(Bloomberg) -- Indian equities are poised to lure more foreign inflows after the general elections, with the economy's promising growth prospects and the Federal Reserve's rate cuts acting as catalysts.

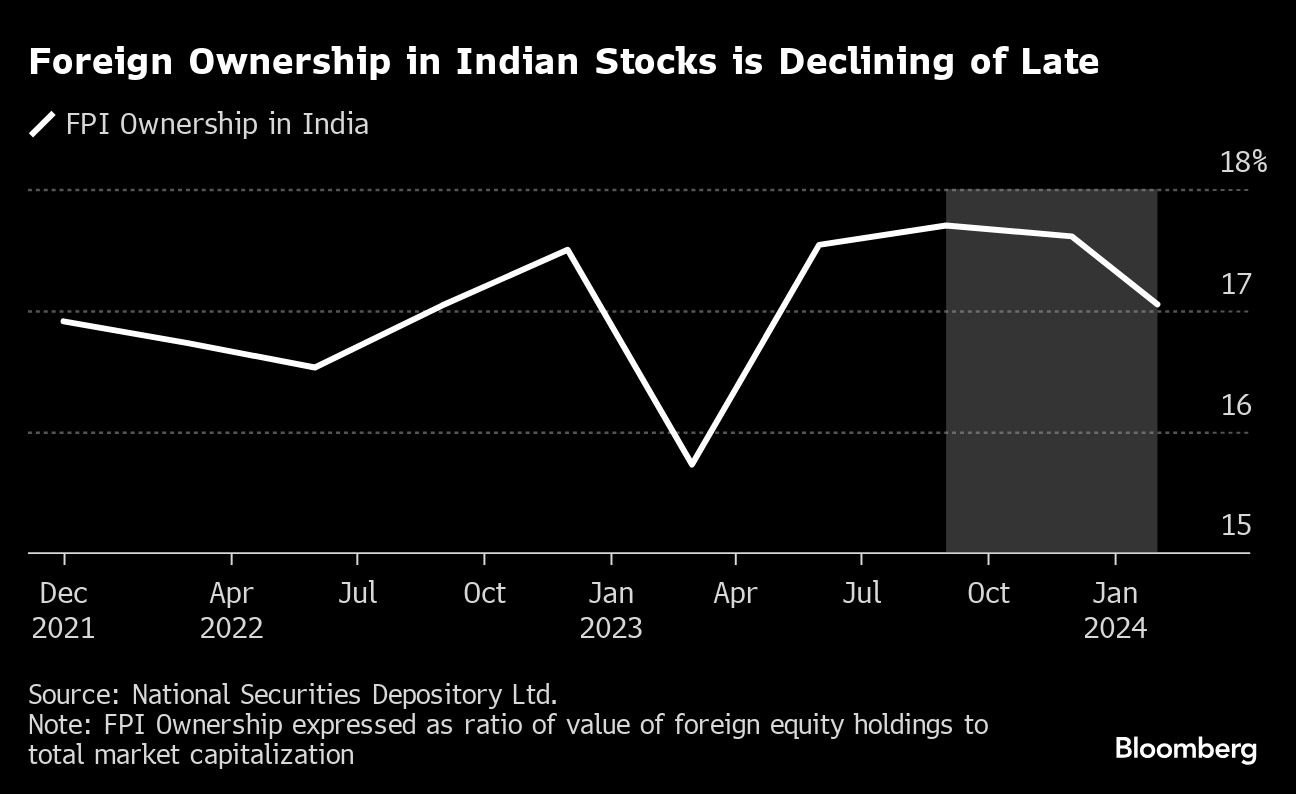

That's the view from Rajiv Batra of JPMorgan Chase & Co., who says global funds' positioning in India's $4.3 trillion stock market remains light and investors will use any correction as an opportunity to increase holdings. His views come as overseas flows have become more volatile ahead of the national vote amid concerns over stretched valuations.

“Foreign investors who didn't increase relative positioning in India over last 2-2.5 years waiting for this clearing event, will start focusing back on growth-driven policies or reforms,” Batra, an Asia strategist at JPMorgan, wrote in an email interview.

JPMorgan joins Goldman Sachs Group Inc. in predicting more inflows as Prime Minister Narendra Modi is widely expected to extend his decade in power. A third term for the leader is seen promising a continuation of market-friendly policies, spending on infrastructure and a push for foreign direct investment.

India will hold general elections over six weeks from April 19, with votes to be counted on June 4.

