Some patience is warranted as the market works through a corrective phase after falling off price and momentum peaks registered in September, according to CLSA.

Investors need to be aware of three key features on the daily Nifty chart, according to the research firm.

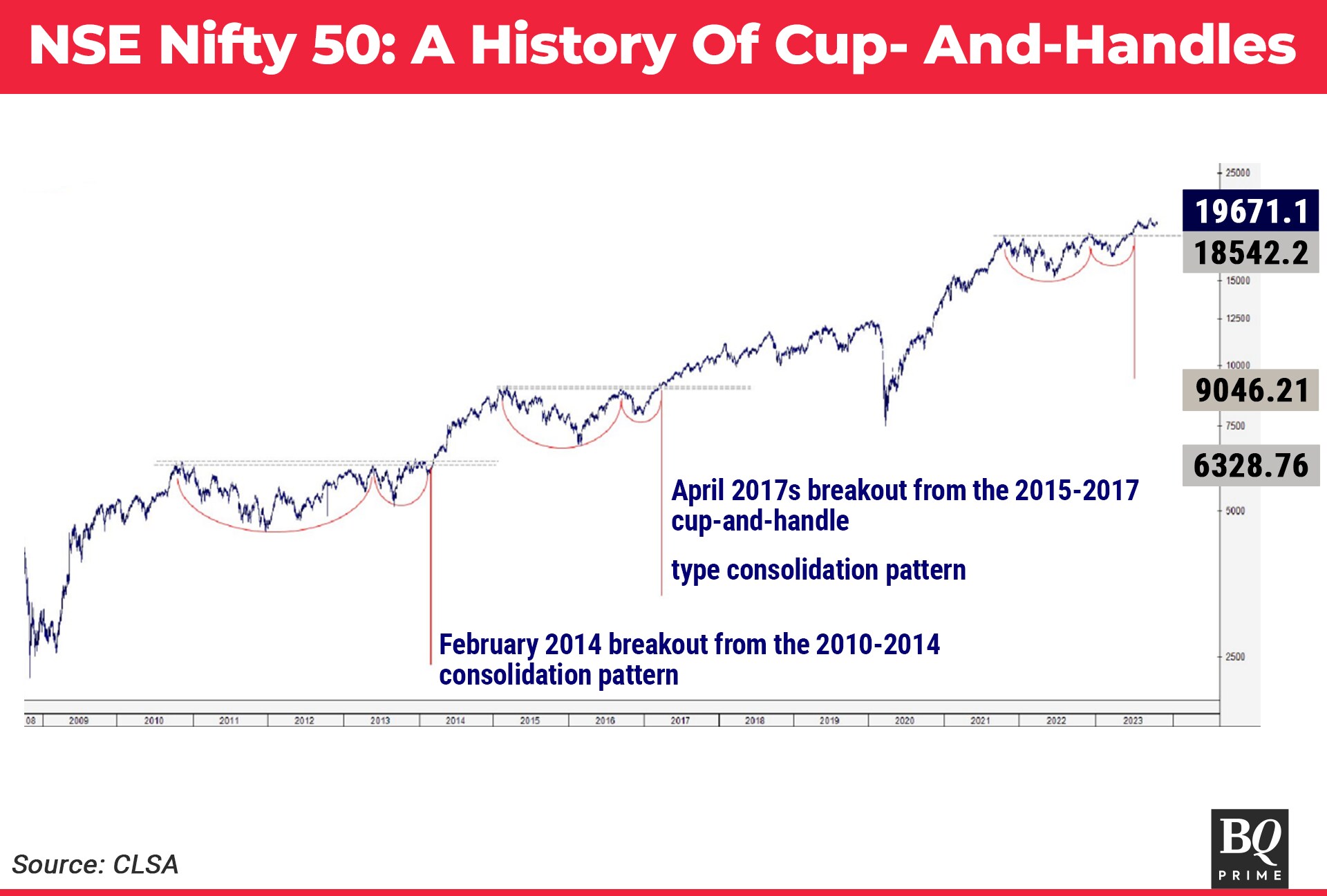

The first is June's breakout from the trading range (cup and handle) that lasted from October 2021 to June 2023, according to the note. This breakout has two upside objectives: the first at 21,200-21,300, and the second at 22,800-23,000 (the full measured move from the cited consolidation pattern), it said.

"Interestingly, this breakout resembles the breakout seen in February 2014 from the 2010-2014 consolidation pattern and the April 2017 breakout from the 2015-2017 cup-and-handle type consolidation pattern," CLSA said in Oct 19 note.

The second feature is the price/momentum divergence seen between the July and September highs. This signals the first sign of slowing upside momentum seen since December 2022, suggesting that the uptrend is mature and vulnerable to correction or consolidation, the brokerage said.

The final feature to note is the two support levels at 19,200-19,230 provided by the August lows and the major support zone at the 18,520-19,017 area, including the 200-day moving average and the 2021 and 2022 highs.

"Through this corrective phase weakness back to the 19,200-19,230 area and potentially a retest of the 18,520-19,017 area should be seen as levels to add to new long positions as the original breakout from the 2021-2023 consolidation pattern still support upside targets of 21,200-21,300 and 22,800- 23,000,", the note said.

Outlook On NSE Midcap Index

CLSA has not changed its outlook for the NSE Midcap Index as price action continues its corrective action post the bearish intraday reversal seen on Sept. 12. That was followed by a violation of the 20-day moving average that had guided the index higher since June breakout from its 2021-2023 consolidation pattern, CLSA said.

According to the brokerage, this action signals a change in the buy-the-dip behaviour seen since April. The 50-day moving average and Oct. 9 lows combined to provide initial support at 39,634-39,744.

Below this, next support is seen at the 36,922-38,086 area provided by the early August congestion zone. Relative to the Nifty, the midcaps uptrend has stalled around resistance provided by the 2018 relative highs, the note said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.