Infosys Ltd.'s share price declined 4% on Friday as the company's second quarter results failed to enthuse investors.

The IT major's results showed a 4.3% increase in revenue over the previous three months to Rs 40,986 crore for the quarter ended Sept. 30, 2024. That compared with the Rs 40,820-crore estimate by analysts tracked by Bloomberg.

Net profit rose 2.2% sequentially to Rs 6,506 crore, meeting the Rs 6,831 crore profit expected by analysts.

The Bengaluru-based software services provider upped its revenue forecast for the financial year ending March 2025. It now expects a revenue increase of 3.75-4.5% for fiscal years 2024–25, up from its previous expectation of a 3-4% rise.

However, Infosys maintained its guidance for the fiscal at 20-22%, according to a media statement issued to the exchanges.

Besides, the large deal total contract value came in at $2.4 billion, with 41% being net new. This compares with $4.1 billion, its highest ever recorded last quarter. The number of active clients stood at 1,870, with 86 added during the quarter.

Analysts Point To Coming Pains

Morgan Stanley has an 'overweight' rating on Infosys, with a target price of Rs 2,150 per share, a potential upside of 9% over the previous close. The investment bank said double-digit sequential rise in small deals could drive improvement in conversion of total contract value to revenue.

Although, it flagged key concerns of weak large deal wins, limited discretionary spending outside financial services and deferred wage hikes that may affect margins. Morgan Stanley also trimmed its current year revenue growth estimate for Infosys to 4.7%.

Citi noted that the management's guidance implies no growth in the remaining two quarter at the mid-point. Forward looking indicators are still looking sluggish for most Indian IT companies and margin levers for most are at close to optimal levels.

It maintained 'neutral' rating on Infosys, with a target price of Rs 1,965 per share from Rs 1,955 apiece previously, a potential downside of 0.5%.

Infosys Share Price Today

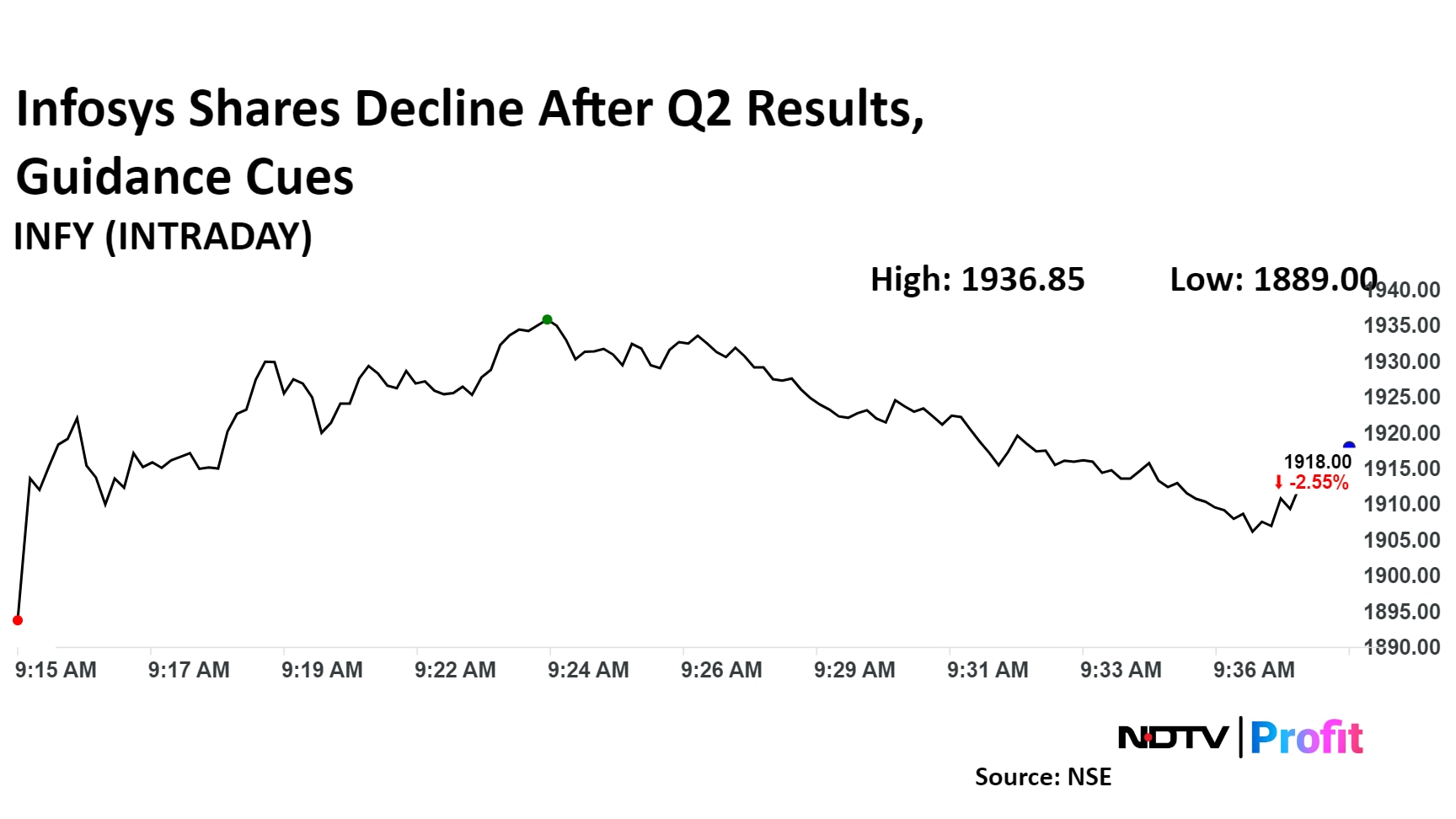

The Infosys stock was trading 2.55% lower at Rs 1,918 by 9:35 a.m.

Infosys' share price declined 4% intraday to Rs 1,889 apiece. The scrip was trading 2.55% lower at Rs 1,918 per share at 9:35 a.m., compared to a 0.4% decline in the benchmark NSE Nifty 50.

The stock has risen 33% in the last 12 months and 24% on a year-to-date basis. Total traded volume so far in the day stood at 3.9 times its 30-day average. The relative strength index was at 49.

Of the 45 analysts tracking the company, 32 have a 'buy' rating, nine recommend a 'hold' and five suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.