L&T Finance Ltd.'s share price fell nearly 5% to its lowest in over four months on Tuesday after HSBC Global Research cut its target price on the stock, citing likely disruption in asset under management and earnings per share growth in the near term due to sectoral headwinds in microfinance.

HSBC Global Research reduced the target price to Rs 180 apiece from Rs 195 apiece, implying an upside of 14.05% from Monday's closing price.

HSBC Global Research also cut the EPS estimates by 3.5–6.3% over the financial year 2025–2027 to factor in lower asset under management, pressure on net interest margin, and higher credit costs, the brokerage said in a note on Monday.

Despite L&T Finance's efforts to safeguard itself from microfinance portfolios, it'll be unlikely to withstand headwinds from the sector, HSBC Global Research said. This will lower the finance company's disbursements and yields and increase near-term credit costs.

Asset quality performance at L&T Finance was better than peers in the microfinance sector due to stricter underwriting, investments made in collections, and low exposure to levered customers, HSBC Global Research noted.

In case the asset quality in the microfinance sector starts to improve from the fourth quarter of the current financial year, L&T Finance may see some improvement in its earnings per share outlook, HSBC Global Research said.

"At the moment, we do not anticipate the MFI stress to last longer than one to two quarters,"HSBC Global Research

The brokerage maintained its 'buy' rating on L&T Finance because it thinks that the finance company has the ability to bounce back sharply once operating conditions in microfinance improve. Improvement is expected from December.

The improvement—if it starts to happen—will uplift in L&T Finance's disbursement growth, NIM, and credit cost estimates. "As a result, we remain constructive on L&T Finance and reiterate our buy rating," HSBC Global Research said.

L&T Finance Q2 Results: Key Highlights (YoY)

Net Profit rose 18.6% to Rs 689 crore vs Rs 581 crore

Total Income rose 15.6% to Rs 4,020 crore vs Rs 3,476 crore

NII up 18% at Rs 2,178 crore versus Rs 1,843 crore.

Source: Exchange Filing

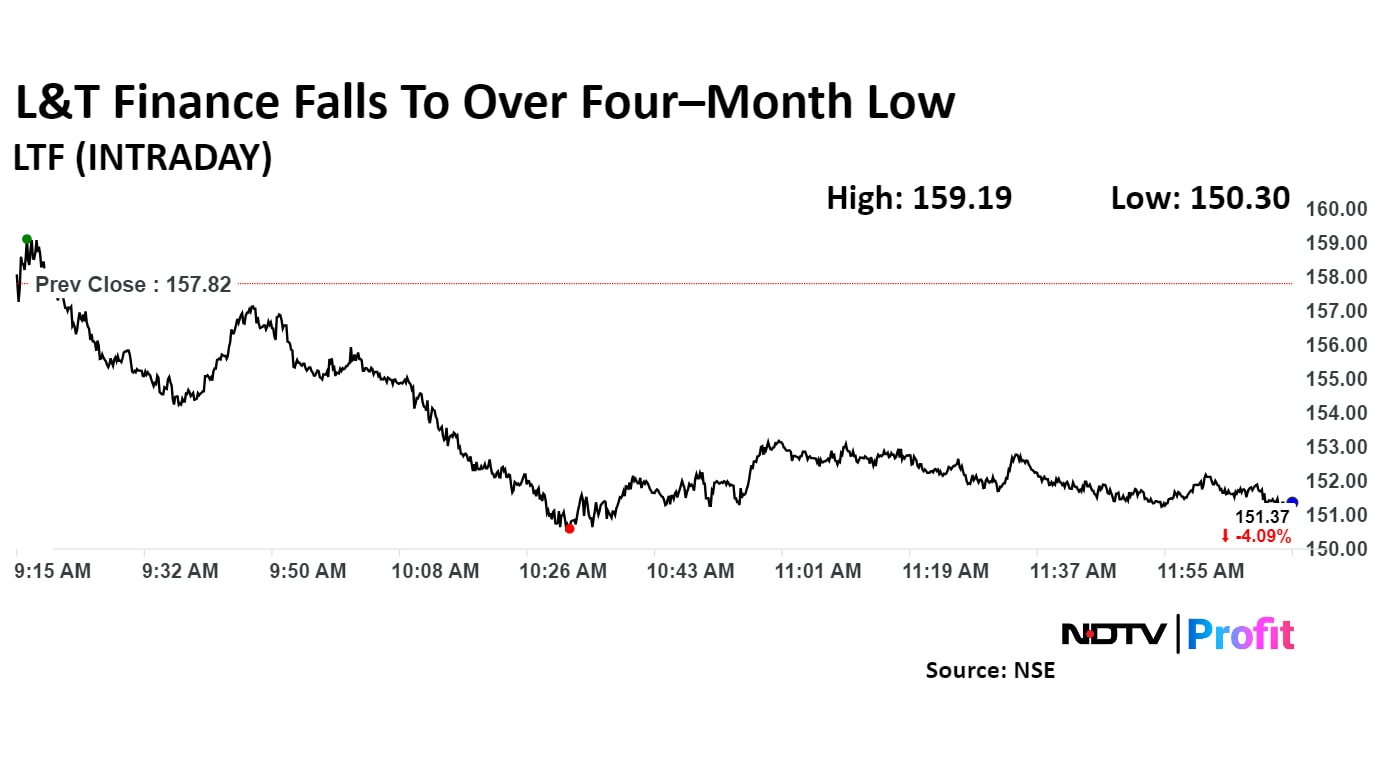

L&T Finance share price declined 4.09% down at Rs 151.37 apiece.

L&T Finance Ltd. share price decline 4.76% to Rs 150.30 apiece, the lowest level since June 5.

The stock gained 14.73% in 12 months, while it declined 7.97% year-to-date. Total traded volume so far in the day stood at 3.3 times its 30-day average. The relative strength index was at 28.00, which implied the stock is oversold.

Out of 19 analysts tracking the company, 14 maintain a 'buy' rating, one recommends a 'hold,' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 27.2%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.