Lemon Tree Hotels Ltd. dropped to an over-two-month low on Thursday after its profit fell, missing analysts' estimates.

The luxury hotel operator's net profit fell 28.6% year-on-year to Rs 20 crore in the quarter ended June 2024, according to an exchange filing. That compares with the Rs 25 crore consensus estimates of analysts polled by Bloomberg.

Lemon Tree Hotels' total expenses increased 30% on the year to Rs 153 crore. However, on a sequential basis, total expenses fell by 2%, it said.

The company's consolidated top line increased by 19.6% year-on-year to Rs 268 crore. This was in line with Bloomberg's estimate of Rs 224 crore.

Consolidated operating profit rose 8.5% on the year to Rs 115 crore, but fell short of Bloomberg's forecast of Rs 123 crore due to higher other expenses. Lemon Tree Hotels' consolidated margin declined 430 basis points to 43% from 47.3%. The Bloomberg Survey projected a 46% margin for the period.

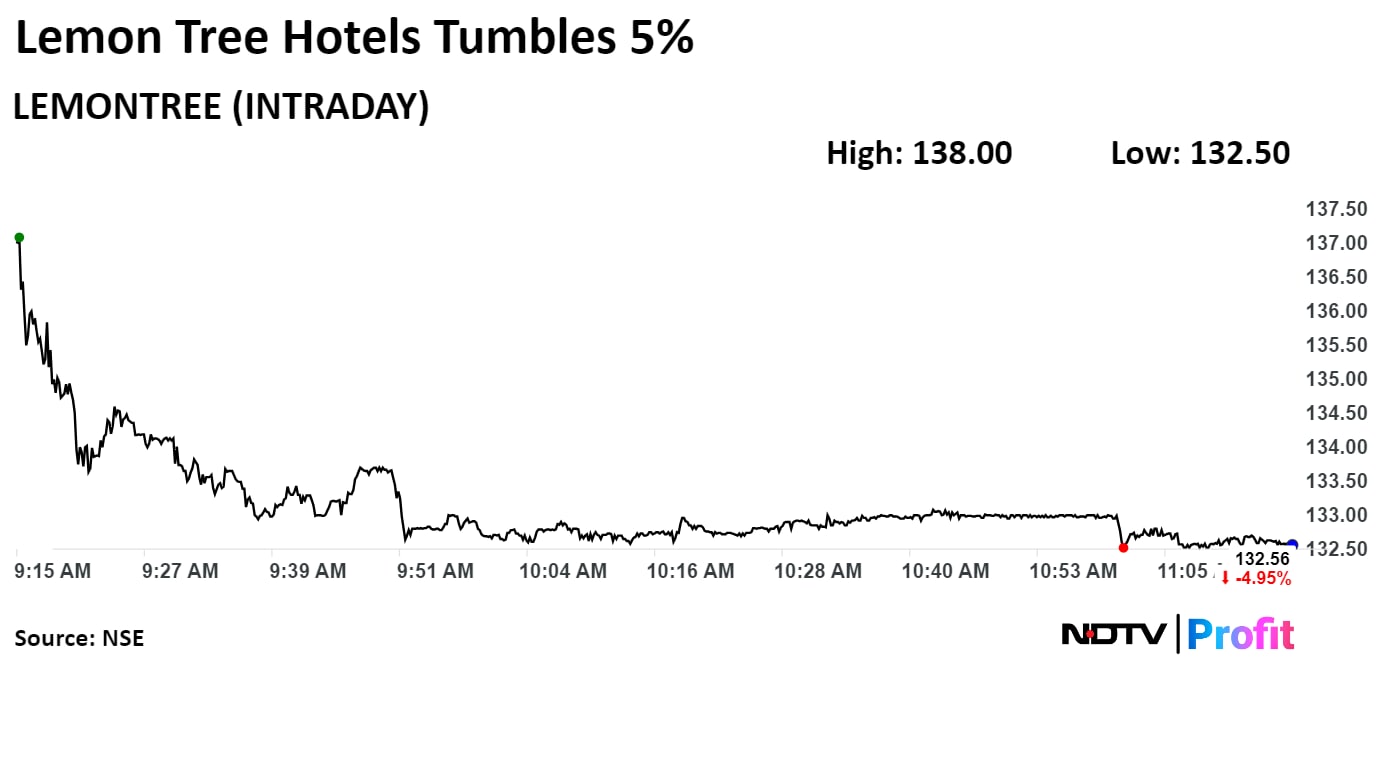

Shares of Lemon Tree Hotels declined 5.65% to Rs 131.60, the lowest level since June. It was trading 5.12% lower at Rs 132.34 as of 11:41 a.m., compared to 0.39% decline in the NSE Nifty 50 index.

The stock gained 39.29% in the last 12 months and rose 9.98% on year to date basis. Total traded volume so far in the day stood at 4.0 times its 30-day average. The relative strength index was at 32.73.

Out of 19 analysts tracking the company, 16 maintain a 'buy' rating, one recommend a 'hold,' and two suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 18.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.