Share price of Kalyan Jewellers India Ltd. rose for a second consecutive session on Thursday when MSCI announced the company's upgrade to mid-cap from small-cap segment.

Along with Kalyan Jewellers, Voltas Ltd., and Bombay Stock Exchange Ltd. were also moved to mid-cap segment of the MSCI Emerging Markets Index and no Indian stocks were removed from MSCI Emerging Markets Index in the current review.

Thursday's gains come on top of 7% advance on Wednesday.

During the September quarter, the jewellery retailer reported consolidated revenue growth of approximately 37% compared to the same period last year. The company's India operations posted revenue growth of 39%, with same-store sales growth of approximately 23% in the second quarter of fiscal 2025, according to a business update.

"Customs duty reduction on gold imports, announced during the Union Budget, resulted in significantly higher footfalls from the last week of July until the end of August, mostly offsetting the impact of 14 days of Shradh (when sales are muted) during the quarter and extreme volatility in gold prices," the company said.

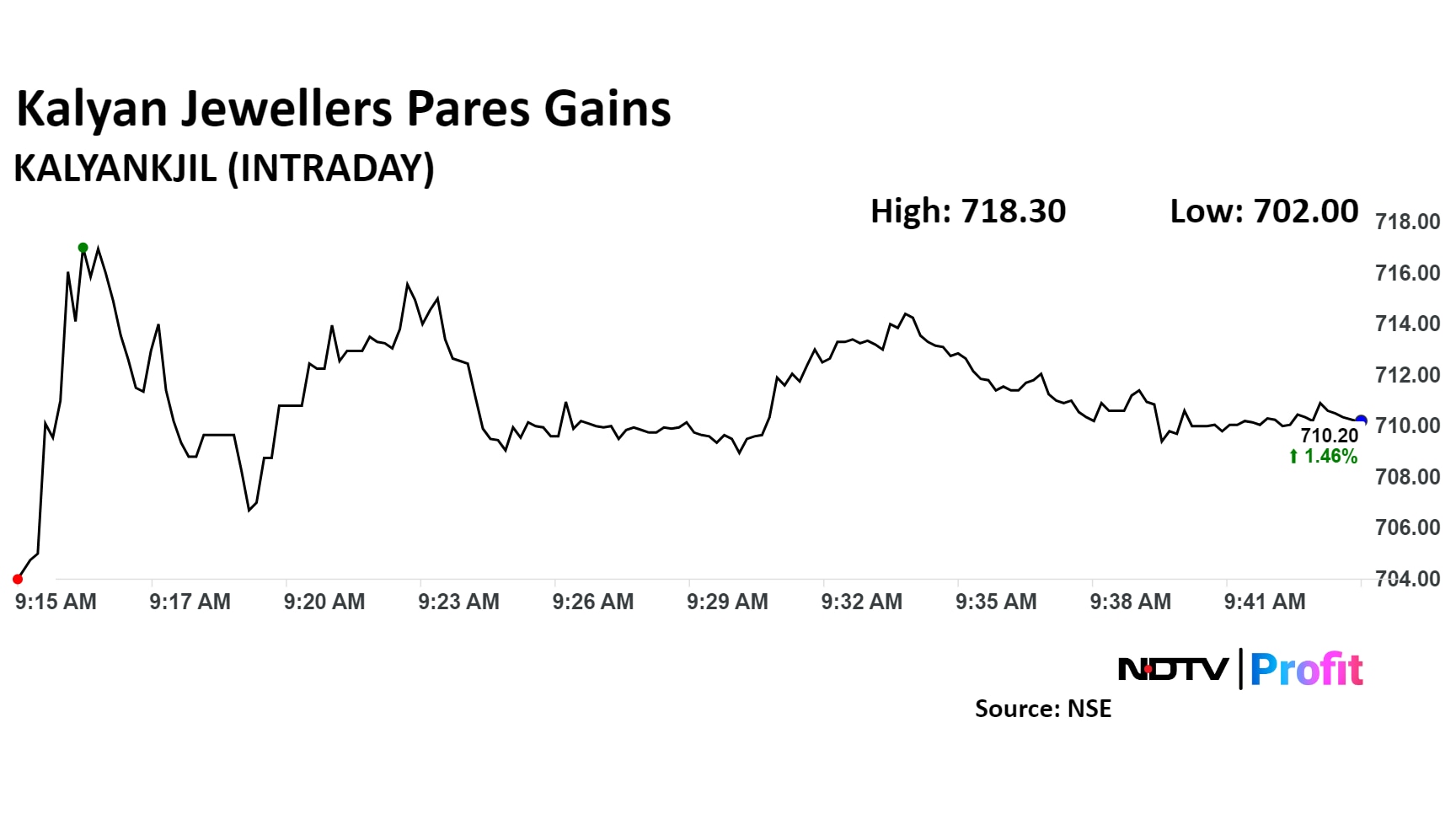

Kalyan Jewellers Share Price

Share price of Kalyan Jewellers rose as much as 2.6%, the highest level since Oct. 22, before paring some gains to trade 2.08% lower at Rs 714.55 apiece, as of 9:51 a.m. This compares to a 0.5% decline in the NSE Nifty 50.

The stock has risen 112.06% in the last 12 months. Total traded volume so far in the day stood at two times its 30-day average. The relative strength index was at 56.

Eight analysts tracking the company have a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 5.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.