(Bloomberg) -- Oil rose on signs that US crude stockpiles are continuing to drop, and as more attacks on vessels in the Red Sea raised the risk that Middle East supply could be disrupted.

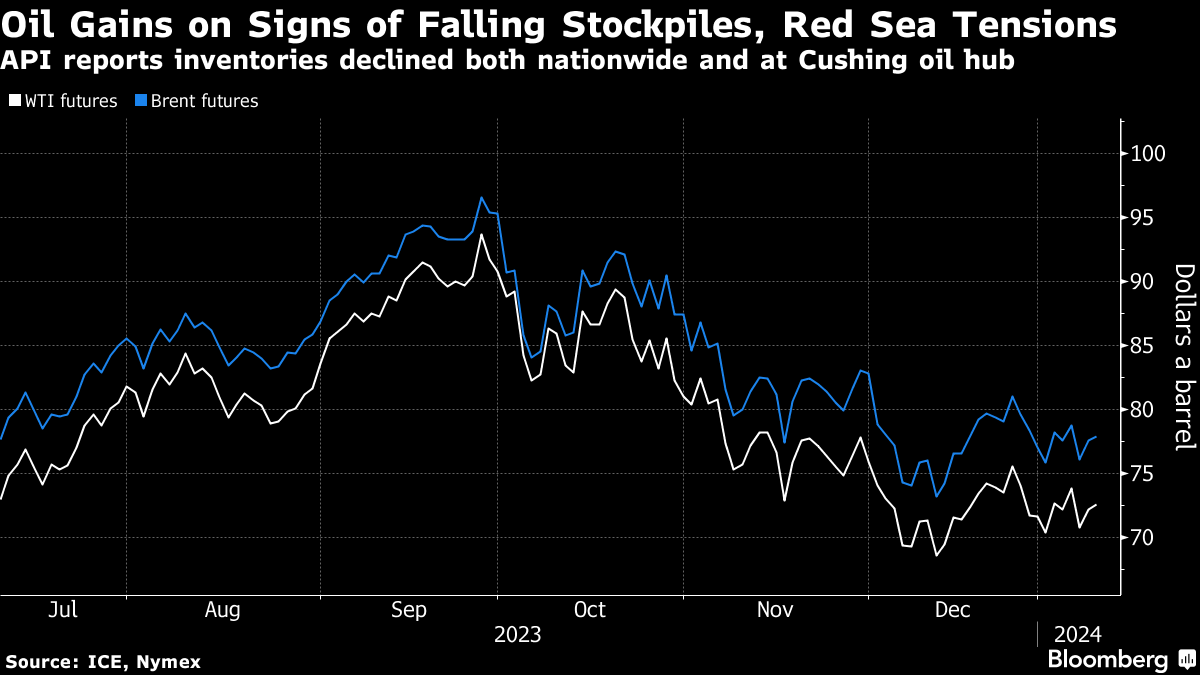

Brent gained toward $78 a barrel, while West Texas Intermediate neared $73. The American Petroleum Institute said nationwide inventories fell 5.2 million barrels last week, with levels at Cushing also down. The Energy Information Administration, meanwhile, forecast a narrow global supply deficit.

Iran-backed Houthi rebels launched further attacks on merchant vessels in the southern Red Sea, although no injuries or damage were reported. The incidents — which have continued despite a US-led maritime force being deployed — are seen as a spillover from the Israel-Hamas war.

Crude has seesawed since the start of the year, rising and falling on alternate days, as traders attempt to gauge the outlook for the coming quarters. The market has been supported by OPEC+ supply cuts, tensions in the Middle East including the Red Sea, and outages in Libya. Still, a deep reduction in official prices by Saudi Arabia has suggested that there's underlying weakness.

“The confluence of factors surrounding the Middle East developments, a conflicting supply outlook, and slow global growth have been driving this wider indecision in prices,” said Yeap Jun Rong, a market strategist for IG Asia Pte.

Widely watched crude timespreads reflect a slightly firmer near-term market, with the gap between the two nearest Brent contracts at 36 cents a barrel in a bullish, backwardated structure — when prompt barrels trade at premiums to later ones. That compares with 11 cents in backwardation a week ago.

Brent closed almost 2% higher on Tuesday after the EIA said in a monthly outlook that global oil demand will outrun supply by 120,000 barrels a day in 2024. Overall US crude stockpiles shrank 4.1% in December, the biggest monthly drop since June 2021, and the EIA will release fresh data later on Wednesday.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.