Read more: Anti-Modi Alliance in India Is Faltering as Election Nears

Investors will keenly be watching the seat-sharing arrangements if Modi's ruling party retains power, said Singapore-based Batra, adding that policy continuity is essential for India's market to sustain its higher valuation or “even witness further multiple re-rating.”

$100 Billion

Batra said that rising investor interest in India is forming a “virtuous cycle” of liquidity, sell-side coverage, investor participation and capital issuance.

“We estimate that if all benchmarked investors (EM, Asia ex-Japan, global ex-US and global) simply close their underweight positions on India, this would lead to $100 billion in inflows over the next few years,” he wrote.

Global funds' holdings of Indian stocks stood at $763 billion at the end of February, according to data from the National Securities Depository Ltd.

Read more: India's Economy Has Parallels to Booming 2000s: Morgan Stanley

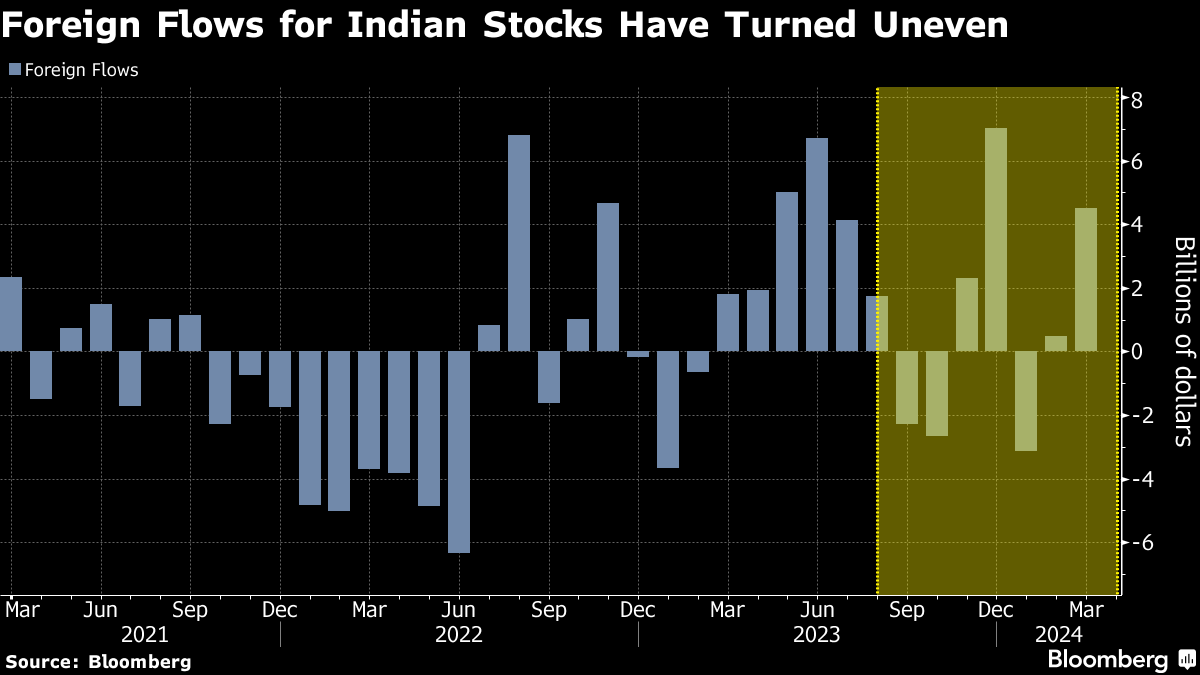

Foreign flows have turned uneven since the second half of last year as a relentless rally in the stock market drove valuations higher. The benchmark NSE Nifty 50 Index is on the verge of erasing all its advance for this year after capping a record eight-year winning streak in 2023, and there have been concerns about speculative froth building in the small- and mid-cap space.

The Indian gauge is trading at 20 times its one-year forward earnings estimates, versus a multiple of 12 times for the MSCI Emerging Markets Index.

Still, many investors argue that India deserves to trade at a higher premium versus the past as well as versus emerging-market peers given the economy's superior growth prospects, favorable demographics and the promise of political stability.

Read more: Shakeout in Indian Small-Caps Seen Luring Dip Buyers to Market

Global funds are “keen to raise exposure to India and are looking for better entry points,” said Sunil Koul, Asia Pacific equity strategist at Goldman Sachs. “We expect foreign flows to pick up in the latter half of the year, given elections will be behind us and the overall liquidity environment will be supportive for EM flows, with central banks easing and a weaker dollar.”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.