Oil Marketing Companies—Indian Oil Corp. Ltd., Bharat Petroleum Corp., and Hindustan Petroleum Corp.—are in focus on Tuesday after they raised the prices of 19 kg LPG cylinders by Rs 39 with effect from Oct. 1.

Following this hike, the new price in Delhi is Rs 1,740, up from Rs 1,691.50, while in Mumbai, the price has increased to Rs 1,692.50 from Rs 1,644, up by Rs 48. This marks the third consecutive month of a price hike, though the current prices in both cities remain below April levels.

"OMCs are currently earning supernormal marketing margins," said Yogesh Patil, director of research at Dolat Capital.

He noted that integrated margins stand at Rs 15 per litre compared to Rs 11-11.5 per litre previously, adding that "a petrol price cut of Rs 4-5 per litre cannot be ruled out due to high marketing margins."

The hike in LPG prices is unlikely to have a material impact on OMCs, as "the companies are still expected to make losses", Patil said. He maintained a negative rating on IOCL, BPCL, and HPCL in the long run, citing "peak valuations" and noted that upcoming cuts in aviation turbine fuel prices could negatively impact the stocks further.

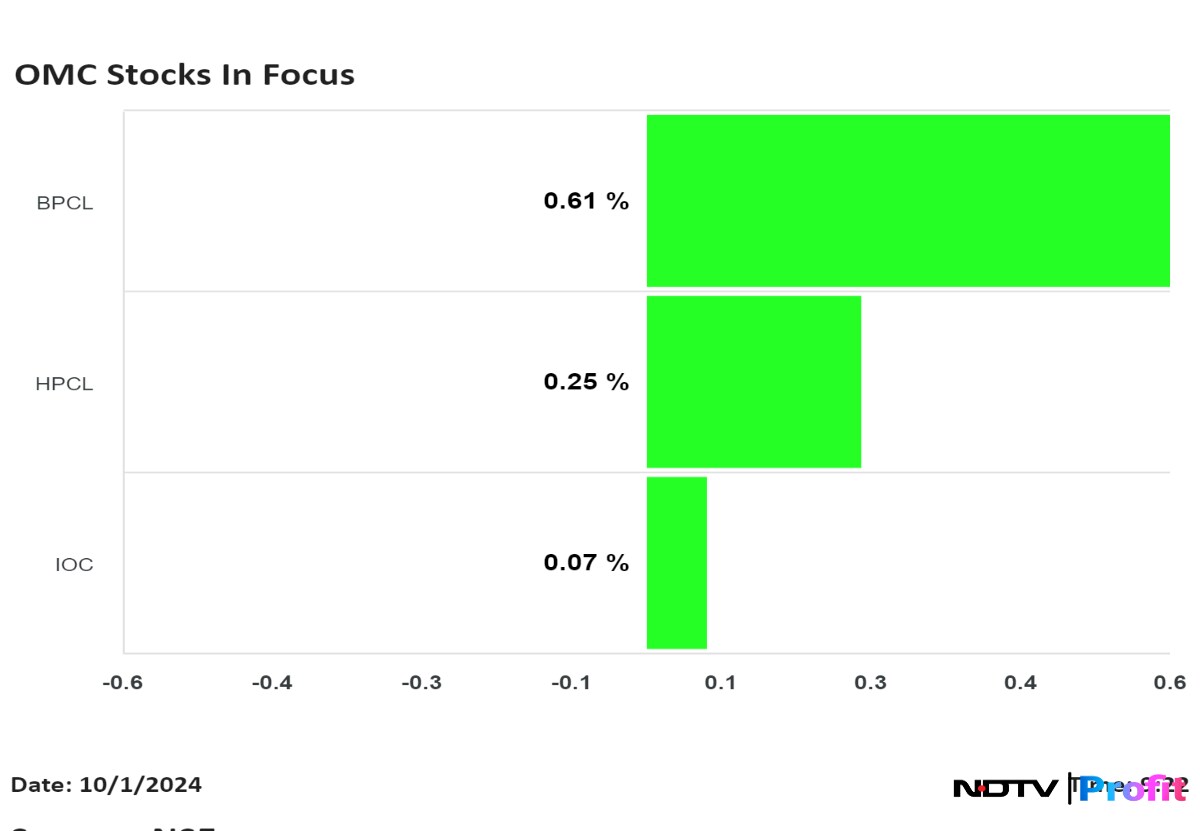

Shares of Bharat Petroleum and Hindustan Petroleum were trading 0.90% and 0.80% higher, respectively, while those of Indian Oil Corp. fell 0.57% as of 9:27 a.m. This compares with the 0.29% advance in the NSE Nifty 50.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.