(Bloomberg) -- Oil declined after a five-day advance, with a likely escalation in the Middle East conflict offset by signs of weakening global demand growth.

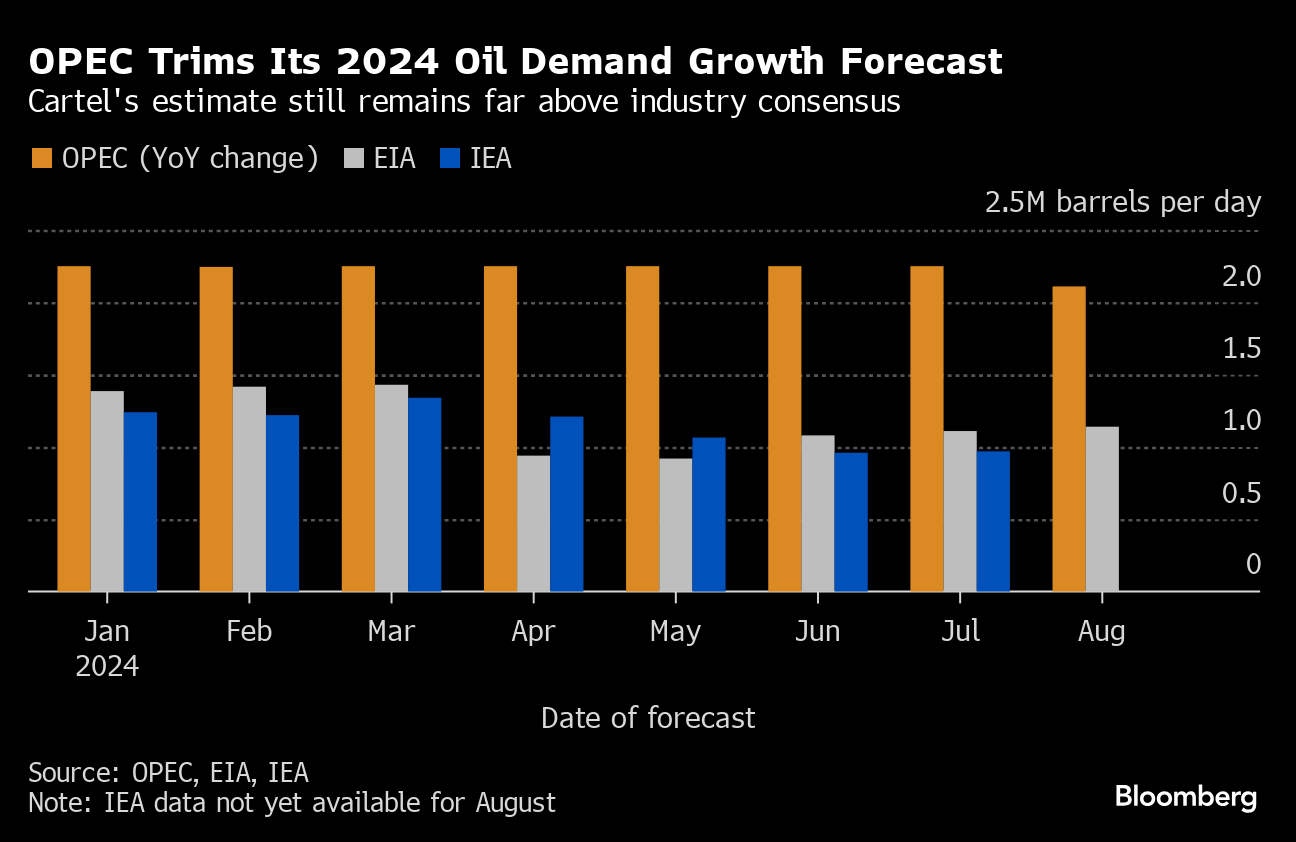

Brent fell below $82 a barrel after rising by almost 8% over the previous five sessions, with West Texas Intermediate trading around $79. While the US believes an attack by Iran on Israel has grown even more likely and may come as soon as this week, there are signs of weak consumption, which led OPEC to trim its demand forecasts for this year and next.

Crude is modestly higher for the year, supported by OPEC+ cutbacks and as equities rebounded from last week's rout. A corresponding outlook from the International Energy Agency is due later on Tuesday, while US inflation data on Wednesday may offer clues on monetary policy in the biggest oil consumer.

“Eyes will be on the upcoming US inflation to anchor the Fed's upcoming policy easing path,” said Yeap Jun Rong, a market strategist at IG Asia Pte. “Risks of a hard landing are not totally out of the window yet,” he said, referring to the possibility of an economic slowdown, which could spill over into oil demand.

Timespreads are signaling underlying strength in markets, with the gap between Brent's two nearest contracts widening further in recent sessions. The measure was 92 cents a barrel in the bullish backwardation pattern, compared with 34 cents at the start of last week.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.