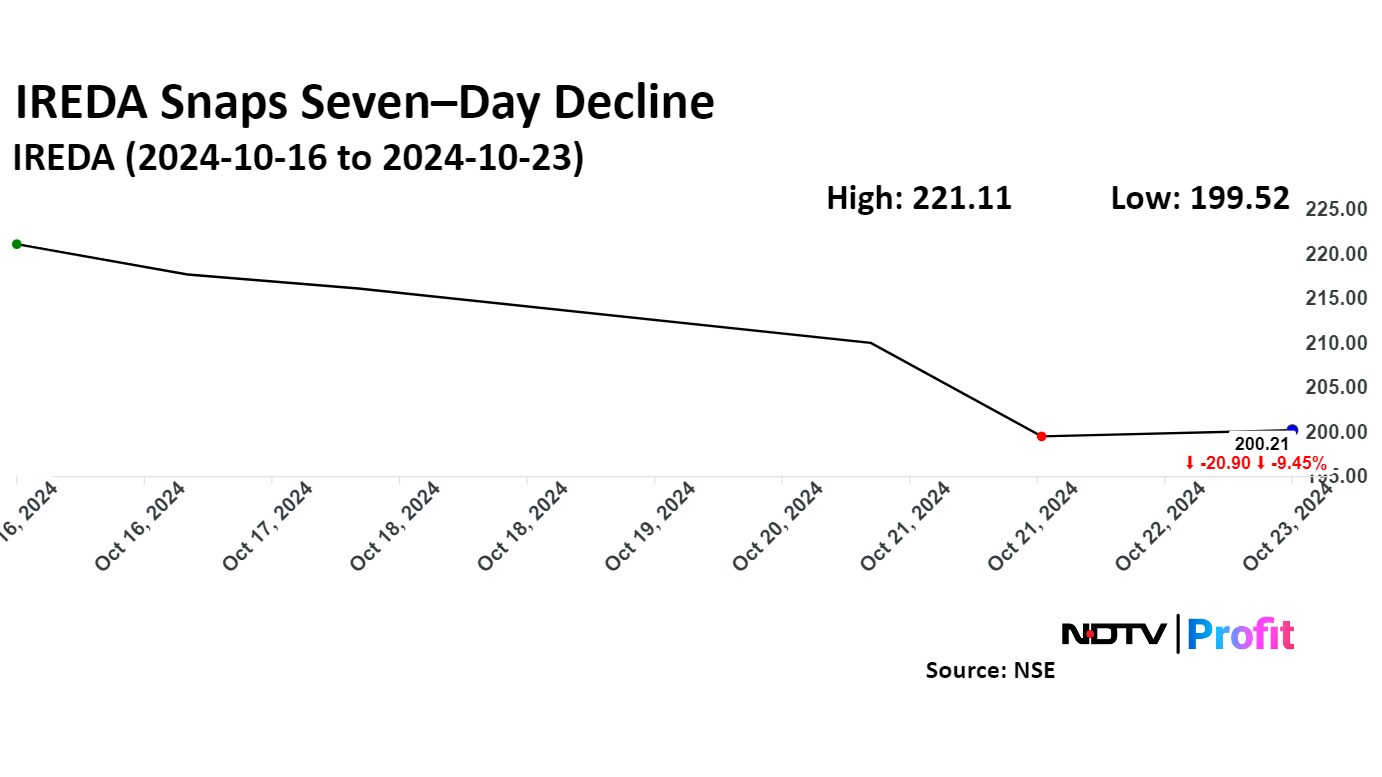

Indian Renewable Energy Development Agency Ltd.'s share price extended losses and touched the lowest level in nearly four months on Wednesday. The shares briefly snapped a seven–session decline earlier in the day.

In the last seven sessions, the stock price has declined 9.31%. It has been struggling to gain since Oct. 11. Sentiment for the stock have likely turned negative since it missed net profit estimates for July–September period.

On Oct. 10, it rose over 2% after it reported that its net profit rose 36.14% on the year to Rs 388 crore versus Rs 285 crore. However, it missed the Bloomberg estimate of Rs 410 crore for the period.

Meanwhile, its net non–performing asset rose to 1.04% during July–September, compared to 0.95% in corresponding period of financial year 2024.

IREDA Share Price Today

In last seven session the stock price declined 8.92%.

Indian Renewable Energy Development Agency share price declined 5.54% to Rs 199.52, the lowest level since June 26. It erased losses briefly and gained 1.69% during the session so far.

Indian Renewable Energy Development Agency's share price was 0.23% down at Rs 199.25 apiece as of 11:27 a.m., as compared to 0.40% advance in the NSE Nifty 50.

The stock has been declining since Oct. 16 and has fallen 9.31% in the last seven sessions. In this period it fell the most on Tuesday, declining 5.73% to Rs 198.00 apiece.

The share price rose 233.68% in 12 months, and 94.55% on year-to-date basis. Total traded volume so far in the day stood at 1.6 times its 30-day average. The relative strength index was at 31.51.

Out of two analysts tracking the company, one maintains a 'buy' rating, and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 40.00%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.