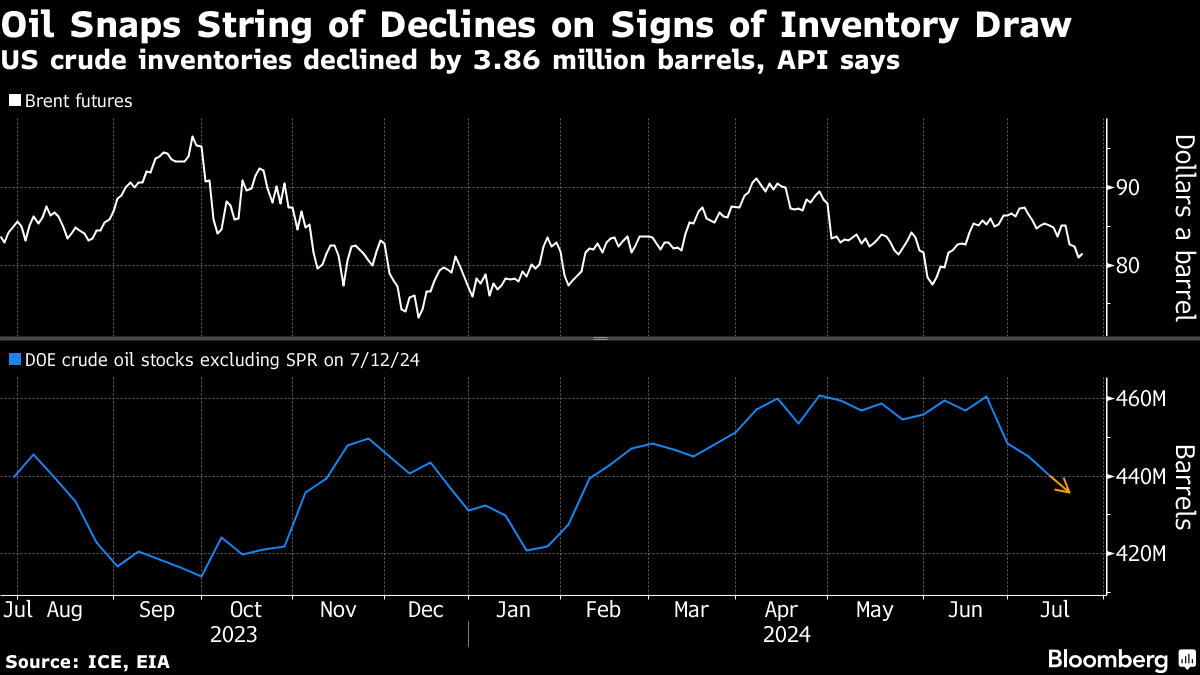

(Bloomberg) -- Oil rose, snapping a run of losses, after an industry report indicated that US crude inventories fell for a fourth week.

Brent crude rose above $81 a barrel after shedding almost 5% over the previous three sessions, with US benchmark West Texas Intermediate near $77. The industry-funded American Petroleum Institute reported stockpiles shrank by 3.86 million barrels, with a drop also seen at the Cushing, Oklahoma, hub.

If confirmed by official figures later Wednesday, a fourth decline would be the longest such stretch since September. While inventories typically fall in the third quarter, current holdings are below the five-year seasonal average.

Oil's recent bout of weakness has come amid concerns about softer demand in China, the world's biggest crude importer, with algorithmic traders compounding the downward pressure. Futures remain higher year-to-date, however, as OPEC+ presses on with output curbs, with a Bloomberg tally of Russian flows showing exports dropping to the lowest since December.

Elsewhere on the supply side, a rash of wildfires across Canada's oil patch were threatening almost 10% of the region's oil production. There were 170 blazes burning in Alberta alone, with more than 50 of them out of control.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.