Larsen & Toubro Ltd. share price saw a one percent uptick after the Indian construction giant bagged new orders worth Rs 10,000 to 15,000 crore in the Middle East for expanding and strengthening the electricity grids at high voltage levels.

The Power Transmission & Distribution secured orders to establish 500 kilovolt high-voltage direct current transmission links associated with these interconnections in Saudi Arabia, according to an exchange filing on Tuesday.

L&T also won orders for three more packages involving two 380kV overhead transmission lines and a bulk supply 380kV gas-insulated substation, in Saudi Arabia.

The conglomerate won an order to build two major 400kV gas-insulated substations in the United Arab Emirates. These substations will enhance the power transfer capacity of the electricity grid, it said.

“The fortification and modernization of transmission systems is the foremost step in establishing a secure, resilient grid capable of handling variable renewable generation in an evolving energy market," T. Madhava Das, whole-time director, L&T, said.

The company classifies a mega order as orders valued between Rs 10,000 to 15,000 crore.

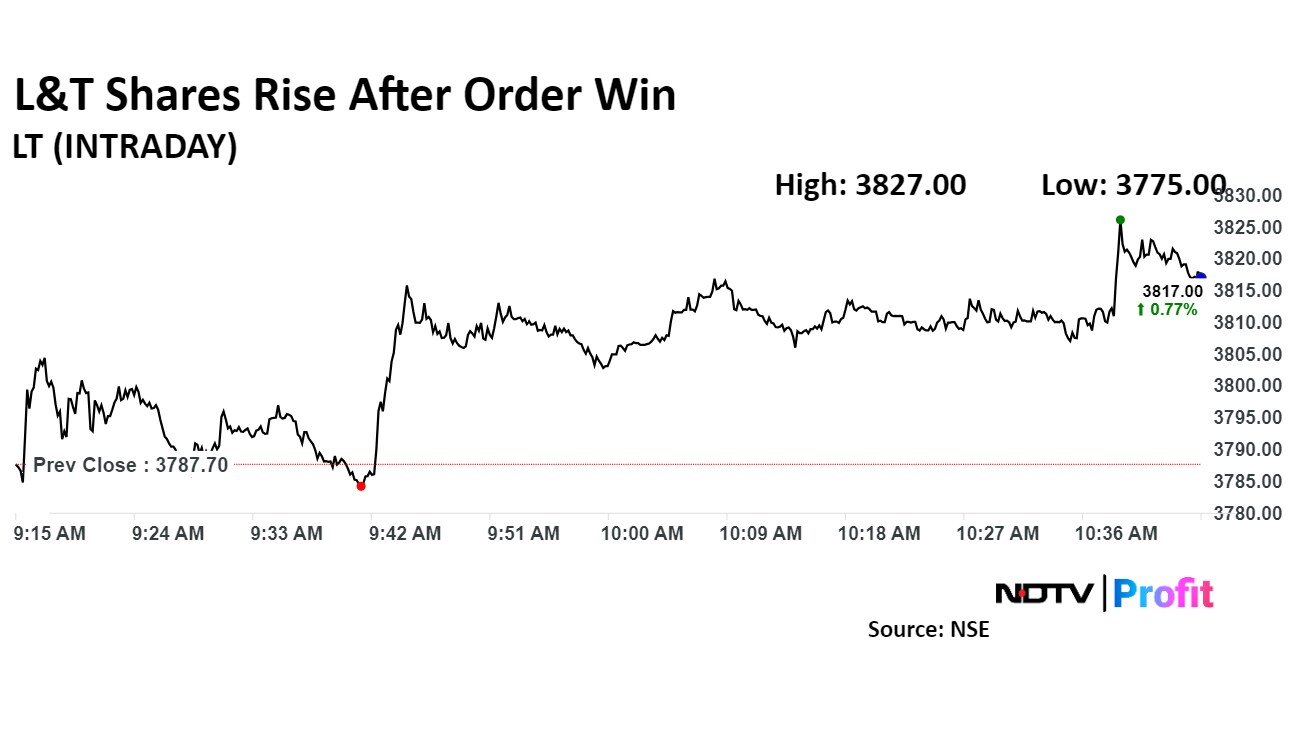

L&T's stock rose as much as 1.16% during the day to Rs 3,831.8 apiece on the NSE. It was trading 0.95% higher at Rs 3,823.7 apiece, compared to a 0.05% advance in the benchmark Nifty 50 as of 10:53 a.m.

It has risen 31% during the last 12 months and has declined by 8.5% on a year-to-date basis. The relative strength index was at 65.

Thirty out of the 35 analysts tracking the company have a 'buy' rating on the stock, three suggest a 'hold' and two have a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.