The LTIMindtree Ltd. stock saw several brokerages raise their target price, citing recovery in the market and deal ramp-ups starting to reflect in revenue. The Indian IT major noted green shoots in artificial intelligence foundation and high-priority transformation in its post-result management commentary, analysts said.

The technology consulting company's revenue rose 2.8% over the previous three months to Rs 9,142.6 crore in the quarter ended June 30, 2024, according to an exchange filing. Revenue on a year-on-year basis was up 5.1%. Profit, however, on a YoY-basis dipped 1.5%, while sequentially it rose 3.1%. The margin for the quarter expanded by 30 basis points to 15%.

LTIMindtree Q1 Results: Key Highlights (QoQ)

Revenue up 2.8% at Rs 9142.6 crore (Bloomberg estimate: Rs 9074.6 crore)

Net profit up 3.1% Rs 1,135 crore (Bloomberg estimate: Rs 1,161.2 crore)

Ebit increased 4.8% to Rs 1371 crore (Bloomberg estimate: Rs 1389 crore)

Margin expanded 30 basis points to 15% (Bloomberg estimate: 15.3%)

Brokerages' Views

The management said it has noted early signs of recovery in high-priority transformation projects and the foundation of AI projects, especially in banking and financial services segments and technology verticals, Citi Research said.

The brokerage has raised the price target from Rs 4,290 to Rs 4,780 apiece.

LTIMindtree has reported better results than Berstein's expected because revenue from deal wins in fiscal year 2024 has started to flow in, particularly from the financial services sector. Clients in this segment have started to ramp up their expenditure on high-priority programmes, with strong momentum across sub-segments.

Bernstein kept its rating 'market perform' and target price unchanged on the stock at Rs 4,800 apiece.

The software service provider's Ebit margin expanded to 30 basis points sequentially to 15% because of one-off project cancellation impact and operational efficiencies, Bernstein said in a note on Thursday.

Jefferies sees margin pressure going forward due to an increase in hiring. It has maintained its rating of 'underperform' but raised the target price to Rs 4,920 apiece from Rs 3,960 apiece.

According to Jefferies, LTIMindtree's utilisation is at its peak, and there is limited scope to cut subcontracting costs.

Citi Research has also increased valuation multiples to 26 times their March 2026 earnings per share estimates, implying that LTIMindtree's growth outlook has improved, according to a note from the brokerage on Thursday.

"While the improved outlook may help the stock in the near term, we think the 20% bounce from low prices is partly this," Citi Research said.

A decline in the health vertical impacted LTIMindtree's growth during April–June, according to brokerages. Meanwhile, financial, technological, and manufacturing-led growth.

Revenues from the company's top five clients increased 50 basis points sequentially to 28.8% of total revenue, Citi Research and Bernstein noted.

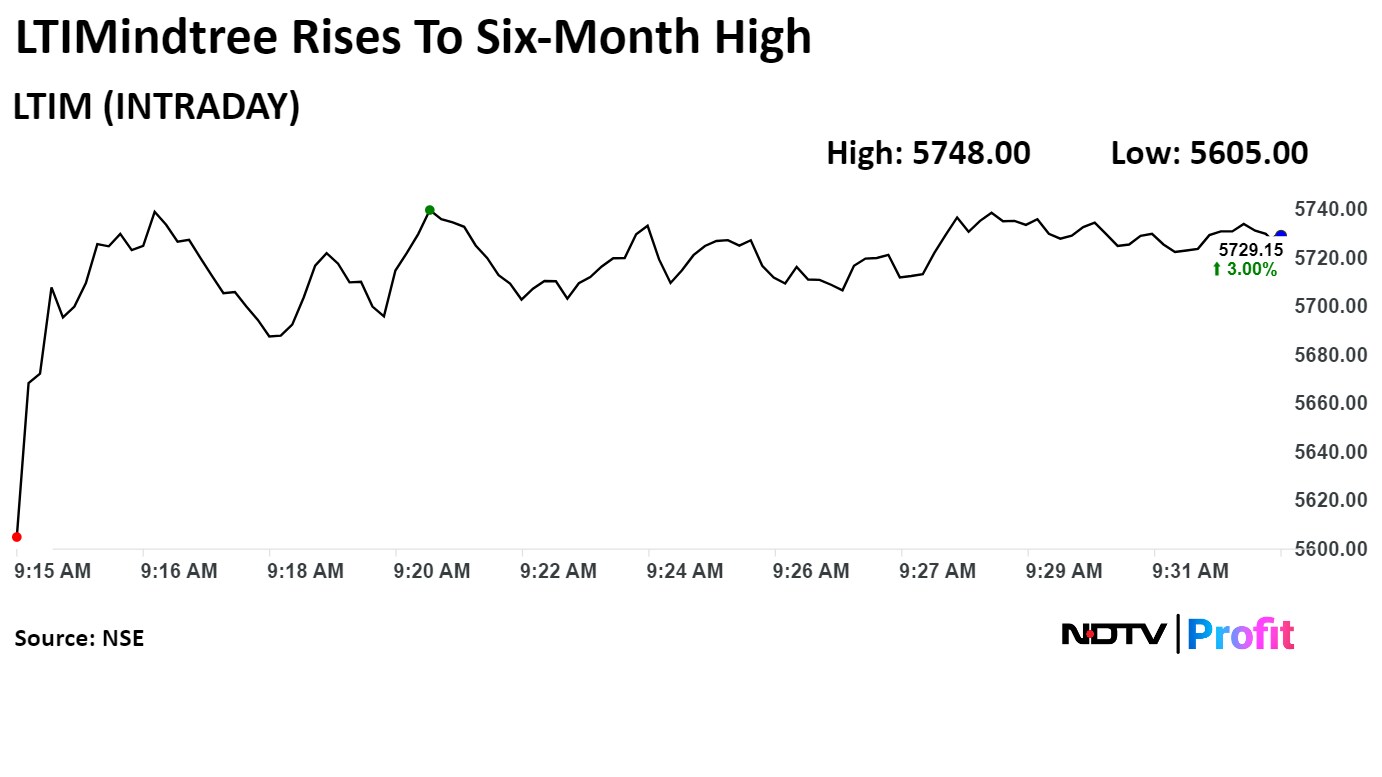

The stock rose 3.37% to Rs 5,750.00, the highest level since Jan 18. It was trading 3.26% higher at Rs 5,743.70 as of 09:36 a.m., as compared to 0.36% declined in the NSE Nifty 50 index.

The scrip gained 14.85% in 12 months, and fell 8.95% on year to date basis. Total traded volume so far in the day stood at 1.18 times its 30-day average. The relative strength index was at 76.66, which implied the stock is overbought.

Out of 41 analysts tracking the company, 17 maintain a 'buy' rating, 11 recommend a 'hold,' and 13 suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 3.5%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.