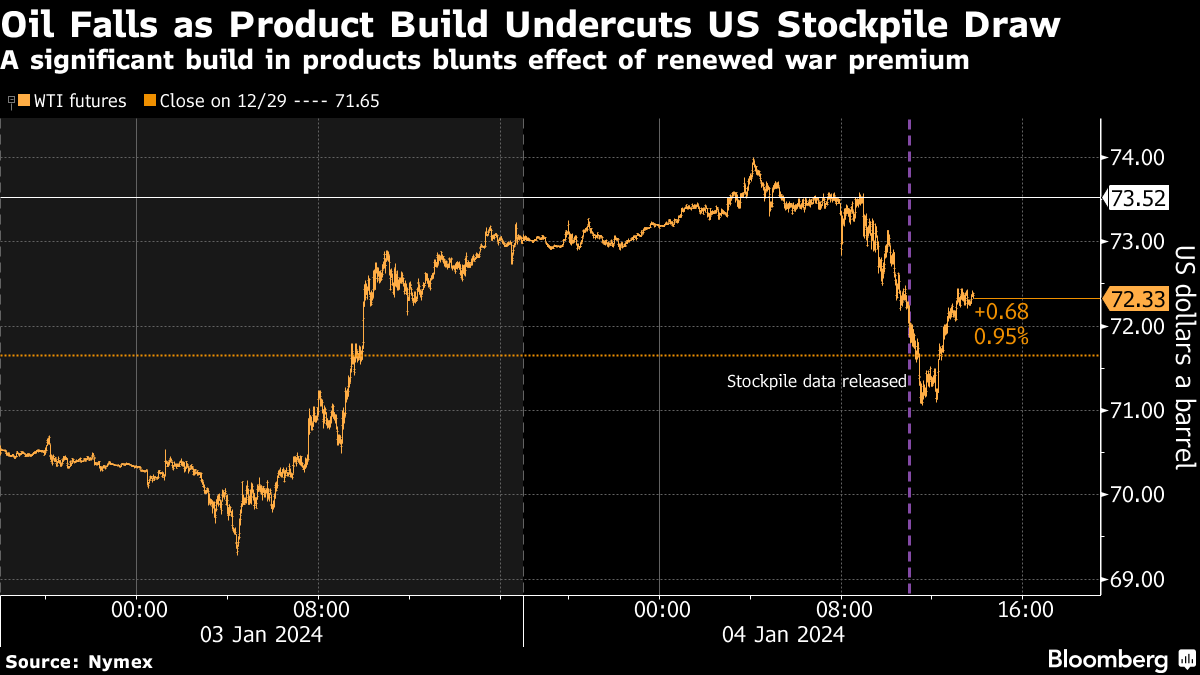

(Bloomberg) -- Oil fell as rising gasoline stockpiles in the US signaled a shaky picture for demand, undercutting the effect of output disruptions in Libya.

West Texas Intermediate edged lower to settle near $72 a barrel after swinging in a $3 range. Traders weighed rising tensions in the Middle East against data showing US gasoline inventories swelling the most since in three decades and implied demand dropping to a yearly low. Crude supplies had a more mixed picture, with inventories at the key storage hub in Cushing, Oklahoma, rising to the highest since July while total US stockpiles fell.

Crude rallied as much as 1.8% early in the session as protesters in Libya shut output from yet another oil field. The disruptions at the Sharara and El-Feel fields may take more than 300,000 barrels a day off the market.

Despite a substantial drawdown in crude inventories, the buildup in both gasoline and distillate stockpiles “is taking precedence and bringing to light that fuel demand is once again stalling,” said Dennis Kissler, senior vice president at BOK Financial. Still, the unrest in the Middle East is diverting attention from weak near-term fundamentals, contributing to greater upside potential than downside risk, he said.

In the Red Sea, Houthi militants claimed to have attacked another merchant ship this week. Meanwhile, the Islamic State claimed responsibility for an attack in Iran that killed almost 100 people participating in a ceremony to commemorate the death of a general in a 2020 US drone strike.

A renewed focus on geopolitics, both in the Middle East and Libya, is showing the potential to reintroduce a conflict premium for oil. Crude fell by about a fifth in the previous quarter as rising production from non-OPEC+ sources, including the US, threatened to outstrip demand.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.