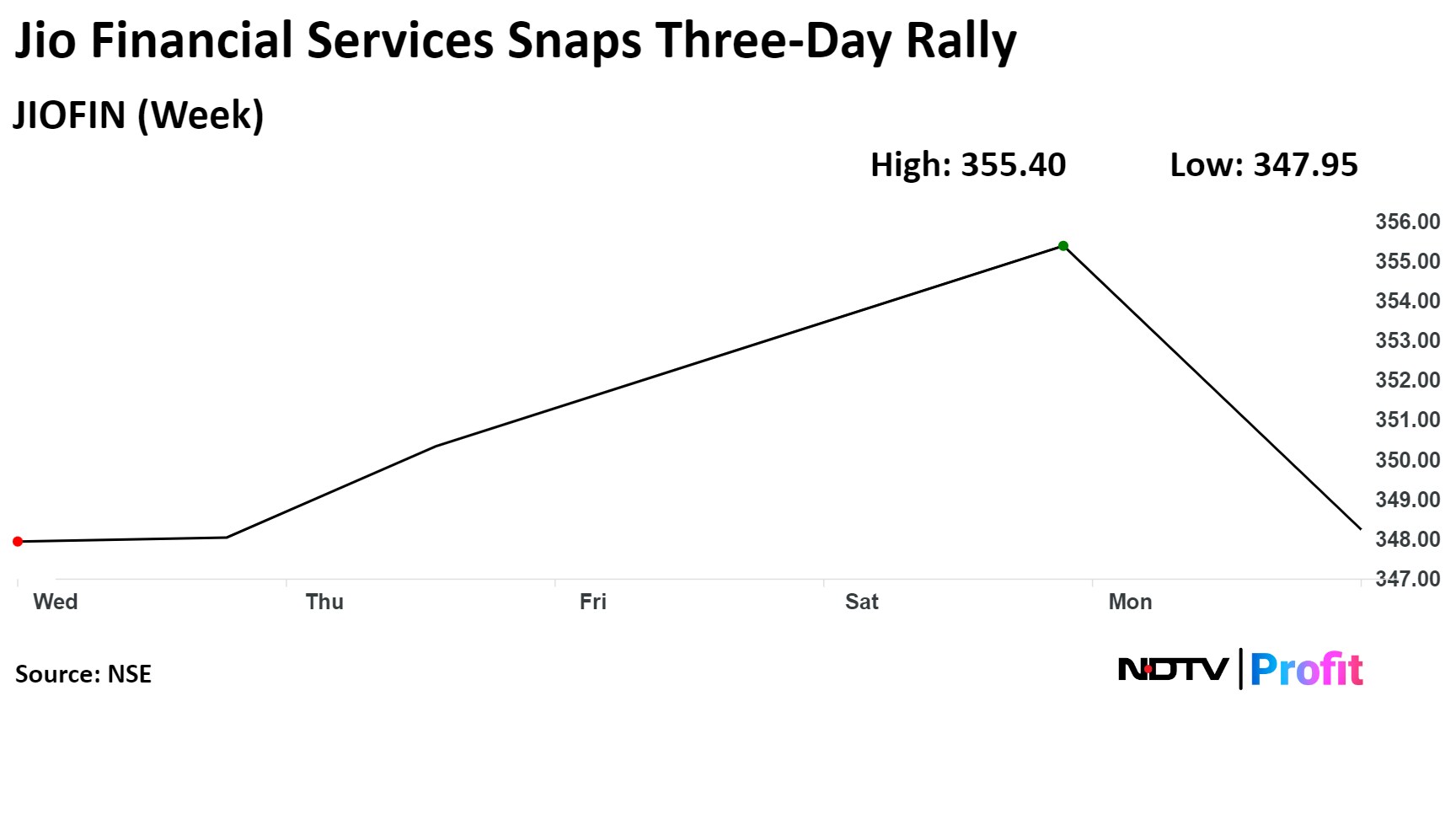

Shares of Jio Financial Services Ltd. fell on Tuesday after reporting flat sequential growth in its revenue and profit for the quarter ended June. The Reliance Industries-owned company snapped a three-session rally today, in which it had gained 2.1%.

Jio Financial Services Q1 FY25 (Consolidated, QoQ)

Revenue flat at Rs 417.8 crore versus Rs 418.1 crore.

Net profit up 0.6% at Rs 312.6 crore versus Rs 310.6 crore.

The company's profit stayed flat due to lower interest income. In the quarter-ended June, the interest income fell 42.3% quarter-on-quarter to Rs 161.74 crore. However, the net gain on fair value changes rose 104% quarter-on-quarter to Rs 217.9 crore.

Jio Financial's total income stayed flat sequentially at Rs 417.82 crore, while the company reported no other income for the quarter under review.

The company's total expenses declined 23% quarter-on-quarter to Rs 79.35 crore. Its employee benefit expenses fell 1% quarter-on-quarter to Rs 38.9 crore, and other expenses dropped the most by 38.6% sequentially to Rs 34.7 crore.

The shares of Jio Financial Services fell as much as 2.43% to Rs 346.75 apiece, the lowest level since July 10. They pared losses to trade 1.94% lower at Rs 348.50 apiece as of 10:23 a.m. This compares to a 0.2% advance in the NSE Nifty 50.

The counter has risen 49.6% on a year-to-date basis. Total traded volume so far on the NSE in the day stood at 0.56 times its 30-day average. The relative strength index was at 45.18.

One analyst tracking the company has a 'hold' rating for the stock, according to Bloomberg data and its target price implies a 12-month upside of 13.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.