..png?downsize=773:435)

Shares of KEI Industries Ltd. fell nearly 7% on Wednesday following the company's second-quarter earnings report, which fell short of analysts' estimated.

The electrical wires and cables manufacturer's net profit rose 11% year-on-year to Rs 155 crore in the second quarter of fiscal 2025. However it fell short of the Rs 167-crore estimate projected by Bloomberg analysts. In the same quarter last year, KEI Industries had recorded a profit of Rs 140 crore.

The company saw its revenue grow 17%, reaching Rs 2,280 crore, up from Rs 1,945 crore in the corresponding quarter of the previous fiscal. This met Bloomberg's revenue estimate of Rs 2,266 crore.

The earnings before interest, taxes, depreciation, and amortisation came in at Rs 221 crore, missing the Rs 240-crore estimate.

Ebitda margin contracted to 9.7%, down from 10.4% in the previous quarter, and fell short of the 10.6% estimate by analysts.

KEI Industries Q2 FY25 Results Highlights (Standalone, YoY)

Revenue from operations rose 17% to Rs 2,280 crore versus Rs 1,945 crore.

Net profit increased 11% to Rs 155 crore versus Rs 140 crore.

Ebitda rose 9% to Rs 221 crore versus Rs 202 crore.

Margin narrowed to 9.7% versus 10.4%.

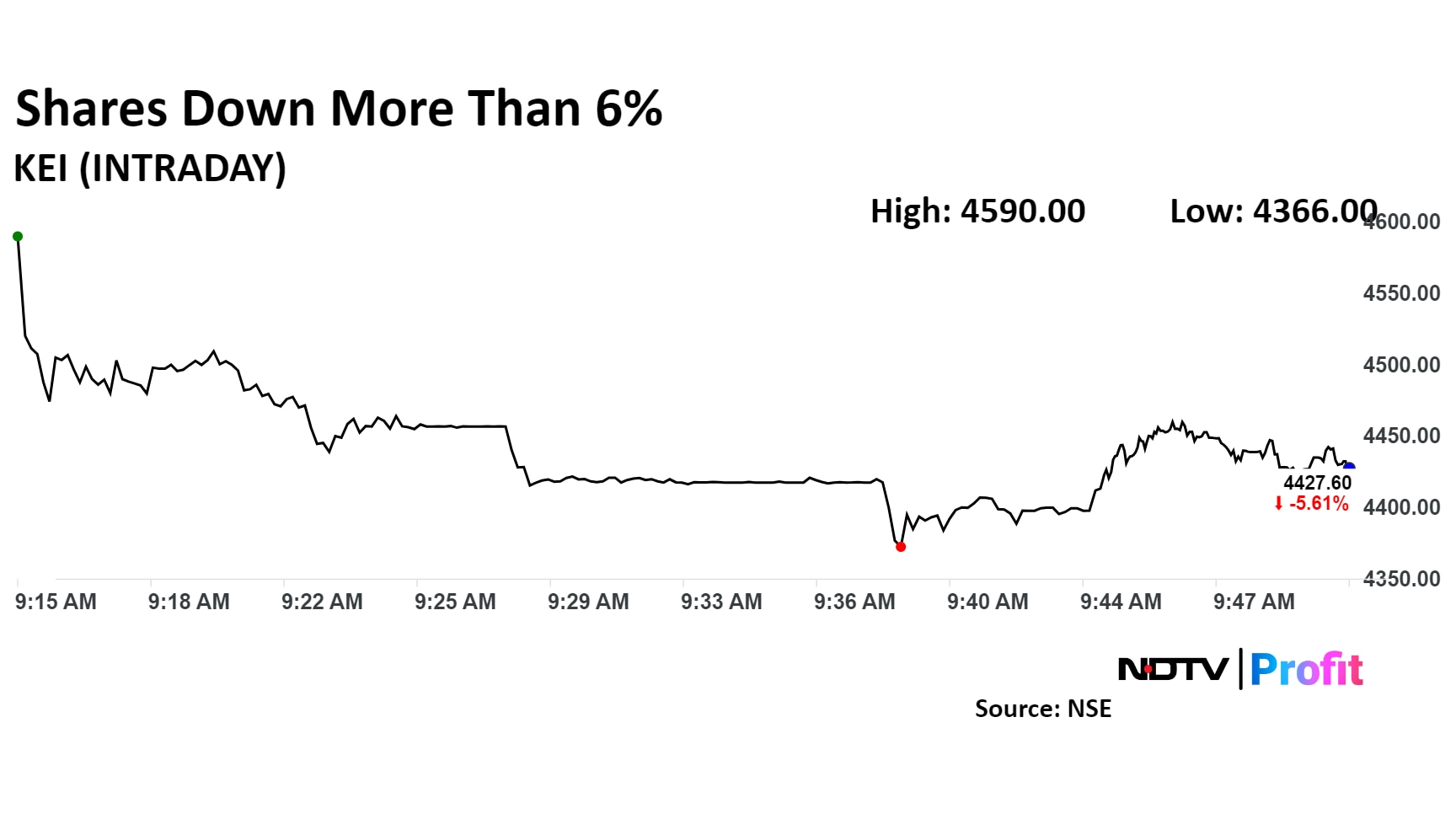

KEI Industries Share Price Today

KEI Industries' share price fell as much as 6.92% to Rs 4,366 apiece. It pared loss to trade 5.4% lower at Rs 4,439.55 apiece as of 09:50 a.m., compared to a 0.08% advance in the NSE Nifty 50.

The stock has risen 84.3% in the last 12 months. Total traded volume so far in the day stood at 1.01 times its 30-day average. The relative strength index was at 50.

Out of 18 analysts tracking the company, 10 maintain a 'buy' rating, seven recommend a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 8.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.