Jubilant FoodWorks Ltd.'s share price rose over 8% to an over one-month high on Tuesday following the announcement of its second quarter results. The operator of Domino's Pizza in India saw its second-quarter performance supported by growth initiatives such as delivery fee waiver and reductions in threshold for free order.

The company posted a revenue rise and earnings that exceeded analyst expectations, despite a profit decline from discontinued operations. Analysts from Citi Research and Nuvama Institutional Research have shared mixed outlooks, but remain optimistic on the stock, based on the company's latest strategies and financial results.

Citi Research On Jubilant FoodWorks

Citi reiterated its 'buy' rating on Jubilant with a slightly reduced target price of Rs 700 per share from Rs 715 apiece, implying a potential upside of 16.3%, citing the company's impressive operational performance amid challenging consumer sentiment. Key initiatives, including the waiver of delivery fees and reduced order thresholds, led to a 2.8% same-store sales growth and an 11.4% boost in delivery LFL growth, further driving up monthly active users by 18.5% year-over-year.

Citi remains optimistic about Jubilant's ability to improve its margins and lead in the Quick Service Restaurant space, noting the company's aggressive expansion plans for Popeyes and the momentum expected to accelerate in the third quarter.

However, Citi also adjusted its FY25-27 revenue and Ebitda estimates by 3% and 5-7%, respectively, considering the near-term impact of delivery cost reductions on margins. Potential risks include inflation pressures, increased competition, and a sluggish consumer environment, though upside possibilities include margin improvements and potential expansion gains from overseas and new ventures.

Nuvama On Jubilant FoodWorks

Nuvama maintained a 'hold' rating, but raised its target price to Rs 631 from Rs 568 per share, noting that "the bold move to offer free delivery and no minimum order has proven to be a game-changer".

Jubilant's recent strategies have positively impacted its performance in a soft market. The company's 9.1% year-on-year revenue growth and its success in boosting delivery LFL by 15.9% are driven by promotional activities like free deliveries, no minimum order limits, and exclusive dine-in offers. Nuvama points out that dine-in's revenue share has decreased from 34% to 30%, reflecting the growing preference for delivery—a shift influenced by Jubilant's cost-effective measures and its 20-minute delivery guarantee.

Despite a 30 basis point contraction in gross margins, Jubilant managed to mitigate most of the negative impact through cost-cutting efforts, according to the brokerage. It's forecast accounts for minor revenue and PAT adjustments for FY25 and FY26, but it remains positive on Jubilant's turnaround potential. Key risks include discretionary spending slowdowns, real estate challenges, and intensifying competition in the QSR market.

Jubilant FoodWorks Q2 Earnings Highlights

Jubilant FoodWorks reported a 32% year-on-year decline in consolidated net profit, down to Rs 66.53 crore, largely impacted by discontinued operations. However, revenue surged by 43% to Rs 1,954.72 crore, outperforming Bloomberg's Rs 1,816-crore estimate. Operating Ebitda also rose by 44% to Rs 398.59 crore, exceeding analyst projections and showcasing a slight improvement in operating margins from 20.3% to 20.4%.

Jubilant's ongoing strategies to improve delivery experience and expand its store footprint, particularly for Popeyes (which is aggressively expanding, according to Citi), suggests the company aims to capture a larger share of the Indian QSR market.

