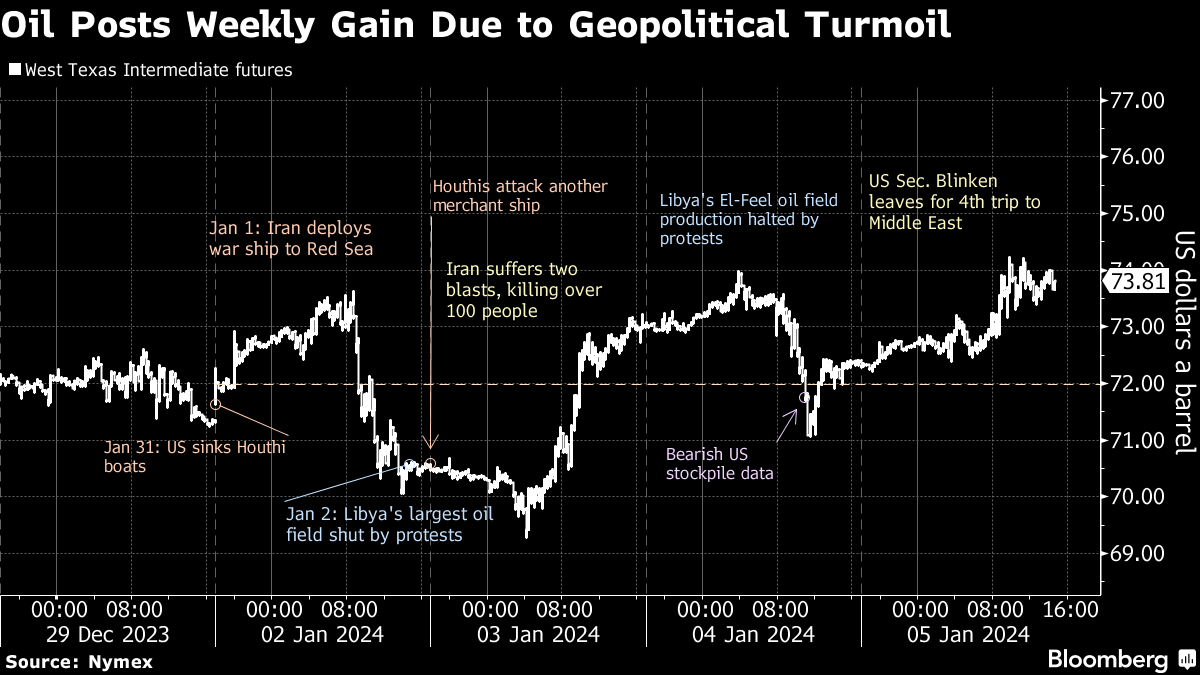

(Bloomberg) -- Oil posted a weekly advance, bolstered by output disruptions in Libya and increased tensions in the Middle East.

West Texas Intermediate rallied near $74 a barrel, posting a 3% weekly gain. Protesters in Libya have disrupted supply from the Sharara and El-Feel fields, which could take about 300,000 barrels a day out of the market. Meanwhile, the Houthi militant group in Yemen claimed another strike on a merchant ship in the Red Sea.

US Secretary of State Antony Blinken was en route to the Middle East after a deadly attack in Iran that has stoked concerns that the conflict is broadening. The geopolitical risk is offsetting bearish US stockpile data that showed large increases in gasoline and diesel inventories.

Crude's gain this week comes despite analysts turning more pessimistic on the market. Wall Street already is cutting price forecasts for this year after global benchmark Brent dropped by almost a fifth last quarter. A surge in supplies from outside the OPEC+ alliance, led by US shale drillers, is expected to continue, while consumption growth is forecast to slow.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.