Shares of Infosys Ltd. tumbled over 1% on Tuesday after Nilanjan Roy resigned as the chief financial officer a day ago.

Roy's last working day is March 31. His deputy, Jayesh Sanghrajka, will be in charge the following day, according to an exchange filing on Monday.

"As Deputy CFO, he (Sanghrajka) has been leading multiple portfolios in the finance function for several years now and his depth of experience and knowledge will serve us well to take the function to greater heights," Chief Executive Officer Salil Parekh said.

Infosys' American depositary receipt fell after the news broke. It was down by 2.66%.

The resignation was unexpected and can weigh on sentiment for the stock in light of past senior exits from Infosys, according to Morgan Stanley. "Given the role has been filled by an internal candidate with a long history at Infosys, we expect the transition to be a smooth one."

It has an 'overweight' rating on the stock with a target price of Rs 1,600, implying an upside return potential of 7%.

"Over the last 15 months, there have been multiple exits from the senior level, which have caused some concern among investors," the research firm said in a note on Monday. "We believe another senior management exit could weigh on sentiment for the stock."

Key To Upside

Revenue growth significantly better than the top end of the growth guidance for the financial year.

Margin performance better than expectations.

Rupee depreciation vs dollar.

Downside Risks

Loss of traction in new business.

Rupee appreciation and regulatory risks pertaining to visas in the US.

Escalations in the geopolitical environment and inflation risks hampering the global macro environment.

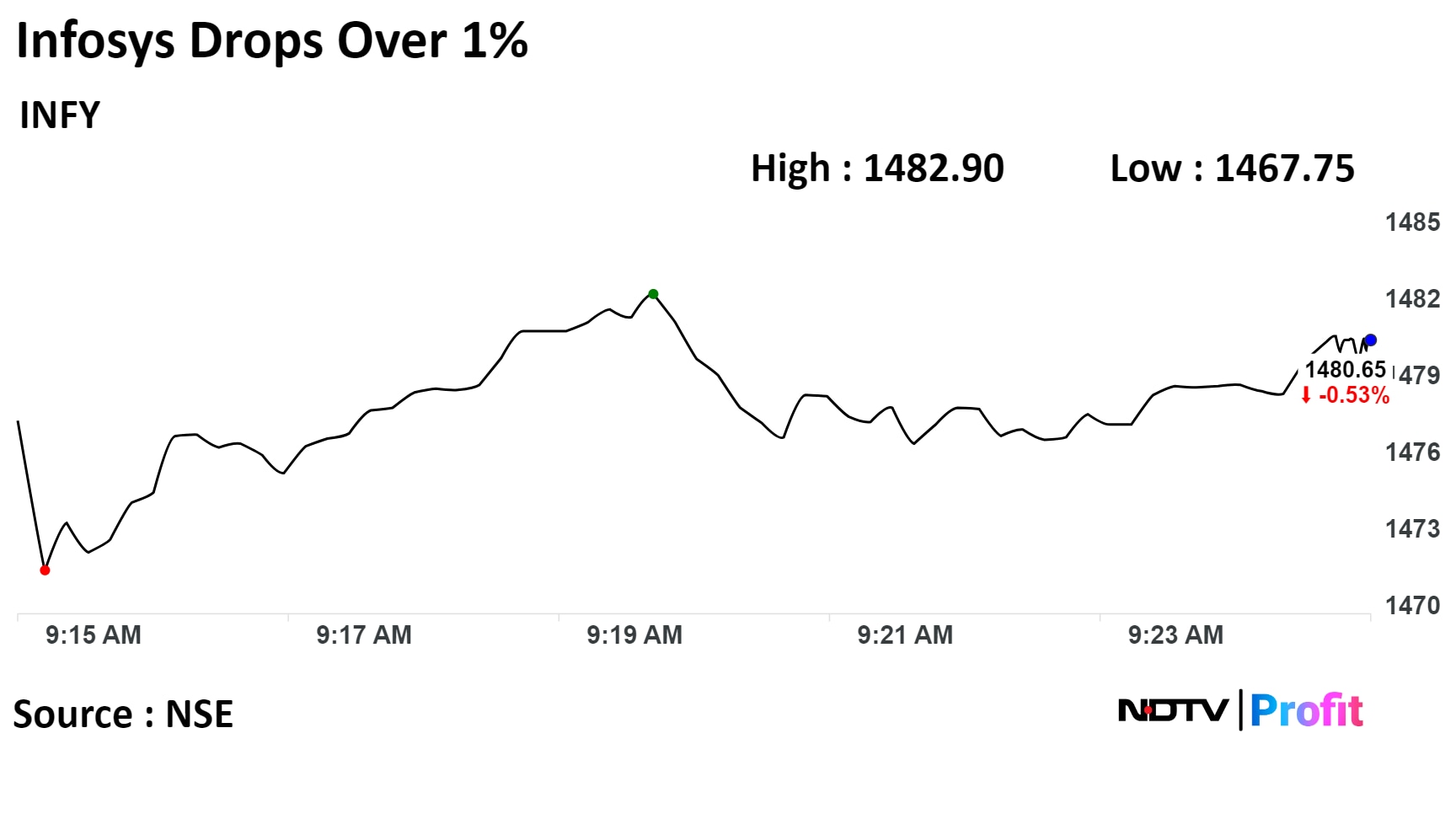

Infosys' stock fell as much as 1.39% to Rs 1,467 apiece on the NSE. The shares were trading 0.68% lower at Rs 1,478.40 compared to a 0.12% advance in the benchmark Nifty 50 at 9.22 a.m.

The stock has fallen 1.31% on a year-to-date basis.

Twenty-one out of the 45 analysts tracking Infosys have a 'buy' rating on the stock, 16 recommend a 'hold' and eight suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 2.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.