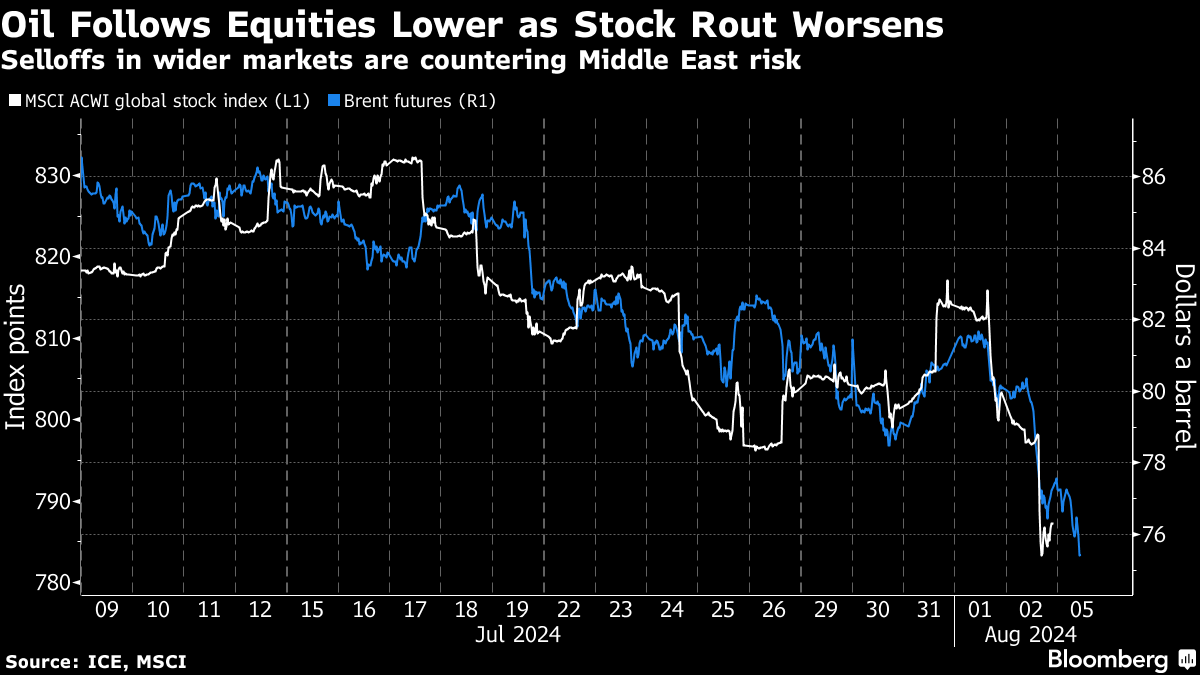

(Bloomberg) -- Oil extended losses to a new seven-month low as a selloff in wider financial markets continued to heap pressure on prices.

Brent futures slipped toward $75 a barrel — erasing this year's gains — and hit the lowest level since January. West Texas Intermediate dropped below $72. A rout in global equities worsened on Monday on concerns around the economic outlook.

The decline has weighed on an oil market that was already signaling concern about the health of demand in China, the largest crude importer.

Speculators have added to the slump, with money managers slashing bullish bets on the global Brent benchmark by the most since 2022 last week. They also have the fewest wagers on rising gasoline prices since 2017.

Oil has notched four weeks of declines on signals of faltering demand in the US and China, with the Asian nation rolling out plans to spur domestic consumption over the weekend. OPEC+ supply cuts and concerns that the conflict in the Middle East could impact production from the region had supported prices.

“The global stock markets are still under strong downward pressure, which could mean that the short-term risk is for further price drops,” said Arne Lohmann Rasmussen, head of research at A/S Global Risk Management. “The central theme for the oil market is the fear that the American economy is seriously slowing down and may even be heading into a recession.”

Elsewhere, Saudi Arabia raised the price of its flagship crude to Asia for the first time in three months, a tentative sign that the kingdom remains confident about demand in the region. It made significant cuts for Europe and the US, with prices for the former slashed by the most since the pandemic.

Still, the market is bracing for a possible attack from Iran and regional militias against Israel in retaliation for assassinations of Hezbollah and Hamas officials. The US has sent defensive reinforcements to the region.

--With assistance from Sarah Chen.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.