Shares of Kalyan Jewellers were up over 8% on Thursday after several block deals involving a total of 6.6 crore shares in the company took place on the exchanges on Thursday. Highdell Investment likely sold part of its stake to promoter Trikkur Sitarama Iyer Kalyanaraman

Kalyanaraman signed a share purchase agreement with Highdell Investment to acquire shares worth Rs 1,300 crore on Wednesday.

Hindell planned to offload 2.43 crore shares, representing a 2.36% stake in the company, for a purchase price of Rs 535 apiece, according to the exchange filing by Kalyan Jeweller. The purchase price was set at a discount of 1.83% from Wednesday's closing price of Rs 544.45 per share.

The promoter planned to raise the funds from financial institutions or non-banking financial institutions and draw down the requisite funds. On completion of the acquisition of shares, the promoter and promoter groups shareholding in the company will increase to 62.95% from 60.59% earlier.

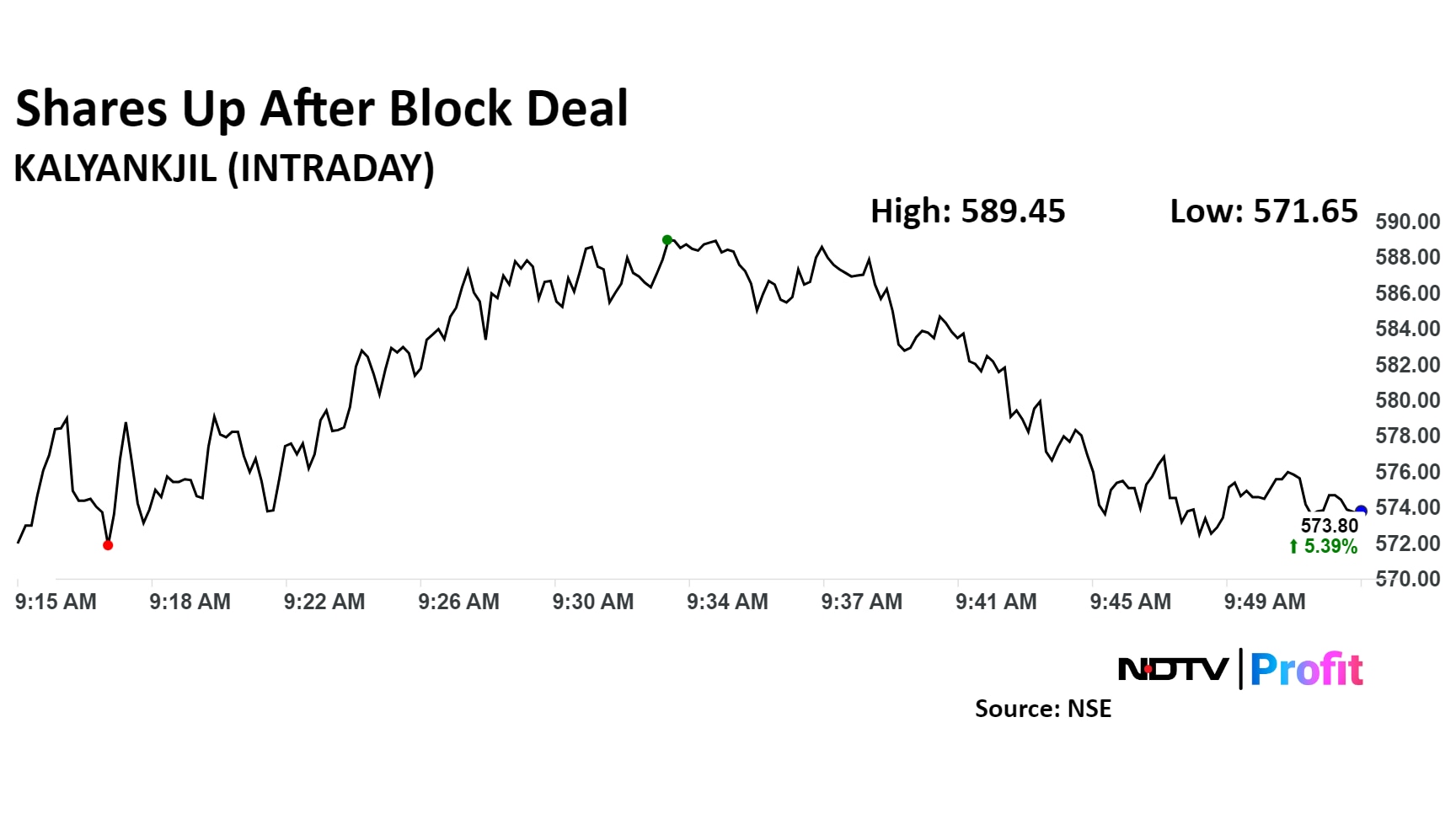

Shares of Kalyan Jewellers rose as much as 8.27%, the highest level since Aug. 1, before paring gains to trade 7.17% higher at Rs 583.50 apiece, as of 09:45 a.m. This compares to a 0.39% advance in the NSE Nifty 50.

The stock has risen 160.96% in the last 12 months. Total traded volume so far in the day stood at 1.5 times its 30-day average. The relative strength index was at 63.

All seven analysts tracking the company maintain a 'buy' rating on the stock, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 6.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.