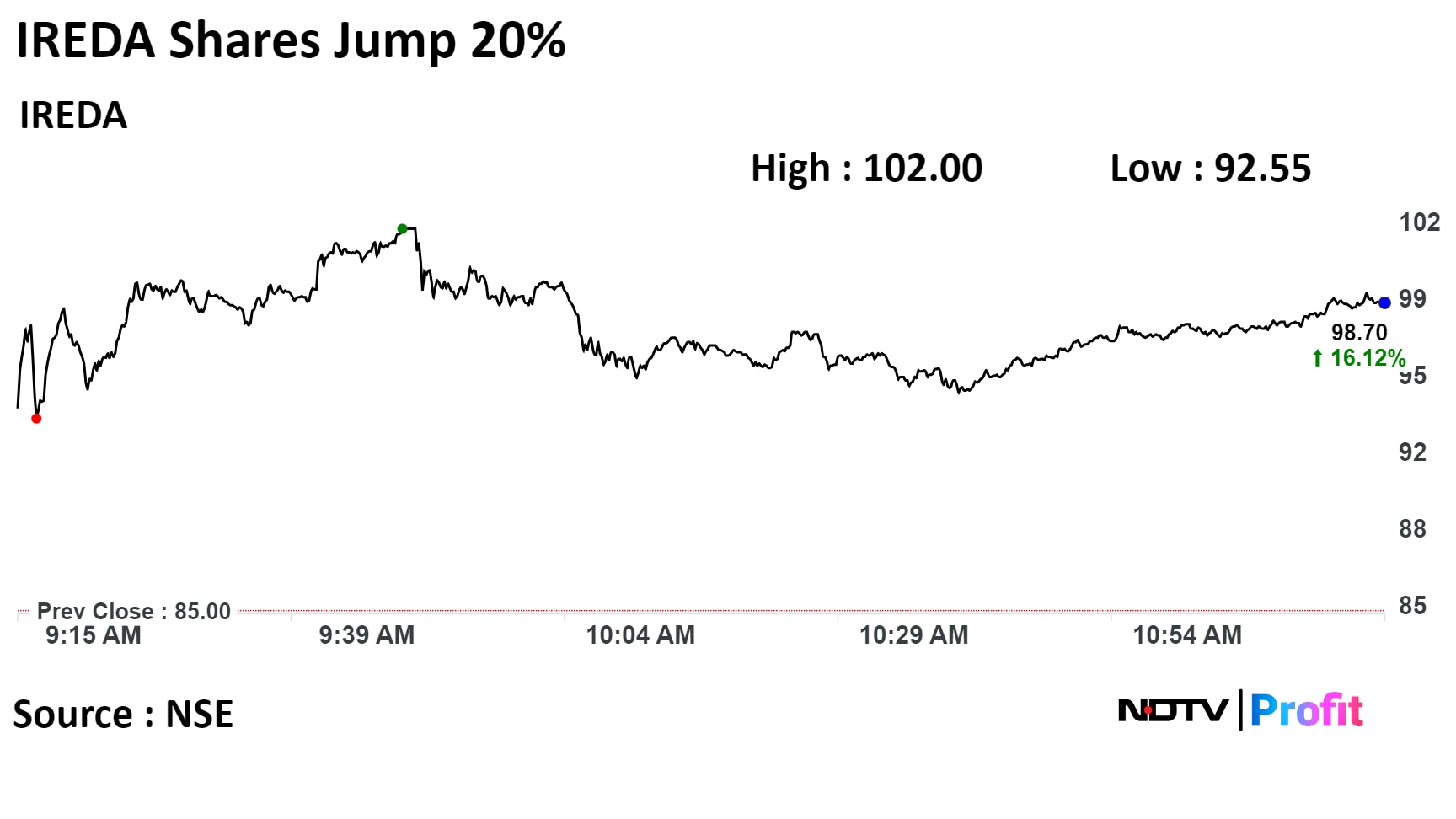

Shares of Indian Renewable Energy Development Agency Ltd. jumped over 20% on Tuesday as post-listing rally continues in the first government-owned company going public in 18 months since Life Insurance Corp.

The stock has now surged more than 200% over its initial public offering price of Rs 32 per share.

Investor interest in shares of the state-owned green energy financier reflects demand for public sector stocks. The Nifty PSE Index has surged nearly 69% year-to-date compared with a 16% rise in the benchmark Nifty 50.

IREDA made its debut in the exchanges on Nov. 29 and marked a stellar closing of a premium of 87.5% over the issue price of Rs 32 per share. The Rs 2,150-crore initial public offering was subscribed 38.80 times on its third and final day.

The government is considering granting IREDA the 'Navratna' status, according to Chairperson Pradip Kumar Das. The financial services company was upgraded to 'Schedule A' category public sector enterprise from 'Schedule B' in September.

IREDA stock rose as much as 20% during the day to Rs 102.35 on the NSE. The shares were trading 14.29% higher at Rs 97.15 apiece compared to a 0.05% advance in the benchmark Nifty 50 as of 11:04 a.m.

Business

Incorporated in 1987, IREDA is a Mini-Ratna (category I) and a non-banking financial institution that promotes, develops and extends financial assistance for new and renewable projects. It operates in four key sectors: solar, wind, hydro, biomass, biofuels and cogeneration.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.