JSW Energy Ltd. shares rose to their record high level on Monday after the company's step-down unit completed commissioning of 300-megawatt wind power capacity at Tuticorin, Tamil Nadu. The 300-MW capacity is part of 450-MW ISTS-connected wind power project awarded under Solar Energy Corporation of India Tranche X.

The newly commissioned power project will contribute significantly to JSW Renew Energy Two Ltd's portfolio in line with the vision of greener and sustainable future, the exchange filing said.

The total installed capacity of the energy company stands at 7,726 MW, and the under-construction capacity is at 2,114 megawatt, which is likely to be completed by the end of financial year 2025, the exchange filing said.

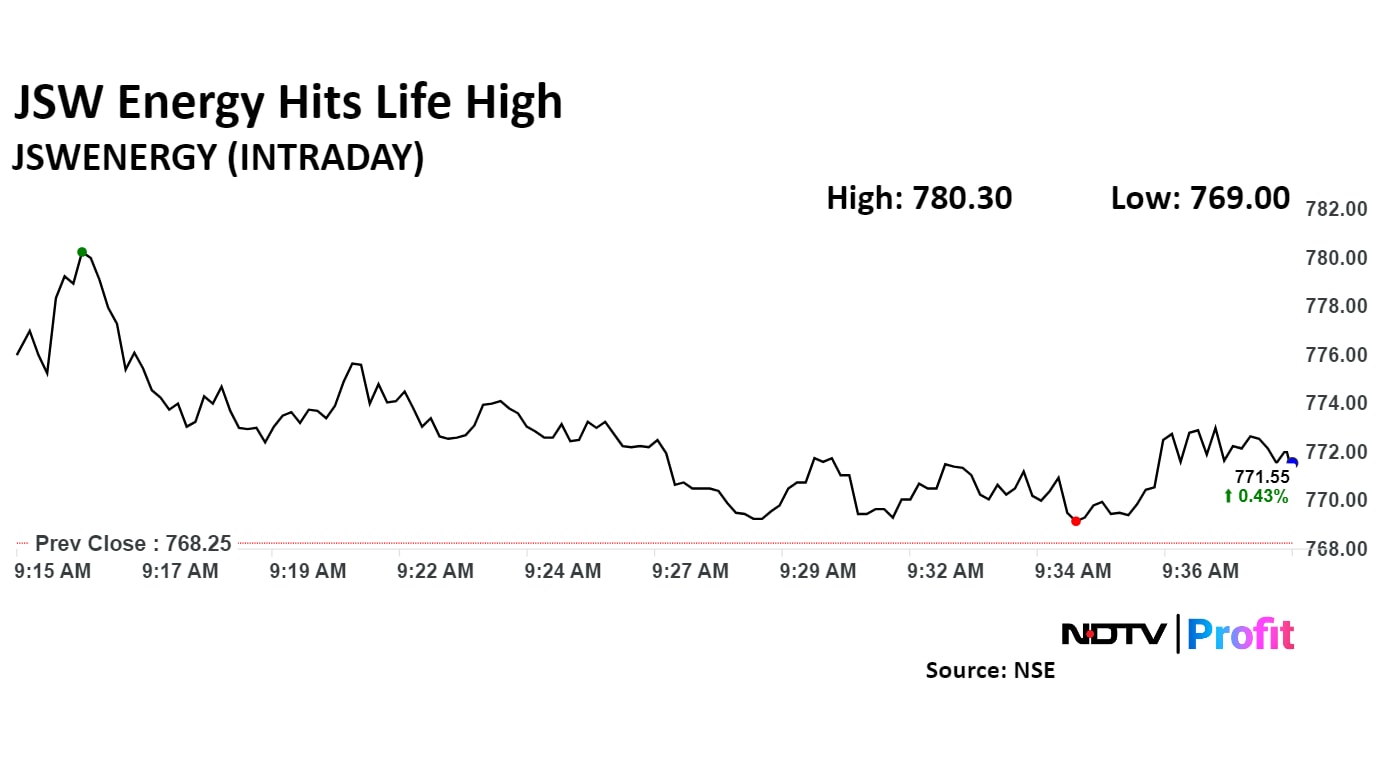

Shares of JSW Energy Ltd. rose as much as 1.56% to Rs 780.30 apiece, the highest level since its listing on Jan 1, 2010. It was trading 0.49% higher at Rs 772 apiece as of 09:38 a.m., as compared to a 0.23% gain in the NSE Nifty 50 index.

The scrip gained 75.99% in 12 months, and 88.23% year-to-date. Total traded volume so far in the day stood at 0.17 times its 30-day average. The relative strength index was at 66.54.

Out of 11 analysts tracking the company, four maintain a 'buy' rating, four recommend a 'hold,' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 18.6%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.