Shares of Kotak Mahindra Bank Ltd. opened lower on Monday after its net interest margin, a profitability indicator, narrowed in the first quarter.

The lender's net interest margin narrowed to 5.02% in the quarter ended June 2024, compared to 5.28% in the previous quarter, according to an exchange filing. The bank's pace of deposit accretion and its impact on margin remain key focus areas in the coming quarters, according to brokerages.

"Amid heightened competition for deposits, we remain watchful on the pace of deposit accretion for the bank and the impact on margins over the coming quarters," Motilal Oswal Financial Services said in a note.

"The NIM for the bank saw a sharp sequential decline 26 basis points sequentially to 5.02% on the back of a continued rise in the cost of funds as well as a term deposit-led deposit growth," Bernstein Research said.

The private lender's standalone net profit rose 81% year-on-year to Rs 6,249 crore in the three months ended June, compared to the projected Rs 3,760.2 crore. Sequentially, the profit was up 39.5%. The bank has a one-time gain from the divestment of a 70% stake in the general insurance arm of Rs 3,512 crore, which is shown as an exceptional item, while it retains 30% ownership as of June.

Chief Executive Officer Ashok Vaswani said that the lender is seeing some signs of stress in the credit cards segment with delinquencies.

The concerns were particularly visible in lower-ticket items, people who are new-to-credit and over-leveraged customers, Vaswani said in a media call after the results announcement.

The comments come after the Reserve Bank of India barred Kotak Mahindra Bank in April from issuing fresh credit cards and onboarding new customers through its online and mobile banking channels.

Vaswani said that the lender has submitted some timelines to the regulator about the process, adding that the bank has made significant progress on the tech side and also deployed resources from Accenture, Oracle, and Infosys to work towards coming out of these curbs.

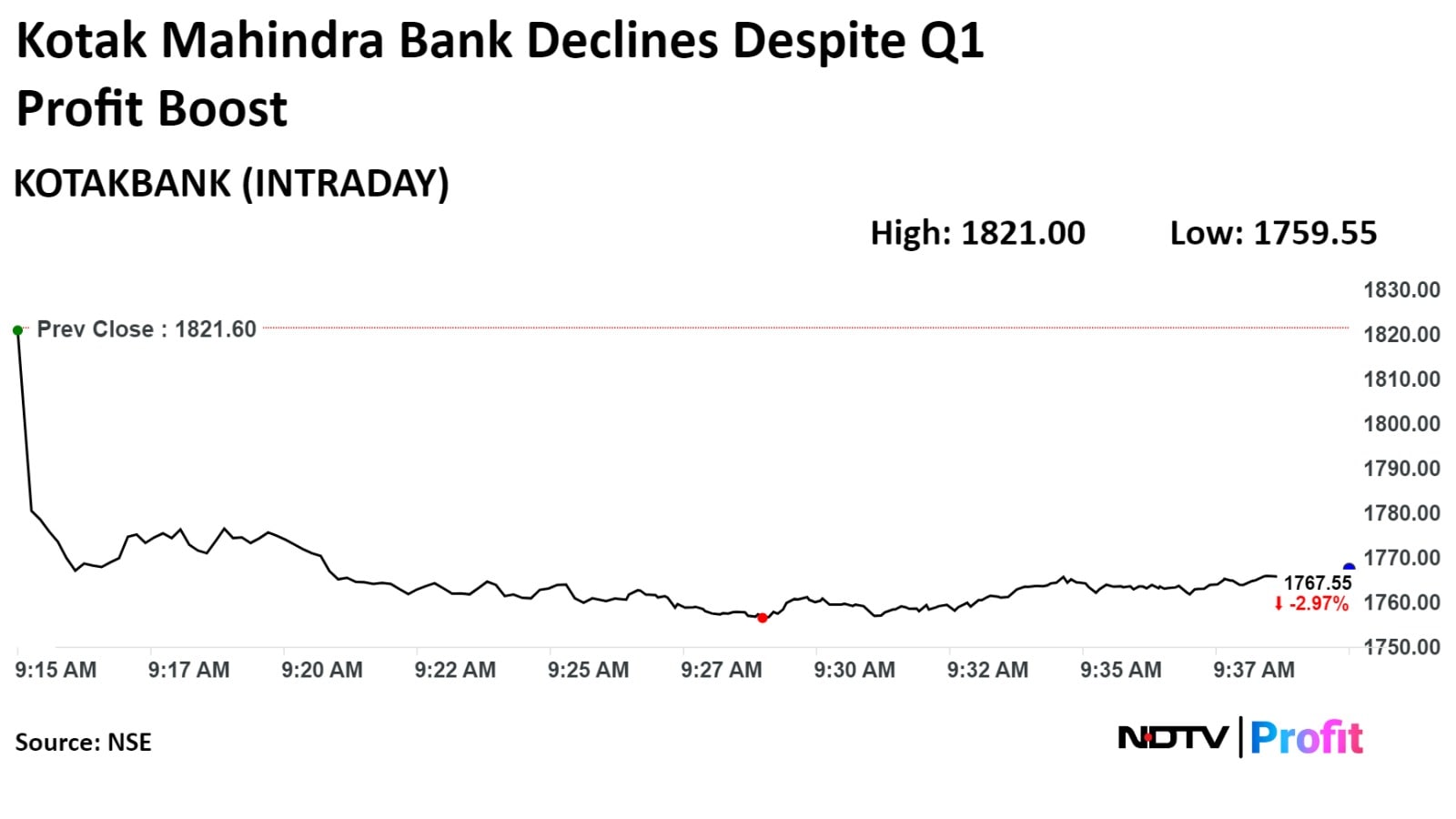

Shares of Kotak Mahindra Bank fell as much as 3.6% to Rs 1,759.15 apiece on the NSE. It was trading 3.2% lower at Rs 1,764.6 apiece, compared to a 0.22% decline in the benchmark Nifty 50 as of 9:35 a.m.

The stock has fallen 10% in the last 12 months and 7% on a year-to-date basis. The total traded volume so far in the day stood at 0.40 times its 30-day average. The relative strength index was at 45.34.

Twenty-seven out of the 42 analysts tracking Kotak Mahindra Bank have a 'buy' rating on the stock, 10 recommend a 'hold' and five suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 11%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.