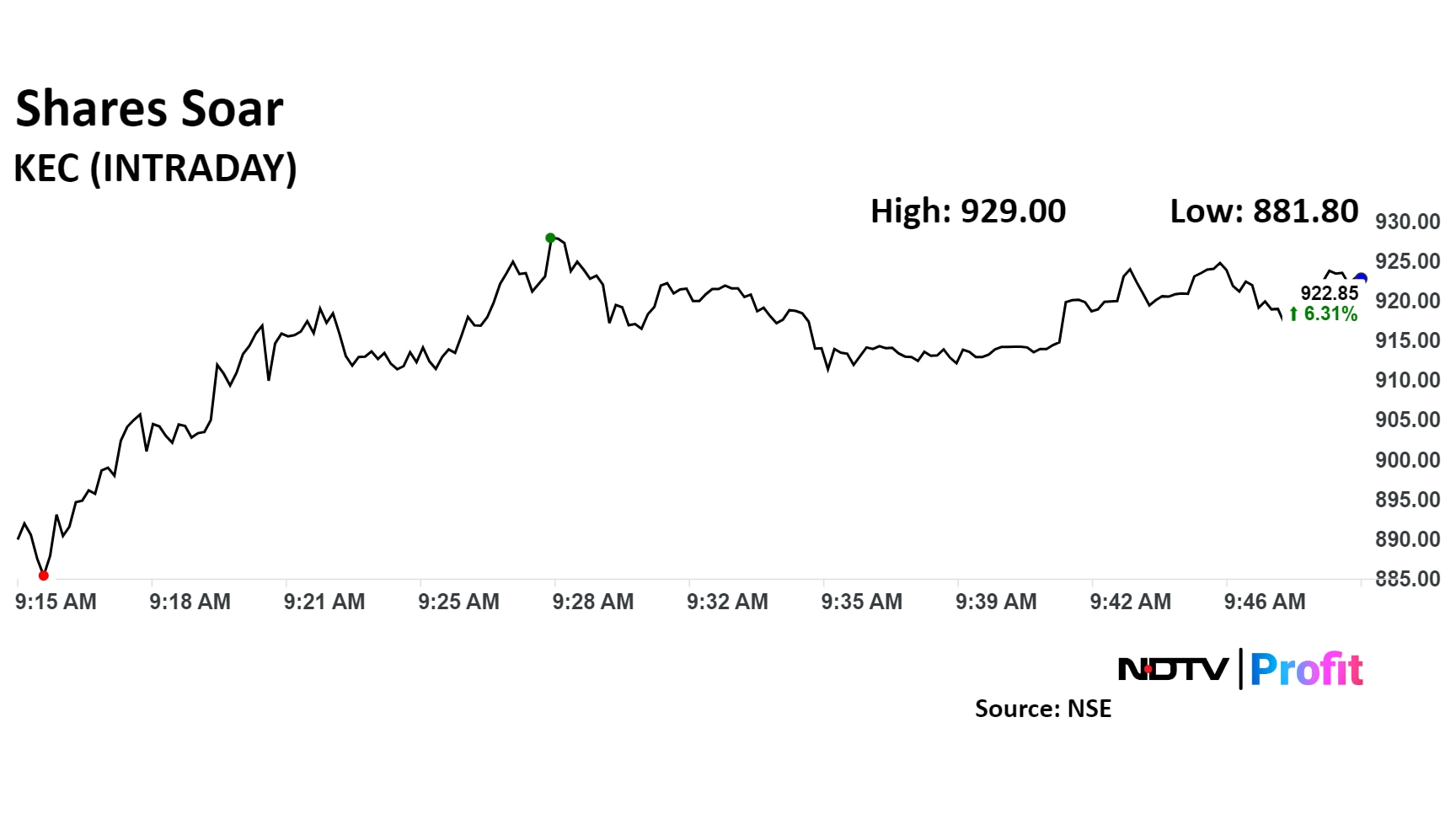

Shares of KEC International Ltd. surged more than 7% on Thursday after it won contracts worth Rs 1,171 crore from the Middle East.

The contracts include a 400 kV transmission line project in the United Arab Emirates and a 380 kV transmission line project in Saudi Arabia, according to an exchange filing.

Vimal Kejriwal, managing director and chief executive of KEC International, expressed optimism about the company's growth trajectory in a televised interview to NDTV Profit. “Our order pipeline stands at Rs 10,000 crore as of today, and we are on track to achieve an order book of Rs 25,000 crore by the end of fiscal 2025,” Kejriwal said. He further highlighted the company's ambitious target of a 15% increase in revenue for the fiscal year 2025.

Kejriwal also touched upon the easing of supply chain challenges, which have been a concern for many in the industry. “Supply chain issues are slowly improving, and we are witnessing a positive trend in business opportunities, particularly from the UAE,” he said.

Looking ahead, KEC International is actively pursuing tenders worth around Rs 40,000 crore in the international market, with a success rate of 20%. The company also expects its Ebitda margin to reach 7.5% for financial year 2025.

Shares of KEC Internationals rose as much as 7.02% to Rs 929 apiece, the highest level since Aug. 1. It pared gains to trade 5.22% higher at Rs 913 apiece as 09:52 a.m. This compares to a 0.18% advance in the NSE Nifty 50 Index.

The stock has risen 35.22% in the last 12 months. Total traded volume so far in the day stood at 17 times its 30-day average. The relative strength index was at 68.

Out of 24 analysts tracking the company, 15 maintain a 'buy' rating, five recommend a 'hold,' and four suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 2.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.