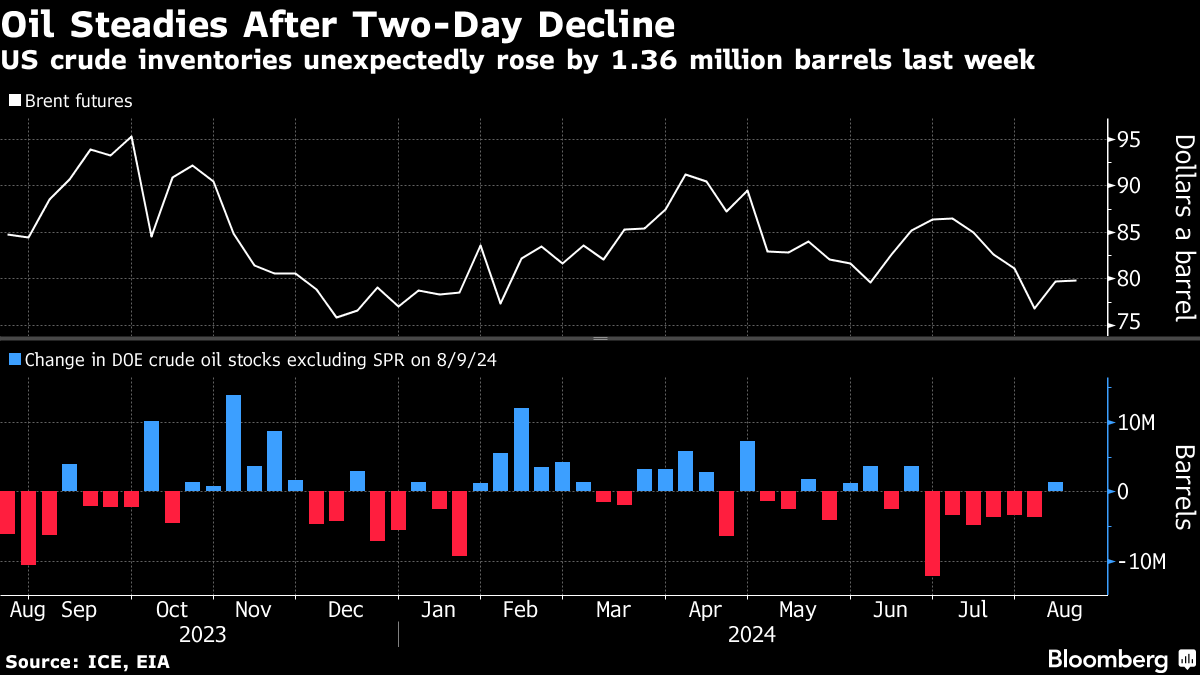

(Bloomberg) -- Oil steadied after a two-day drop as nervousness over a potential Iranian attack on Israel outweighed downbeat China data showing a decline in crude consumption.

Brent traded near $80 a barrel after falling by 3.1% over the previous two sessions, with West Texas Intermediate above $77. Two weeks after Iran vowed to retaliate for the killing of a senior Hamas leader on its soil, tension is building over what form the attack might take.

In China, apparent oil demand fell 8% from a year ago in July, government data showed Thursday, exacerbating the dour outlook in Asia's biggest economy.

“The data doesn't look great,” said Warren Patterson, head of commodities strategy for ING Groep NV in Singapore. “It only reinforces the demand concerns that have been lingering in the market for a while, and with China expected to make up almost 60% of global demand growth this year, these worries are unlikely to disappear anytime soon.”

Meanwhile, US crude inventories unexpectedly rose by 1.36 million barrels last week, in its first gain in seven weeks, official data showed on Wednesday. The build was notable given a report from the American Petroleum Institute a day earlier that pointed to a sizable drop. Stockpiles remain below seasonal averages, but the data may increase concern about flagging demand.

Crude has fallen from a recent peak in early July, weighed down by a dour outlook for consumption in No. 1 importer China, with gasoline demand there being damped by growing use of cleaner fuels. OPEC lowered its global demand forecast for 2024 in its monthly report issued earlier this week, while International Energy Agency data showed the market would be in surplus next quarter if the cartel went ahead with a plan to restore supply.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.