.jpeg?downsize=773:435)

Shares of JSW Infrastructure Ltd. surged over 5% on Tuesday after Jefferies initiated a 'buy' coverage, citing its upcoming capacity expansion and growth focus.

JSW Infra plans 2.4-fold capacity expansion by the financial year 2030 and has also recently forayed into logistics with the acquisition of Navkar Logistics, Jefferies said in a note on Aug. 27. "We believe, on its smaller base, growth will be over 20% from current levels, with group volumes giving comfort on utilisation."

The brokerage firm has set a target price of Rs 375 per share, implying a potential upside of 21% from the previous close. The firm's evaluation comes with risks, including delays in group capex plans that support volume growth.

The double-digit volume and Ebitda CAGR between market share gains, acquisitions, and expansions should continue for private sector ports, Jefferies said. It said that all-India port cargo should rise at 6% CAGR in fiscal 2024–2030, slightly higher than the 5% growth seen in the last 10 years.

Jefferies is also positive on Adani Ports and Special Economic Zone Ltd., as Ebitda growth should be over 15%, backed by volumes and operating leverage. They have a target price of Rs 1,910 per share, a 28% potential upside from the previous close.

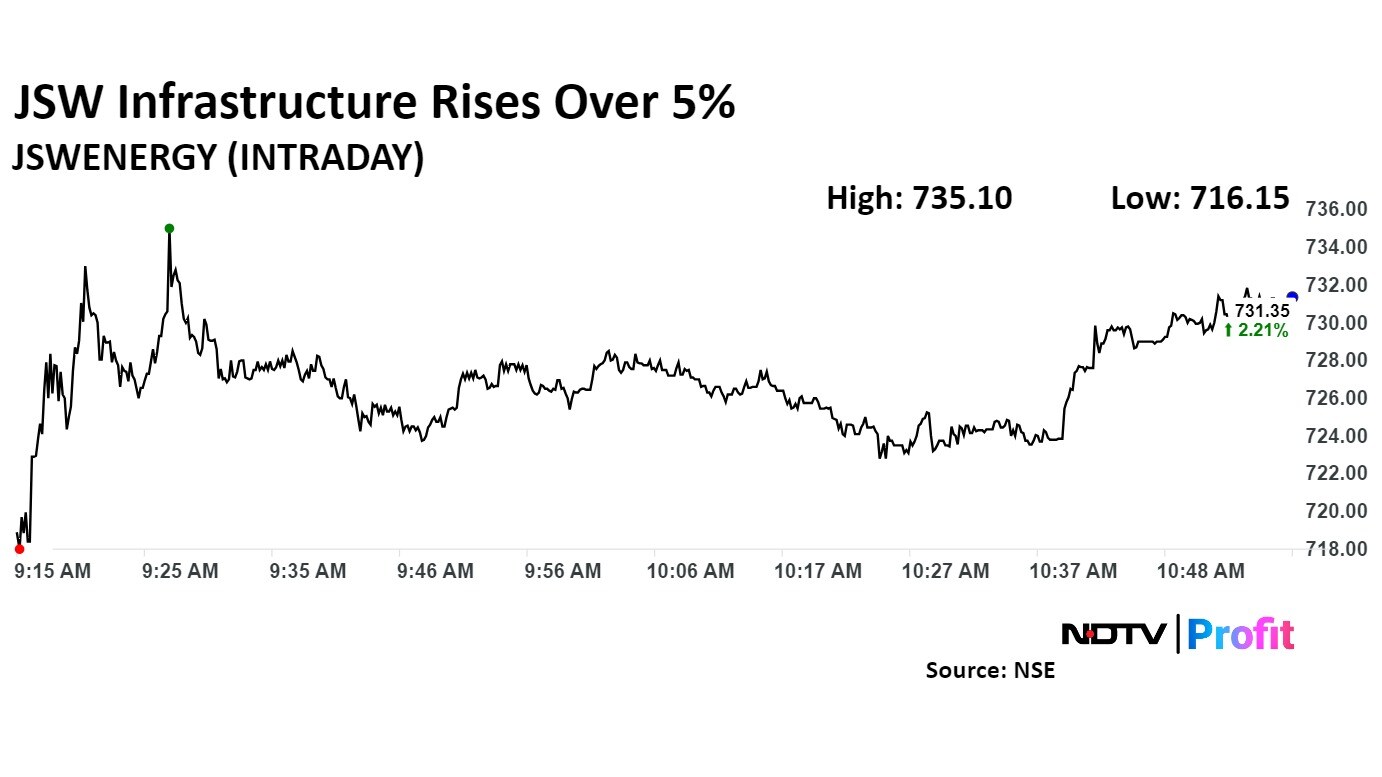

JSW Infra's stock rose as much as 5.02% during the day to Rs 324.8 apiece on the NSE. It was trading 3.6% higher at Rs 320.3 apiece, compared to a 0.11% advance in the benchmark Nifty 50 as of 11:00 a.m.

It has risen 103% during the last 12 months and has advanced 54 % on a year-to-date basis. The total traded volume so far in the day stood at four times its 30-day average. The relative strength index was at 51.

Six out of the nine analysts tracking the company have a 'buy' rating on the stock, and three have a 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 5.2%.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.