Nuvama Institutional Equities initiated coverage on JTL Industries Ltd. with a 'buy' rating, citing volume, margin expansion, and enhanced capacity. The brokerage has a target price of Rs 303 per share, implying a potential upside of 50% from the previous close on the BSE.

The iron and steel products manufacturer has been consolidating its position via volume and margin expansion. Enhanced capacity — in both organic and inorganic — has aided volume, Ebitda, profit expansion at a compound annual growth rate of 43%, 45% and 50% respectively over financial year 2019–24, according to a note dated Aug. 6.

Nuvama expects the profit CAGR to be a robust 38% over fiscals 2024–27 on the back of capacity expansion and an improved product mix. It said JTL had been efficiently utilising warrants and qualified institutional placements to build up capacity, including via bolt-ons.

The management is paying close attention to working capital, which is improving operating cash flow, it said. "Better OCF shall lead to an improved debt profile and returns ratios."

Key risks for the company include a slowdown in the economy or the steel sector and fluctuations in steel prices, Nuvama said.

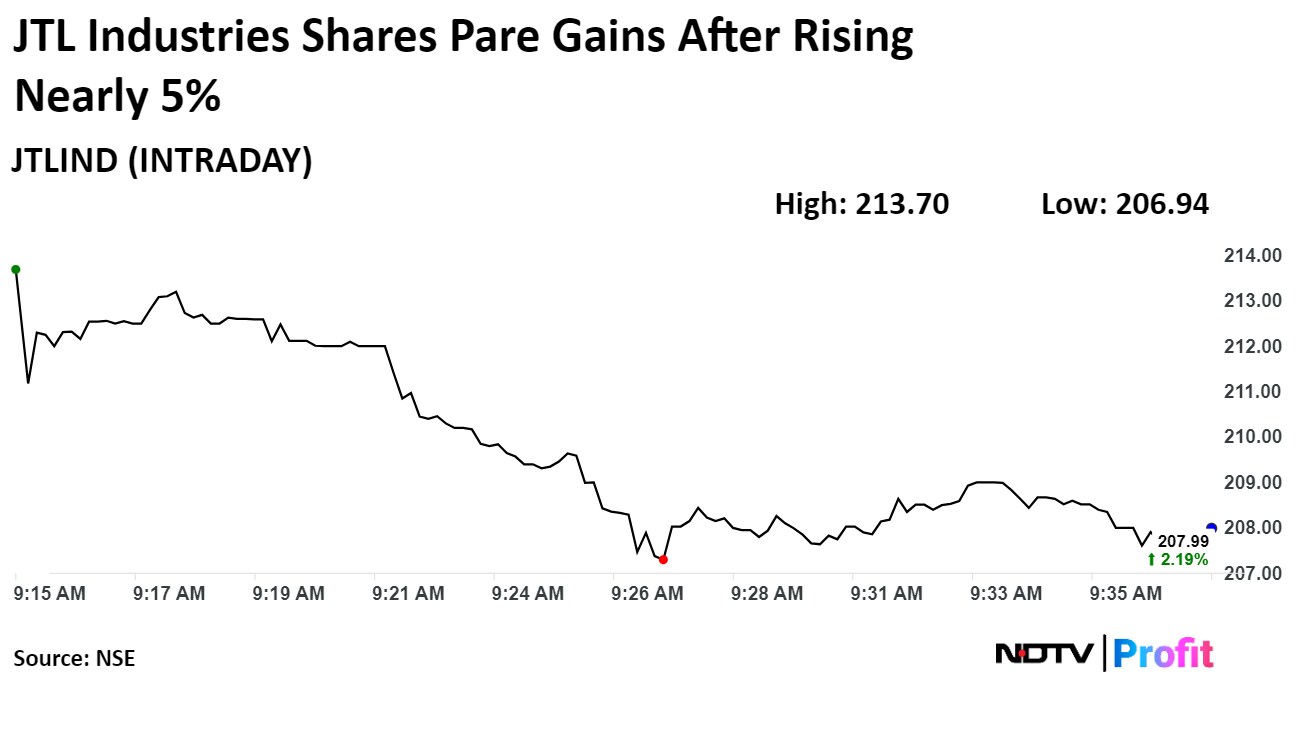

JTL's stock rose as much as 4.9% during the day to Rs 213.7 apiece on the NSE. It was trading 2.41% higher at Rs 208.4 per share, compared to a 1.08% advance in the benchmark Nifty as of 9:35 a.m.

The share price has risen 4% in the last 12 months but declined 12% on a year-to-date basis. The total traded volume so far in the day stood at 3.3 times its 30-day average. The relative strength index was at 43.

Two analysts tracking the company have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 35%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.