Macquarie Research has expressed optimism towards private lenders amidst a challenging growth landscape for public sector banks, insurance firms, and fintech companies, grappling with regulatory hurdles and other challenges.

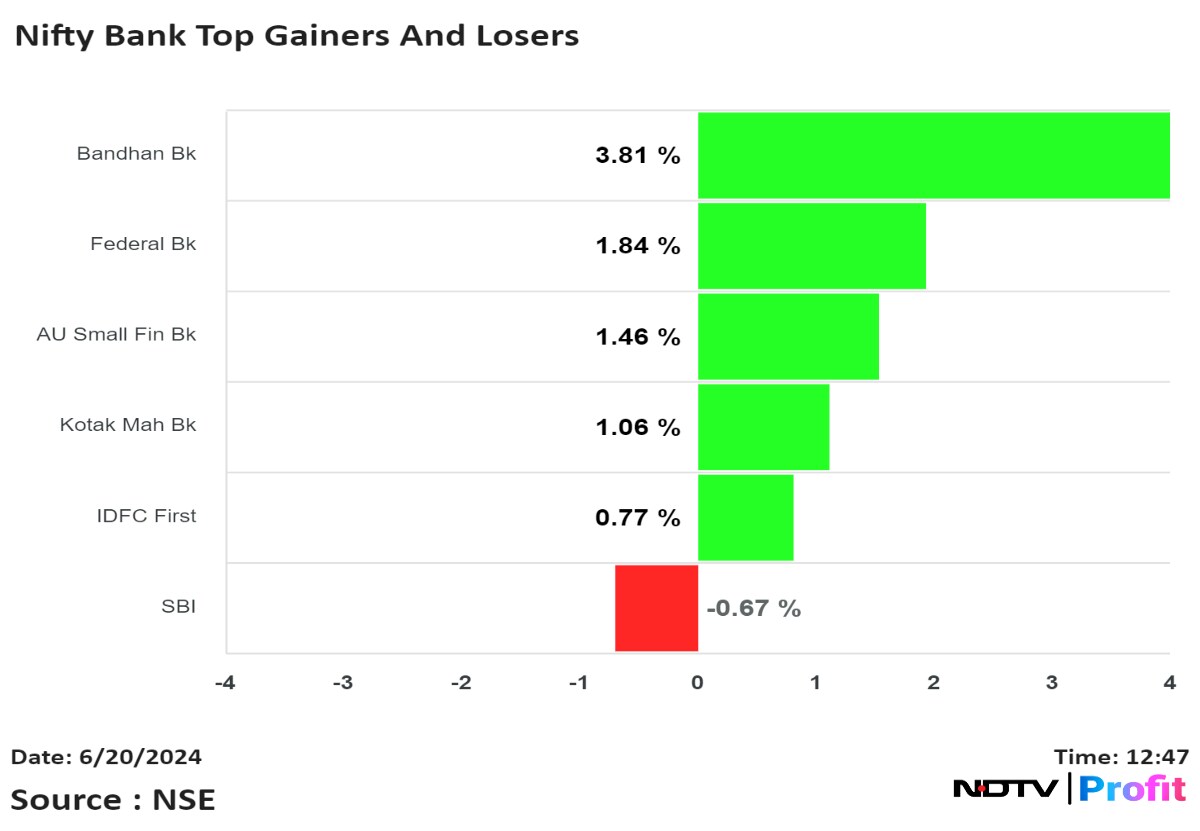

The brokerage has downgraded shares of State Bank of India to 'underperform' from 'neutral' due to multiple reasons, including the stock's recent outperformance, falling return on assets and return on equity, and possible equity-capital raise. However, it has raised its target price to Rs 665 from Rs 615 earlier, implying a potential downside of 22% from the previous close.

In the last 90 days, the stock has gained more than 15%. On June 3, it hit its all-time high of Rs 912 apiece.

Among non-banking financial companies, Bajaj Finance's rating has been downgraded to 'underperform' from 'neutral' due to its outlook for lower growth, falling RoE and a delayed rate-cut cycle. Macquarie also downgraded the rating of Cholamandalam Investment and Finance Co. and Mahindra & Mahindra Financial Services Ltd.'s rating from 'neutral' to 'underperform'.

The brokerage remains cautious in the insurance space but has upgraded SBI Life Insurance Co. to 'outperform' from 'neutral' as it is affected less by the IRDAI regulations, it said. "We expect it to deliver sector-leading VNB (value of new business) growth of 15%, and valuations in that context are reasonable in our view."

Kotak Mahindra Bank Ltd. and City Union Bank Ltd., which have underperformed in the last 12–24 months, got a rating upgrade to 'outperform' from 'neutral'. The target price of Kotak has been raised to Rs 2,025 apiece from Rs 1,860, implying an upside of nearly 16%. For City Union bank, the brokerage has revised target to Rs 180 from Rs 160 earlier.

In the last 12 months, City Union Bank has risen over 30%, but Kotak Mahindra Bank has fallen over 4%. On Thursday, shares of Kotak Mahindra Bank hit Rs 1,789.85 apiece, its highest level since April 24, and those of City Union Bank hit Rs 167.5 apiece, a six-month high.

The brokerage firm said that despite a lower loan-growth environment, it expects private sector banks to report healthy RoAs and RoE over the next three years and remain a steady power of compounding stories.

Macquarie said these banks are less affected by expected credit loss due to regulations and most of them carry contingent buffers. "We do not see any adverse asset-quality outlook," it said.

The brokerage also said that a delayed rate-cut cycle further cushions the net interest margins for them in the near term.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.