(Bloomberg) -- Oil edged higher in rangebound trading as investors weighed shifting risks in the Middle East against hawkish comments from the Federal Reserve.

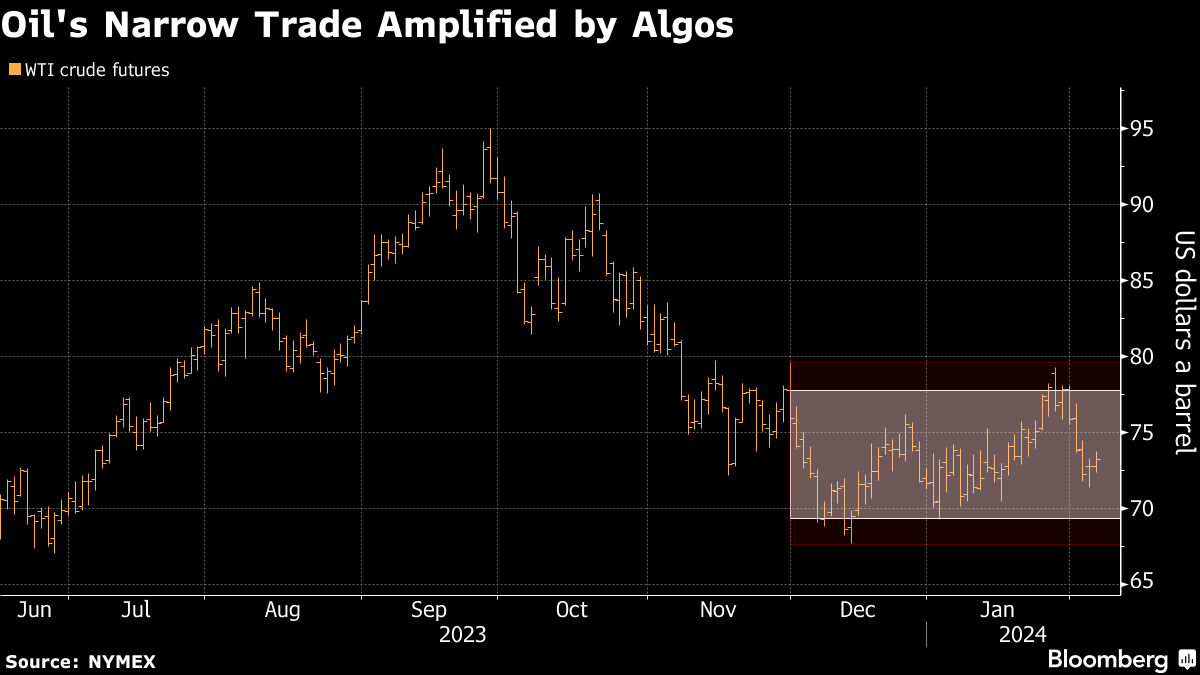

West Texas Intermediate rose 0.7% to settle above $73 a barrel after rebounding from a three-week low on Monday. Prices have now returned to the roughly $5 channel where they've spent most of this year. Algorithmic trading has exacerbated price choppiness as its trend-following traders quickly flip from bearish bets to bullish ones.

“Current price action is instead consistent with CTA buying activity across both WTI and Brent crudes, as rangebound trading activity whipsaws trend signals once again,” Daniel Ghali, a commodity strategist at TD Securities, wrote in a note to clients.

Continued tension in the Middle East is supporting prices. The US has vowed to conduct more strikes against Iranian forces and regional proxies, while Yemen's Houthi rebels claimed another attack on merchant shipping. Prices pared gains and even briefly declined after Qatari Prime Minister Sheikh Mohammed Bin Abdulrahman Al Thani said at a news conference that Hamas's response in negotiations over a ceasefire with Israel has been “positive.”

Still, the potential that the conflict will disrupt crude flows has provided a counterweight to early-week gloom in financial markets as traders discounted the chance of a Fed interest rate cut in March.

While headline crude prices remain rangebound, other corners of the market are showing more movement. BP Plc Chief Executive Officer Murray Auchincloss said the diesel market is short of supplies because of refinery shutdowns. A key Asian crude trading window has also seen heightened trading this week.

Saudi Arabia, meanwhile, kept the price of its main crude grade steady for March as the Organization of Petroleum Exporting Countries and its allies stick with production cutbacks to avert a surplus. The kingdom will need prices to average more than $90 a barrel this year to balance its budget, Fitch Ratings said. OPEC+ is set to decide in early March on whether to extend the curbs into the second quarter.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.