(Bloomberg) -- Oil edged lower for a third day on concerns over weak Chinese demand and the impact of a stronger US dollar.

Brent crude dropped toward $84 a barrel after losing 0.6% over the previous two sessions, with West Texas Intermediate near $81. The US currency rose for a second day on Tuesday after the attempted assassination of US presidential contender Donald Trump, a headwind for commodities including oil.

Crude has advanced this year, aided by OPEC+ supply curbs and expectations of US interest-rate cuts. China, however, remains a key risk for the market, with the country's growth unexpectedly slowing to the most sluggish pace in five quarters in the three months to June. The country's Third Plenum, which sets broad economic and political policies, is taking place this week.

China's “slowdown still paints a narrative of weak consumer confidence” that is likely to put downward pressure on oil prices, said Vivek Dhar, an analyst at Commonwealth Bank of Australia. “China's Third Plenum is currently underway, but is unlikely to yield any game‑changing policy reform.”

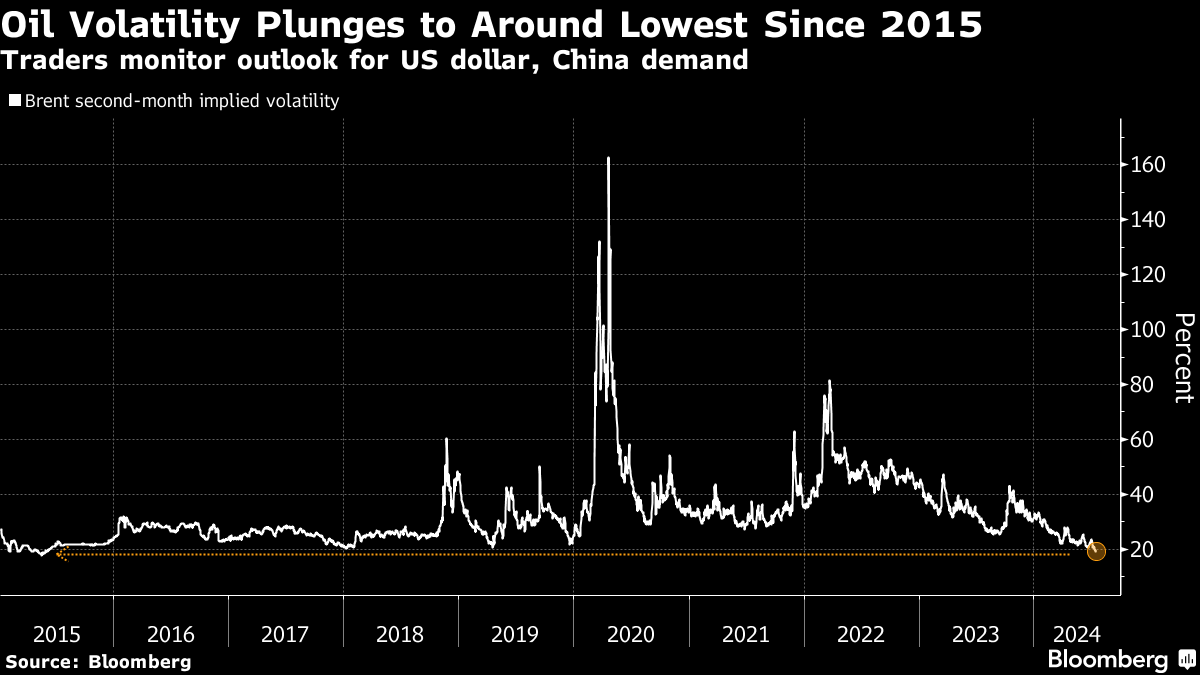

Oil's listless trading has sent volatility to a multiyear lows, with Brent's implied volatility — a forecast of the likely movement of crude that's tied to options pricing — near the lowest since 2015.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.