Page Industries Ltd.'s share price gained over 4% to its highest level in a year on Friday after Motilal Oswal upgraded the stock's rating to 'buy' with a target price of Rs 54,000, implying an upside of 20%.

The brokerage cited robust performance in the second quarter of the current fiscal, with the company reporting an 11% year-on-year sales growth, driven by a 7% volume increase—significantly outperforming expectations.

Demand picked up sequentially, particularly during the festive season, and Page Industries has also managed to reduce trade inventory by three days, improving its secondary order fulfillment, said Motilal Oswal.

With healthy volume growth projected to sustain, new product launches in the women's and kids' categories, and the upcoming Orissa facility expected to boost capacity, Page Industries' earnings outlook looks promising, the brokerage said. Motilal Oswal forecasts a stable Ebitda margin of 20-21% for fiscals 2025 to 2027, making the stock an attractive pick in the consumer space.

Citi, on the other hand, maintained its 'buy' call on the stock and hiked the target price to Rs 35,800 from Rs 33,100 earlier, on the back of better-than-expected margins.

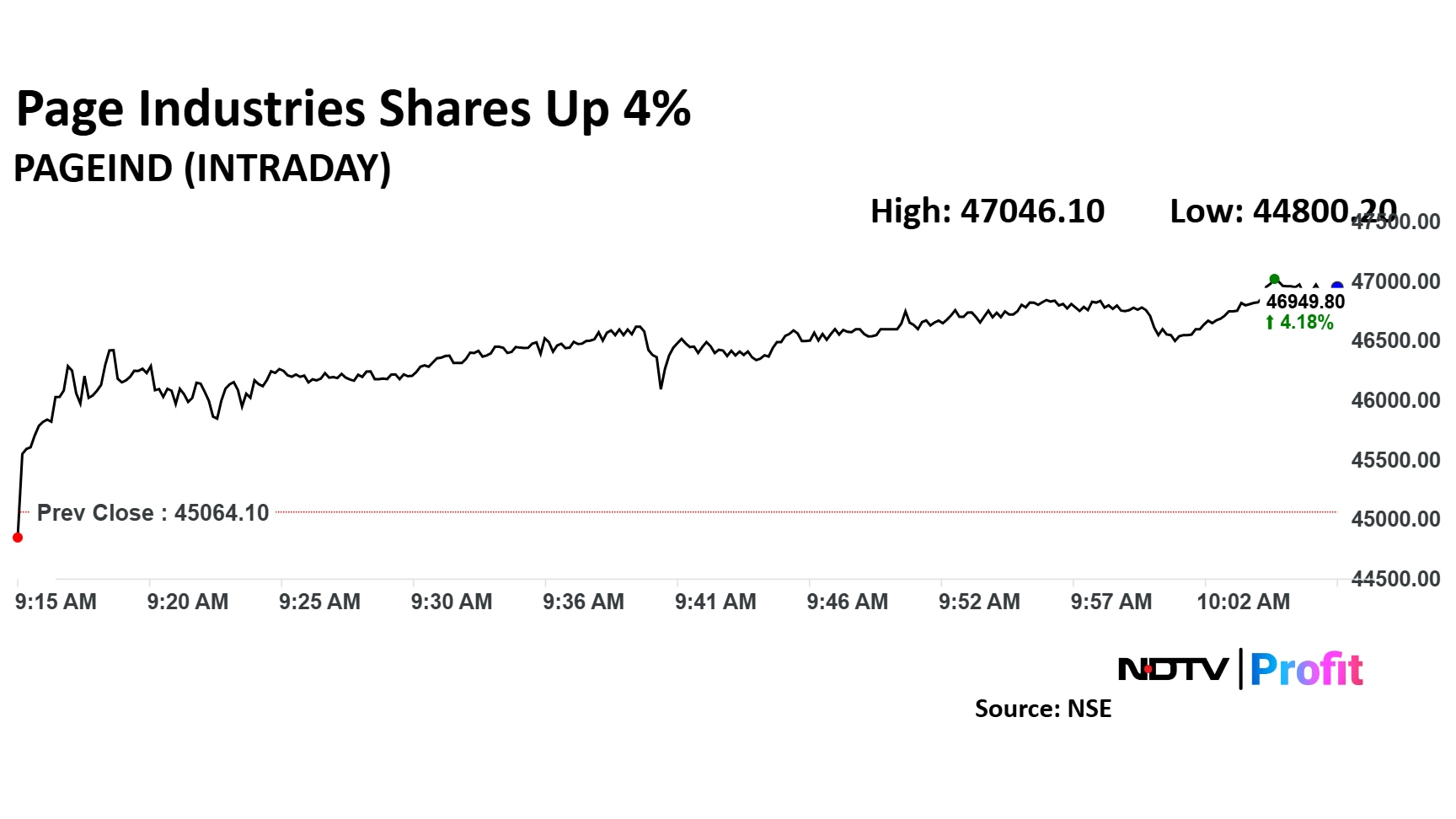

Shares of the company rose as much as 4.18% to Rs 46,947 apiece, the highest level since Dec. 14, 2022. The stock pared gains to trade 3.46% higher at Rs 46,625.40 apiece as of 10:03 a.m. This compares to a 0.14% advance in the NSE Nifty 50 Index.

The stock has risen 19.42% on a year-to-date basis and 23.08% in the last 12 months. Total traded volume so far in the day stood at 9.7 times its 30-day average. The relative strength index was at 69.61.

Out of 22 analysts tracking the company, eight maintain a 'buy' rating, five recommend a 'hold,' and nine suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 5.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.