Nvidia Corp. is the talk of the investing world. However, three Indian stocks, that have market capitalisation of over Rs 1,000 crore, have managed to beat the returns offered by the tech giant since 2022.

Nvidia became the largest listed company in the world with a market capitalisation of $3.3 trillion, or about Rs 275 lakh crore. This comes out to be nearly 14 times the size of India's largest listed entity, Reliance Industries Ltd., which has a market cap of Rs 19.8 lakh crore, or about $237 billion.

During the run up, Nvidia became the third company to cross the $3 trillion mark after surpassing Microsoft Inc. and Apple Inc., and its shares currently trade at $135, or Rs 11,253 per share.

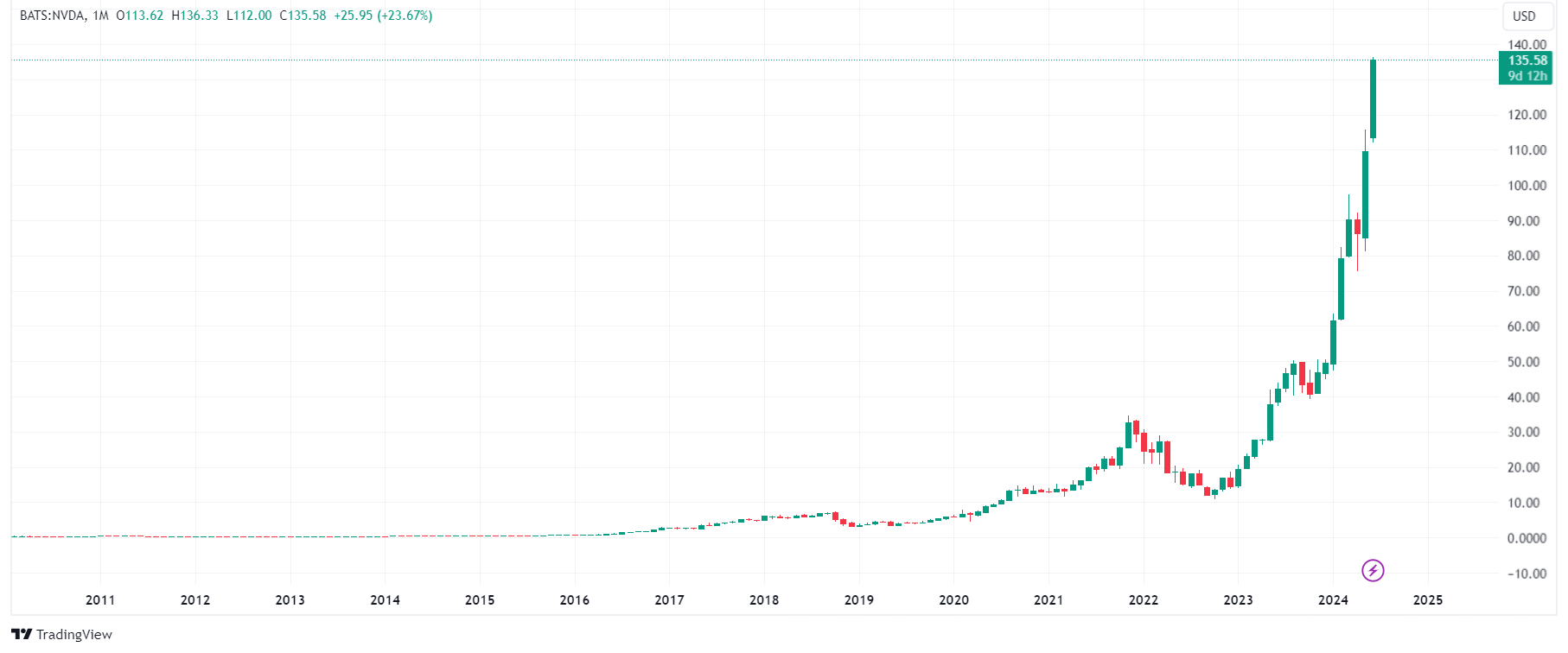

It wasn't long ago when Nvidia's shares traded at $12 apiece in October 2022, when a major part of the surge in its shares began.

The company's shares have grown to 12 times their price since then.

Over the same period, however, there have been Indian-listed companies that have given similar and even greater returns.

Jai Balaji Industries Ltd.

The stock has grown over 2,100%, with nearly twice the returns given by Nvidia over the same period.

Jai Balaji Industries manufactures iron and steel products. It was incorporated in 1999 and listed in 2007.

The surge in its shares has been a result of increasing operating efficiency and high earnings growth over the past few years.

Guidance given by the company's chairman and managing director, Aditya Jajodia, indicates peak revenue will reach around Rs 9,000–Rs 10,000 crore.

Transformers And Rectifiers (India) Ltd.

TRIL is the largest private sector manufacturer of transformers and is projected to expand its installed capacity from 400 GW in 2022 to 786 GW by 2030.

Annual profit-after-tax for the company has nearly tripled since 2022, growing at a compound annual growth rate of 66%.

The company's shares have been on a continuous uptrend since hitting a low of Rs 8 in March 2020 and have grown nearly 140 times since then.

GE T&D India Ltd.

As the listed entity of American multinational conglomerate General Electric's grid solutions business in India, GE T&D Ltd. operates in the power transmission and distribution business.

The company reported a loss of Rs 69.4 crore in fiscal 2022 due to a drop in revenues.

Since then, the company has reported a turnaround, with a profit of Rs 263 crore in fiscal 2024, led by significant order wins during the year.

With a rally that began in March 2023, shares of the company have multiplied over 15 times.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

:max_bytes(150000):strip_icc():focal(722x523:724x525):format(webp)/Savannah-Guthrie-mother-Nancy-Guthrie-020226-02-0368cb6ddb864bf09919fd100fe546b0.jpg?im=FeatureCrop,algorithm)