(Bloomberg) --

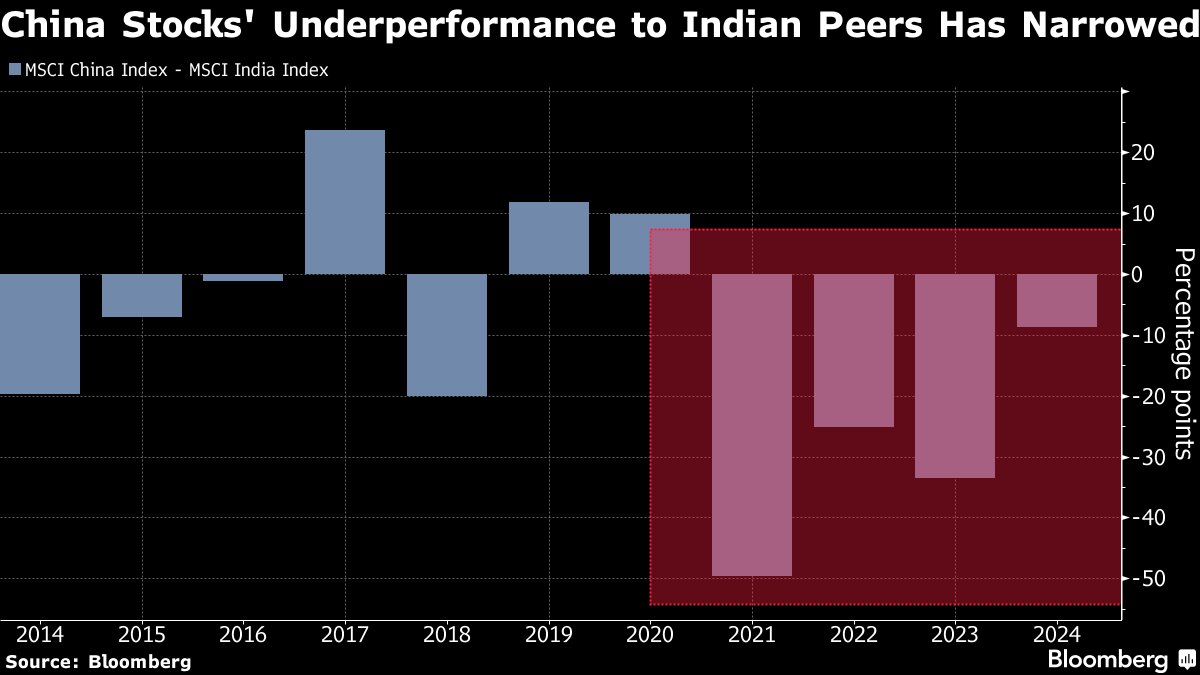

A popular equities strategy to “buy India, sell China” has reached an inflection point for some investors.

Lazard Asset Management, Manulife Investment Management and Candriam Belgium NV are paring exposure to India after a record-breaking rally. They're pivoting to former favorite China, as Beijing's support for its economy spurs a recovery in industrial profit and manufacturing.

The nascent swing highlights how funds are starting to buy into the narrative that China's policy support will be enough to revive growth. While major Wall Street banks continue to position India as the key investment destination for the next decade, investors are turning wary amid stretched valuations and regulatory warnings about market froth.

Read more: Wall Street Pivots to India as It Searches for China Alternative

“As China has got cheaper and cheaper, some of our Chinese investments have become less valuable but the investment case for them has increased,” said James Donald, head of emerging markets at Lazard Asset. The fund manager's China portfolios are aligned with the index weight, while India “has been a source of negative attribution for our portfolios” due to its rich valuations, he said.

There are signs the shift is gaining traction, even if most see it as a tactical play given the outlook for India's booming economy and expectations that Prime Minister Narendra Modi will win a third term in elections starting April 19.

More than 90% of emerging market funds are adding back their positions in mainland Chinese shares, which were underweight, while also dialing back exposure to India, according to HSBC Holdings Plc. Global investors were net buyers of onshore shares via a link with Hong Kong for a second straight month in March, a feat last seen in June and July.

By way of performance, the MSCI China Index has more than doubled gains clocked by the Indian measure since February with a push from Beijing's stimulus, while India's rally has cooled.

Candriam's $2.5 billion emerging markets fund has raised its exposure to China “partly at the expense of India,” said portfolio manager Vivek Dhawan.

“We have positioned India as a funding source for some interesting themes that we find in China, especially those related to self-sufficiency and localization,” he said. “We are adding names in the semiconductor supply chain because China would increase spending there.”

Green Shoots

Investors are turning more optimistic about the world's second-largest economy after China's official manufacturing purchasing managers index registered the highest reading in a year, the latest economic green shoot alongside strong exports and rising consumer prices.

To be clear, the path forward remains uncertain. The nation's property woes continue to be a drag on the economy and the latest earnings season has been mixed, with disappointing results from names such as BYD Co., Wuxi Biologics Cayman Inc. and China Mengniu Dairy Co.

Yet, some investors are convinced of Beijing's resolve to revive growth and end the equities rout, which had wiped out $7 trillion at one point.

“China's path is in favor of a more robust economic environment and a bit more positive sentiment toward risk assets in the coming 12 months,” said Nathan Thooft, chief investment officer of multi-asset solutions at Manulife Investment.

Thooft said his portfolio is modestly underweight China, but the fund is adding to the nation's shares as it raises exposure to emerging-market equities.

The wide valuation gap is also a draw. The MSCI China Index trades at 9.1 times its one-year forward earnings, 60% cheaper than the multiple for the MSCI India Index, which hit a record last month.

The last time the gap was this wide, Chinese equities outpaced their South Asian rivals over the subsequent months, often with Beijing's policy moves acting as a primary catalyst.

“We think China is cheap and there are some potential bargains while staying very selective,” said Xin-Yao Ng, director of investment at abrdn. “India has a good structural story for as long as Modi's constructive policies remain in place, but valuation is expensive.”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.