(Bloomberg) --

The courtroom drama over an Indian options strategy that allegedly made $1 billion for Jane Street Group is drawing fresh attention to one of the world's fastest-growing derivatives markets.

Wall Street has been riveted by the trading firm's suit against two former employees and Millennium Management, after Jane Street claimed earlier this month that they stole a confidential and “immensely valuable” trading strategy. The strategy's focus on Indian options only became clear after lawyers for Millennium inadvertently identified the country in a hearing on Friday.

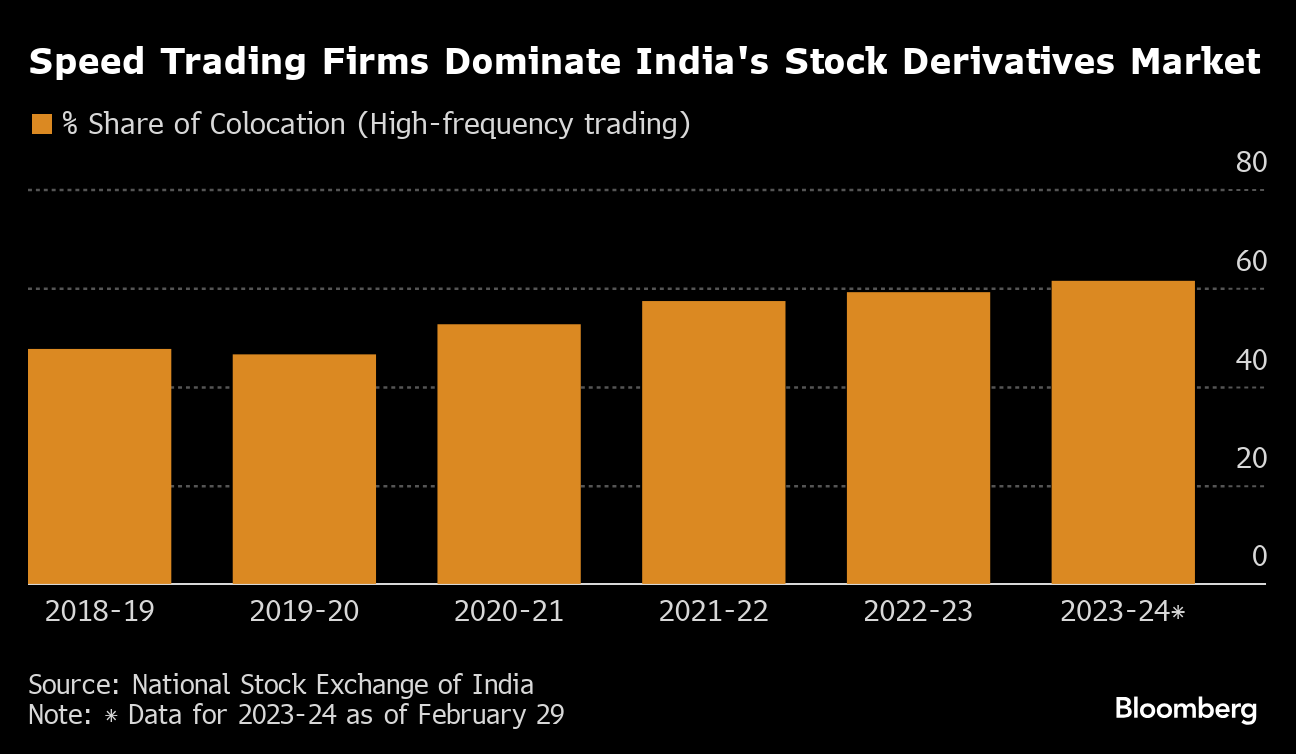

While many details of the strategy remain murky, the case offers a rare glimpse into the profits being made by secretive high-speed trading firms in a market that has soared over the past decade to become the world's largest by number of options contracts traded. Jane Street competitors including Optiver, Citadel Securities LLC, IMC Trading BV and Jump Trading have all been expanding in India, alongside a bevy of hedge funds and other players.

“Options market-making is a ‘winner takes all' game,” said Anant Jatia, the Mumbai-based founder and chief investment officer at Greenland Investment Management, a systematic investment firm that oversees more than $1 billion. “Market making in India has become very competitive where the fight is not even over microseconds, it's nanoseconds.”

As market participants in Mumbai exchanged theories over the nature of Jane Street's strategy on Monday, several expressed concern that the firm's outsized profits might be coming at the expense of unsophisticated mom-and-pop traders.

Retail investors make up about 35% of option trades in India, with the market regulator estimating that 90% of active retail traders lose money on derivatives.

“As retail participation in derivatives has gained traction in the post-Covid world, these players could be misled by complex market-maker positioning,” said Tejas Shah, head of derivatives trading at Equirus Securities Pvt.

Jane Street claimed it earned about $1 billion from the strategy last year, the judge said during Friday's hearing. The company reeled in more than $10 billion in net trading revenue last year, Bloomberg reported in January.

Despite the risks, the allure of India's market potential remains strong for both domestic and foreign market makers.

The success of local high-frequency trader Graviton Research Capital, which was established in 2014, and India's push to develop GIFT City, a financial hub that rivals Dubai and Singapore, are seen as reasons for foreign firms to scale up.

“The driving force is the liquidity that is now available in India,” said Vaibhav Sanghavi, a hedge fund manager at ASK Investment Managers in Mumbai. “It has become one of the only markets besides the US that can offer the kind of opportunity.”

--With assistance from Ashutosh Joshi.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.