Kalpataru Projects International Ltd.'s share price advanced nearly 5% on Tuesday as its profit jumped 40% in the second quarter. Consolidated net profit rose to Rs 126 crore in the July-September quarter, compared to Rs 89.9 crore for the same period last year, according to an exchange filing.

The company's revenue grew 9.1% to Rs 4,930 crore from Rs 4,518 crore in the second quarter of the previous fiscal.

On the operating side, earnings before interest, taxes, depreciation, and amortisation saw a growth of 18% to Rs 438 crore from Rs 371 crore in the year-ago period. Margin widened to 8.9% from 8.2%.

The earnings report was released after market close on Monday.

The total orderbook rose 29% to Rs 60,631 crore, while it secured deals worth Rs 11,865 crore to date in the current fiscal.

The management expects Ebitda margin to stabilise between 8.5% and 9%. It is targeting order inflows of Rs 22,000-23,000 crore this year and has given a revenue growth guidance of 20%.

Kalpataru Projects' board also approved a proposal to raise up to Rs 1,000 crore through qualified institutional placements.

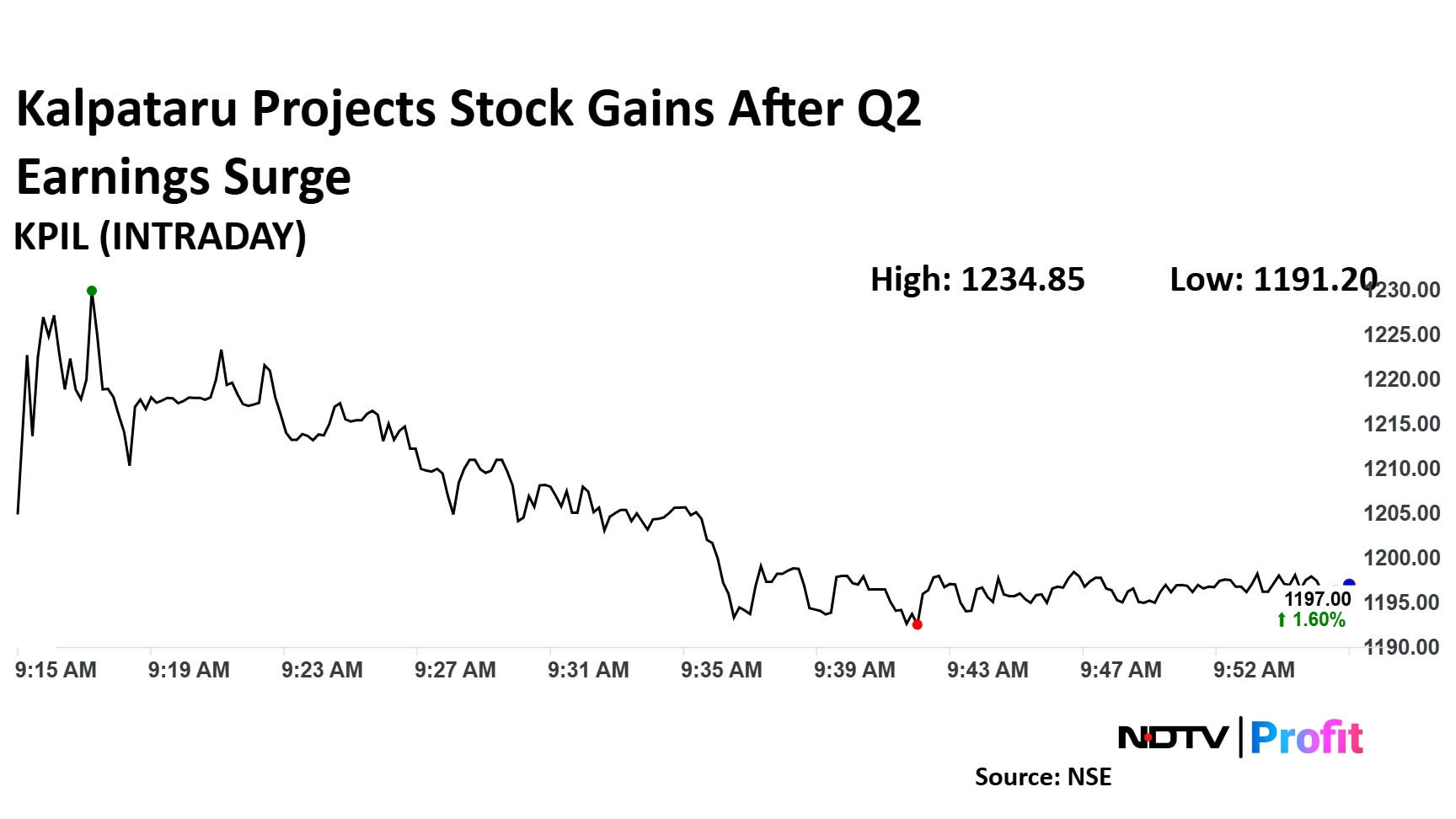

Kalpataru Projects Share Price Movement

Kalpataru Projects stock was trading 1.6% higher at Rs 1,197 by 9:55 am, compared to a 0.67% decline in the benchmark Nifty 50.

Kalpataru Projects share price jumped 4.8% to Rs 1,234.8 apiece. It was trading 1.6% higher at Rs 1,197 by 9:55 am, compared to a 0.67% decline in the benchmark Nifty 50.

The stock has risen 87% in the last 12 months and 70% on a year-to-date basis. The total traded volume was 1.8 times the 30-day average.

Out of the 17 analysts tracking the company, 14 have a 'buy' rating on the stock, two recommend 'hold' and one suggests a 'sell', according to Bloomberg data. The average of 12-month analysts' consensus price target of Rs 1,488.7 implies a potential upside of 24%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.