Shares of ITC Ltd. rose over 3% after the diversified conglomerate released its financial results for the quarter ending Sept. 30, 2024. The company reported a net profit of Rs 5,078.34 crore for Q2 FY25, a 3% rise year-on-year.

Despite the profit growth, ITC's operating margin came under pressure, hitting its lowest level in nearly three years. The company's operating margin contracted by 470 basis points to 32.8%, missing analysts' expectations by approximately 4 percentage points. This margin decline is the lowest recorded since Q2 of the financial year ending March 2022, when it stood at 32.5%, according to data compiled by NDTV Profit via Bloomberg.

ITC attributed these challenges to a combination of factors, including subdued demand conditions, unusually heavy rainfall in various parts of the country, high food inflation, and a sharp increase in certain input costs.

Even as the net profit rose in the July-September period, it fell short of the Rs 5,154-crore consensus estimate of Bloomberg analysts.

Revenue increased by 16% year-on-year to Rs 19,327.7 crore, compared to Rs 16,550 crore in the same quarter last year. That included a 6.79% increase in cigarette revenue, which rose to Rs 8,177 crore from Rs 7,657 crore a year ago.

Revenue from FMCG, excluding cigarettes, increased by 5.4% to Rs 5,577 crore from Rs 5,291 crore in the corresponding period last year. The Bloomberg analysts had pegged the top line at Rs 18,068 crore.

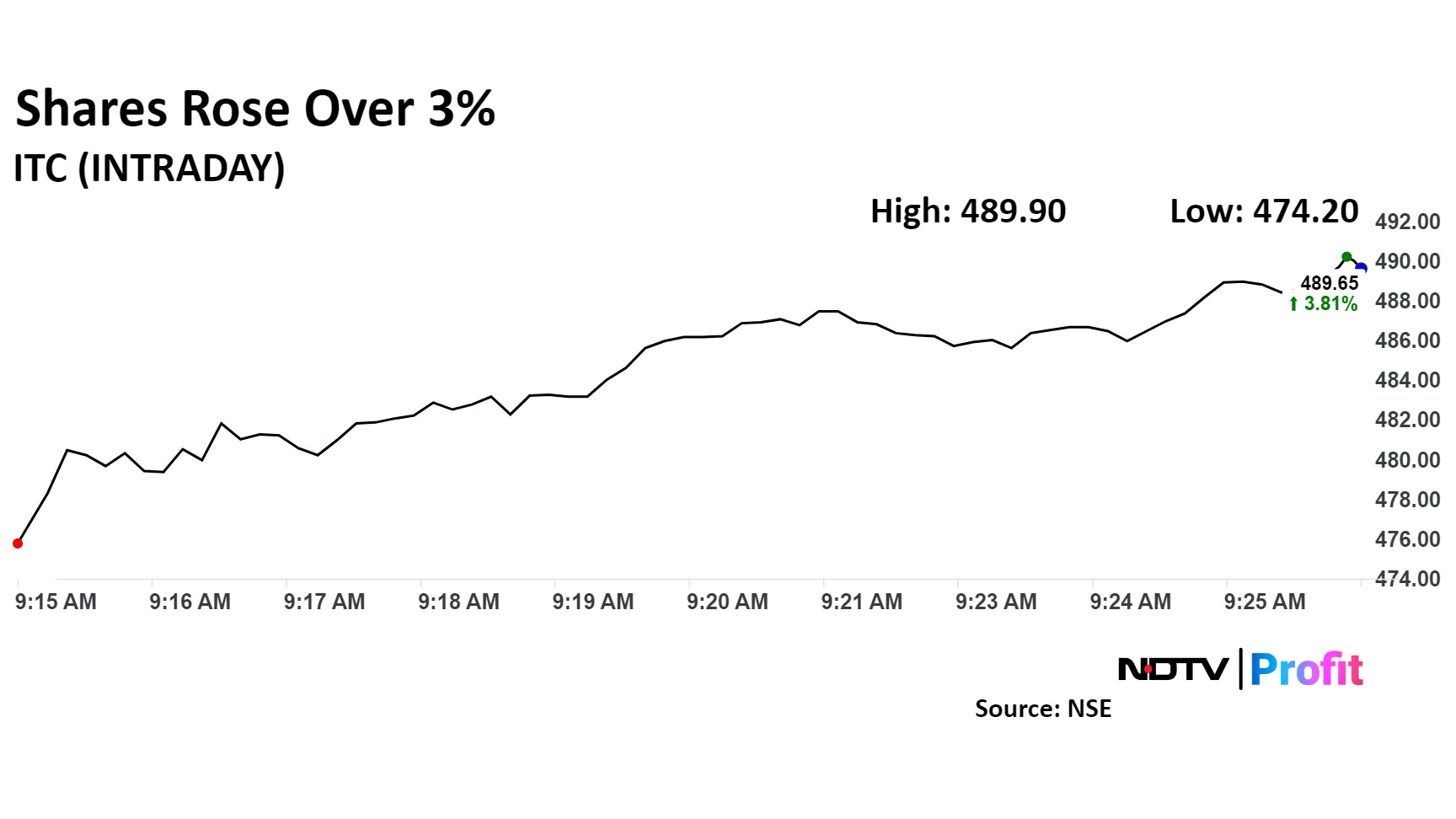

ITC Share Price Today

Share price of ITC rose as much as 3.12% to Rs 486.40 apiece. It pared some gains to trade 3.05% higher at Rs 486.10 apiece as of 09:22 a.m., compared to a 0.01% advance in the NSE Nifty 50.

The stock has risen 12.42% in the last 12 months. Total traded volume so far in the day stood at 0.21 times its 30-day average. The relative strength index was at 42.

Out of 39 analysts tracking the company, 34 maintain a 'buy' rating, three recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 13%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.