.JPG.jpg?downsize=773:435)

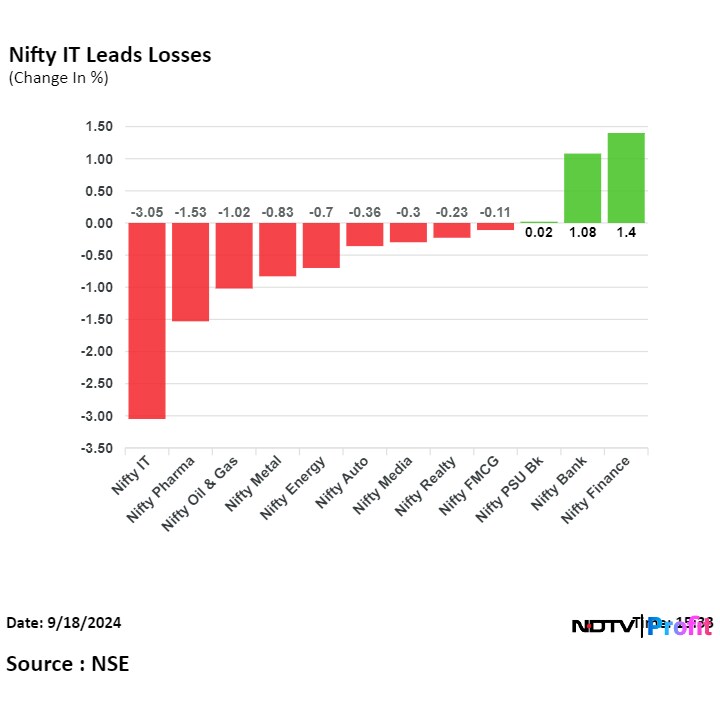

India's IT stocks tumbled on Wednesday with the NSE Nifty IT emerging as the top loser with over 3% loss. This happened as market watchers were on edge over the quantum of the likely rate cut by the US Federal Reserve and as Tata Consultancy Services Ltd.'s management expects a softer second quarter.

The market cap of IT companies declined by Rs 1.20 lakh crore to Rs 37.03 lakh crore.

TCS management, while talking to analysts about July-Sept guidance, said that they expect the second quarter to be soft. The growth and deals won in the first quarter are likely fizzling out, according to the management, that added that the business in North America and BFSI is in bit of struggling mode.

Indian IT companies conduct substantial business with American firms, thus, making them vulnerable to the US economic environment.

Investors across the globe are divided on the possibility of Fed rate cut. They either expect a 50-basis-point rate cut or a 25-bp rate cut. The US rate setting panel is expected to announce its decision late Wednesday. The former scenario is gaining more ground among traders given the condition of the labour market in the US, and comparatively lower level of inflation.

XM Australia expects the US Federal Open Market Committee to cut the benchmark federal fund rate by 50 basis points at its two-day policy meeting, Chief Executive Officer, Peter McGuire, said. However, in an interview to NDTV Profit, he also noted more traders were vouching for a 25 bp rate cut.

According to CME FedWatch tool, the Fed fund future traders are pricing in a 65.0% possibility of a 50 bps rate cute, while 35% expects a quarter of percentage point rate cut.

Meanwhile, recent US retail sales data did little to give any respite to the ongoing debate over the quantum of rate cuts. US retail sales, which are mostly goods not adjusted for inflation, rose 0.1% in August, compared to the 0.2% decline analysts have forecast in a Reuters' poll.

The NSE Nifty IT declined as much as 3.69% to 41,814.40, marking the lowest level since Sept. 9 as Infosys Ltd., Tata Consultancy Services Ltd. dragged it down.

The index had hit a record high of 43,645.90 on Tuesday. Nifty IT settled 3.05% lower at 42,089.30.

Meanwhile, Mphasis Ltd. logged the most loss among its peers with 6.38% intraday loss. It ended 5.46% lower at 3,004.40. TCS followed suit and declined 4.10% to Rs 4,321 per share during the session. The stock settled at 3.54% lower at Rs 4,346.15 apiece.

In contrast to other stocks, LTIMindtree Ltd. posted least decline. The stock settled down 1.39% at Rs 6,366.30.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.