(Bloomberg) -- Oil fell below $86 a barrel, dropping from a five-month high alongside lower equities, as traders assessed diplomatic efforts in the Middle East.

Israel said progress has been made in negotiations for a cease-fire in Gaza, though Hamas dismissed the claim. A senior commander in Iran's Revolutionary Guard, meanwhile, said it won't block the Strait of Hormuz amid rising tensions with Israel. Direct Iranian involvement in the war holds the potential for significant disruptions to global crude supplies.

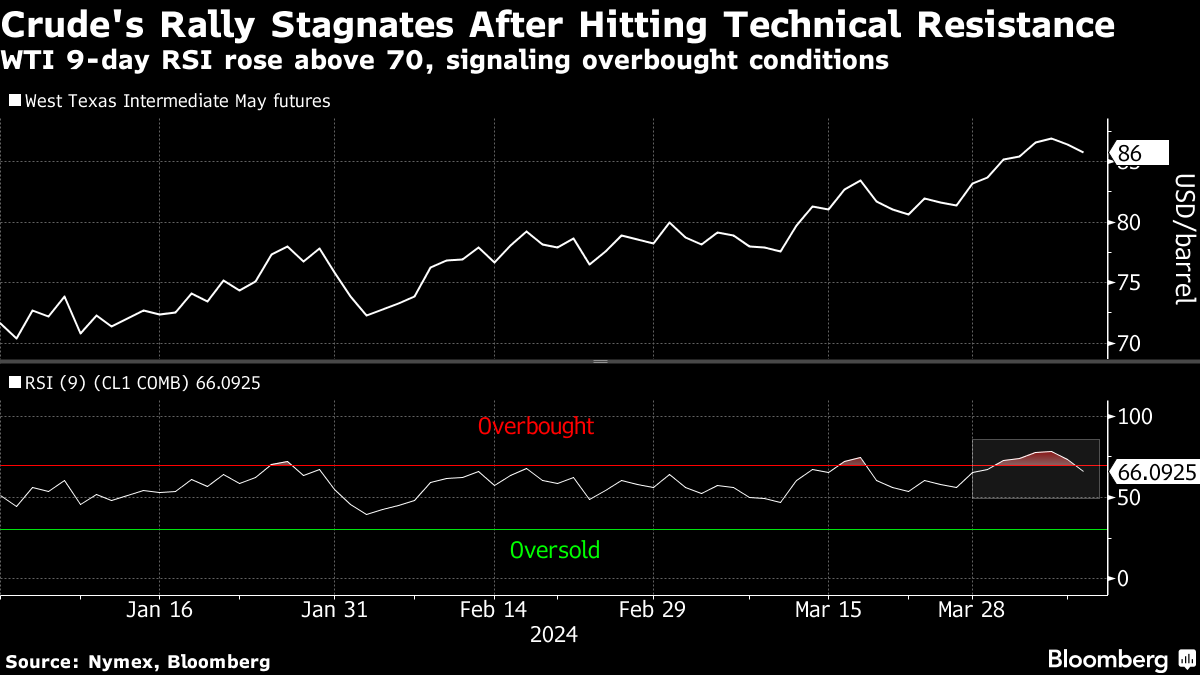

Oil's recent pullback was also driven by technicals, with gauges such as the relative strength index signaling futures were overbought. Still, the broader outlook remains bullish and some market watchers are predicting $100 oil as OPEC+ maintains its output cuts.

“The rally in recent weeks has partially been supported by positive fundamental news,” Morgan Stanley analysts including Martijn Rats and Charlotte Firkins said in a note in which the bank upgraded its forecasts for this year.

The options market is flashing strength, with the heaviest buying of bullish call options for Brent — which profit when prices rise — since 2019 on Friday followed by another day of frenzied trading on Monday.

Oil prices may trade in a $80-to-$100 range this year, Vitol Group Chief Executive Officer Russell Hardy said at the Financial Times Commodities Global Summit in Switzerland on Tuesday, adding that the company expects strong oil consumption growth. Gunvor Group's global head of research said demand expectations had risen, echoing comments from Trafigura Group a day earlier.

Meanwhile, a new Chinese mega-refinery received an import quota for this year, people familiar with the matter said. The volume would equate to about 167,000 barrels a day of additional crude import demand, adding to the improved consumption outlook.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.