(Bloomberg) -- Oil declined for the fourth time in five sessions as traders tracked US-led efforts to secure a cease-fire in the 10-month old conflict between Israel and Iran-backed Hamas in the Gaza Strip.

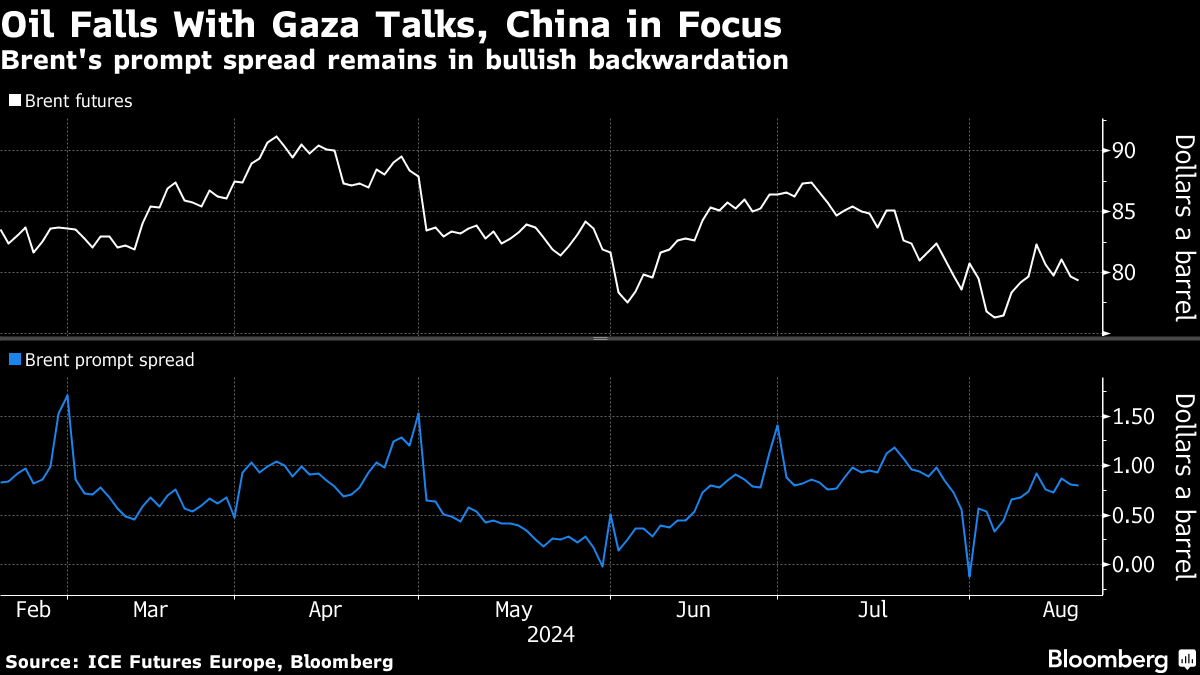

Brent traded below $80 a barrel, while West Texas Intermediate was near $76. Israel initially voiced cautious optimism over the prospect of a pause in the fighting — which could defuse tensions in the oil-producing region — but fresh disagreements are surfacing. The market is also still waiting for Iran's response to the killing of a Hamas leader in Tehran.

Adding to the recent bearish tone have been further signs of softness in China, the biggest importer. Economic growth there has slowed, and the decarbonization of the transport sector has eroded some fuel demand.

“Near-term volatility is likely to remain elevated as markets remain on alert for a potential Iran response,” said Han Zhong Liang, an investment strategist at Standard Chartered Plc in Singapore. However, “the longevity of the geopolitical risk premium hinges on whether there is a realized impact to the demand-supply balance,” he said.

Crude remains modestly higher this year, helped by OPEC+ output curbs and expectations that the Federal Reserve may soon lower borrowing costs — a potential support for energy demand. This week, investors will be on alert for clues on the path forward for US monetary policy when Fed Chair Jerome Powell addresses the annual central bankers' gathering in Jackson Hole, Wyoming.

Elsewhere, production at Libya's Waha oil field has returned to normal levels of about 300,000 barrels a day after pipeline maintenance was completed earlier than expected, according to people with knowledge of the situation. The nation's Sharara field, however, remains offline.

Timespreads suggest less tight near-term conditions. While the gap between Brent's two nearest contracts remains in a bullish, backwardated structure at 78 cents a barrel, that's down from more than $1 a month ago.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.