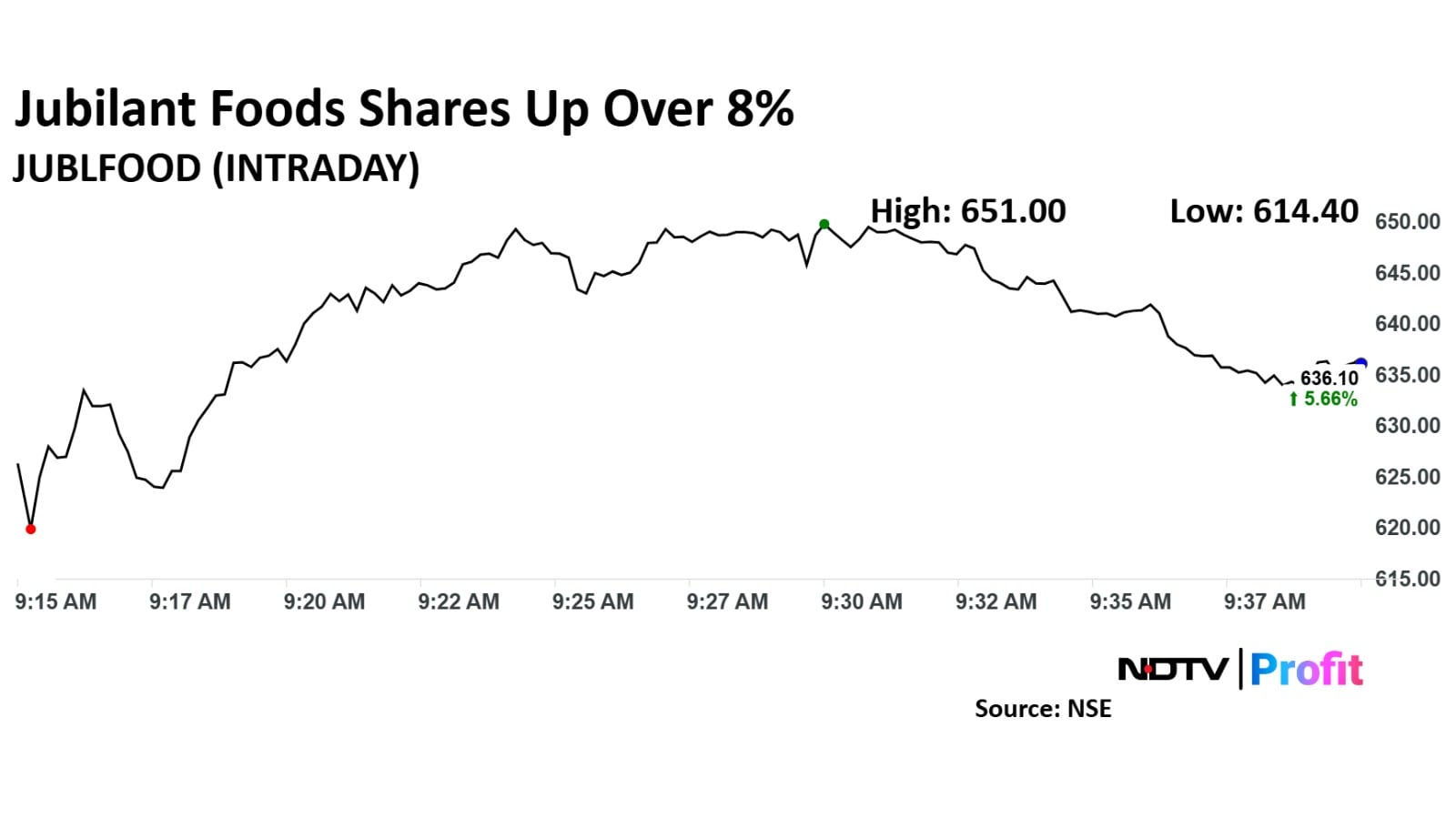

Jubilant FoodWorks Share Price Today

Jubilant FoodWorks stock rose as much as 8.14% during the day to Rs 651 apiece on the NSE. It was trading 6.25% higher at Rs 639.65 apiece, compared to an 0.06% advance in the benchmark Nifty 50 as of 9:43 a.m.

It has risen 25.04% in the last 12 months and 13.23% on a year-to-date basis. Total traded volume so far in the day stood at 30 times its 30-day average. The relative strength index was at 61.26.

Of the 31 analysts tracking the Domino's operator, 13 have a 'buy' rating on the stock, 10 recommend a 'hold' and eight suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' consensus price target implies a potential downside of 4.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.