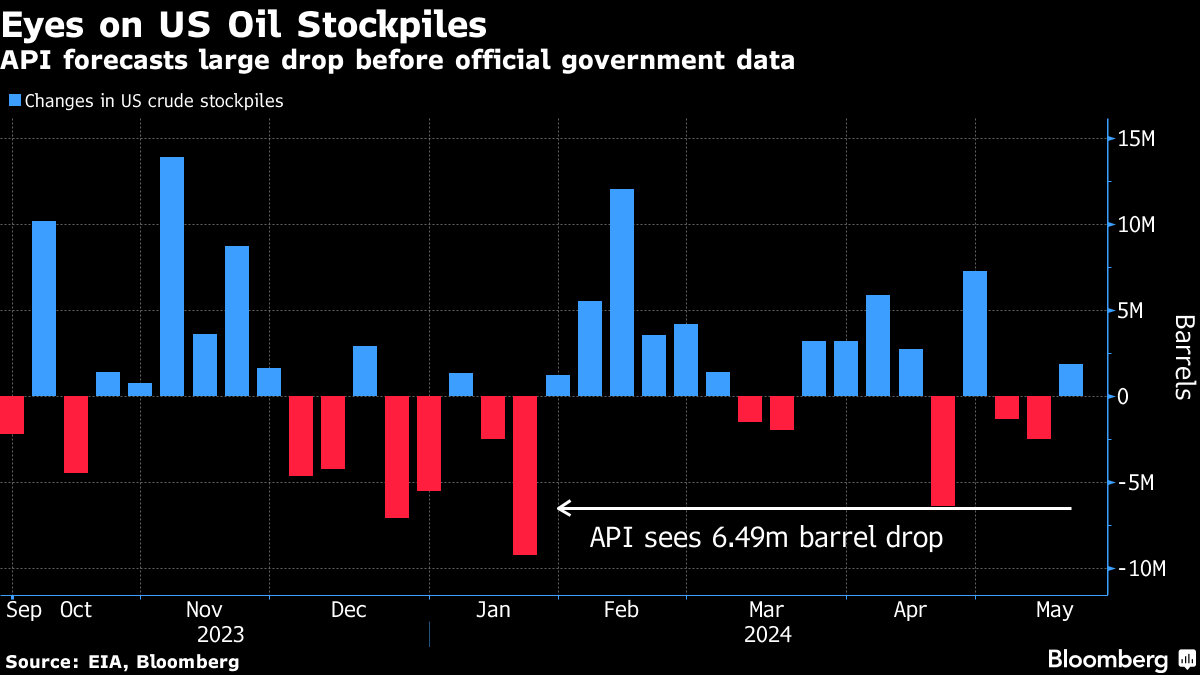

(Bloomberg) -- Oil pared declines after US data showed the biggest drop in the nation's stockpiles in five weeks, signaling a tighter market as traders await Sunday's OPEC+ meeting for more guidance on supply.

West Texas Intermediate crude traded below $79 a barrel after slipping in the previous session. US inventories fell by 4.16 million barrels last week, compared with a median of 1.15 million in analyst estimates compiled by Bloomberg.

Commodities followed stocks lower amid lingering concern that interest rates will stay higher for longer. The bearish sentiment offset worries about an attack on a ship in the Red Sea and an Israeli official's prediction that the country won't be able to defeat Hamas before the end of this year. Meanwhile, the prompt timespread for Brent crude has weakened into a contango structure for the first time since January, suggesting abundant supply.

Oil has risen this year on geopolitical conflicts and production curbs by the Organization of the Petroleum Exporting Countries and its allies. The group will likely consider factors including a drop in prices over the past month, a weaker Chinese demand outlook and healthy supplies from the Americas when ministers convene on Sunday. The alliance is widely expected to prolong output cuts into the second half of 2024.

“There's some caution in the market, with attention on slowing consumption just before the high-demand summer season,” said Will Sungchil Yun, a senior commodities analyst at SI Securities Corp. “But a surprise from OPEC+ can't be completely ruled out and that could drive prices immediately higher.”

The market will also be looking at US oil and fuel stockpiles data due later on Thursday for a read on demand as the summer driving season gets under way. US crude inventories fell by 6.49 million barrels last week, according to the American Petroleum Institute, which would be the largest drop since January if confirmed by official figures.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.