(Bloomberg) -- Oil edged lower after four straight weekly gains, even as traders tracked twin threats to crude production posed by a hurricane in the US and wildfires in Canada.

Brent fell toward $86 a barrel after rising more than 8% in the run of gains from early June, while West Texas Intermediate was around $83. Beryl, once again a hurricane, is set to continue strengthening as it nears the Texan coast, with oil companies adjusting operations. Wildfires in Alberta are also threatening supply.

While Beryl “puts some offshore oil-and-gas production at risk, the concern when the storm makes landfall is the potential impact it could have on refinery infrastructure,” said Warren Patterson, head of commodities strategy for ING Groep NV in Singapore. “Any prolonged refinery outages would be bearish for crude oil and bullish for refined products.”

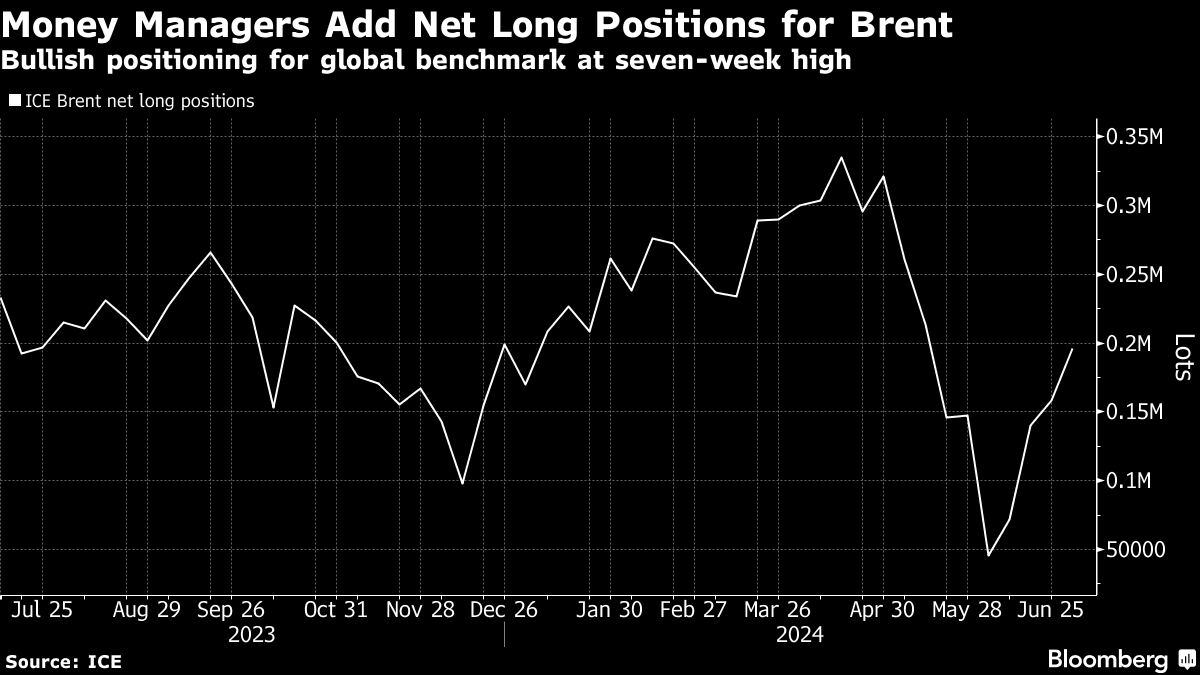

Oil touched the highest level since late-April last week as expectations for higher demand and lower stockpiles over the summer months pushed prices higher. While the rally has faced some resistance from signs of weakness in China, the largest crude importer, wider market expectations for US interest-rate cuts have helped to buoy risk assets, including commodities. Money managers increased their net-long positions on Brent for a fourth week.

Despite the intraday move lower, widely watched metrics still point to a solid market. Brent's prompt spread — the difference between its two nearest contracts — was 87 cents a barrel in backwardation, a bullish pattern. It was less than half that a month ago.

Traders are in line for a slew of reports this week that will shed light on global crude balances. The Organization of Petroleum Exporting Countries — which has been choking off output to bolster prices — delivers its monthly outlook, as does the International Energy Agency. In addition, there'll be a snapshot from the US Energy Information Administration.

On the geopolitical front, reformist Masoud Pezeshkian was voted in as Iran's president, seeking to restart talks with the US over a landmark nuclear deal. Elsewhere, a shock legislative election result in France saw the left-wing coalition winning, threatening political gridlock, while in the US, pressure continues to mount for Joe Biden to quit the race for president.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.