Larsen & Toubro Ltd.'s share price rose on Monday after JPMorgan initiated coverage with an 'overweight' rating and a target price of Rs 4,360, implying an upside of 25% from the previous close.

The stock is trading at 25 times fiscal 2026 core earnings per share with a 23% earnings-per-share CAGR over fiscal 2024-2027, according to JPMorgan. It believes that the company offers an attractive combination of growth at a reasonable valuation and expects 60 basis points of core margin expansion over fiscal 2024-2027. It also expects the company to be well suited to benefit from capex tailwinds in India and the Middle East.

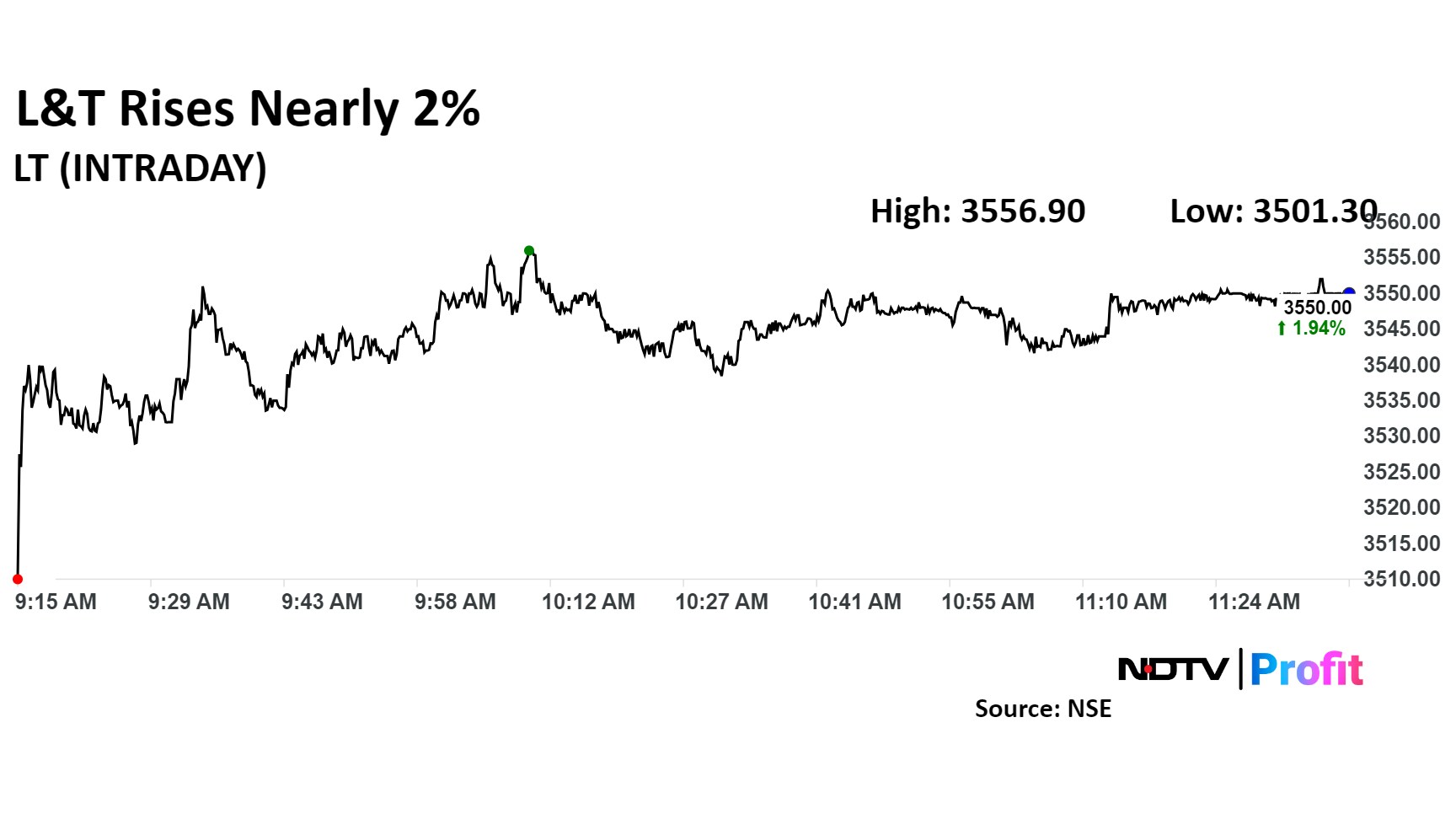

The stock was among the top three gainers in the Nifty 50 index as of 11:45 a.m.

Shares of the company rose as much as 2.1% to Rs 3.556.90 apiece. The stock pared gains to trade 1.9% higher at Rs 3,549.20 apiece as of 11:41 a.m. This compares to a 0.7% advance in the NSE Nifty 50 index.

The stock has risen 0.68% on a year-to-date basis and 21.18% in the last 12 months. The relative strength index was at 45.1.

Out of 36 analysts tracking the company, 30 maintain a 'buy' rating, four recommend a 'hold,' and two suggest a 'sell,' according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.