strong earnings in the second quarter but fell soon after to hit the lowest level in seven months.

The net profit of the company that owns the Lodha brand surged 108% year-on-year to Rs 423 crore in the quarter ended September 2024, according to an exchange filing. Its revenue jumped 50% to Rs 2,626 crore, In its investor presentation, the company said it has achieved its best-ever quarterly performance in pre-sales of Rs 4,290 crore, higher by 21% YoY, despite ‘Shradhh' falling in September.

It also noted that investment in growth led to an increase in net debt, well within the ceiling of 0.5 times of equity. Moreover, "Q2 operating cash flow of 75% was higher than Q1," and it has significant growth planned in the second half as construction picks up post monsoon and aids collections.

Motilal Oswal has maintained its 'buy' rating and target price of Rs 1,082, implying a 0.03% downside. Market participants now await management commentary in its analysts call to be held later Monday.

The stock rose as much as 5.04% to Rs 1,136.95 apiece, before falling 3.63% to hit Rs 1,043.05 apiece, its lowest level since March 18. It was trading 1.34% higher at Rs 1,095.95 as of 11:42 a.m., compared to 1.37% advance in BSE Sensex.

The stock has risen 5.82% on a year-to-date basis and 37.6% in the last 12 months. Total traded volume so far in the day stood at 0.6 times its 30-day average. The relative strength index was at 35.

Out of the 19 analysts tracking the company, 12 maintain a 'buy' rating, three recommend a 'hold,' and four suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 31.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.