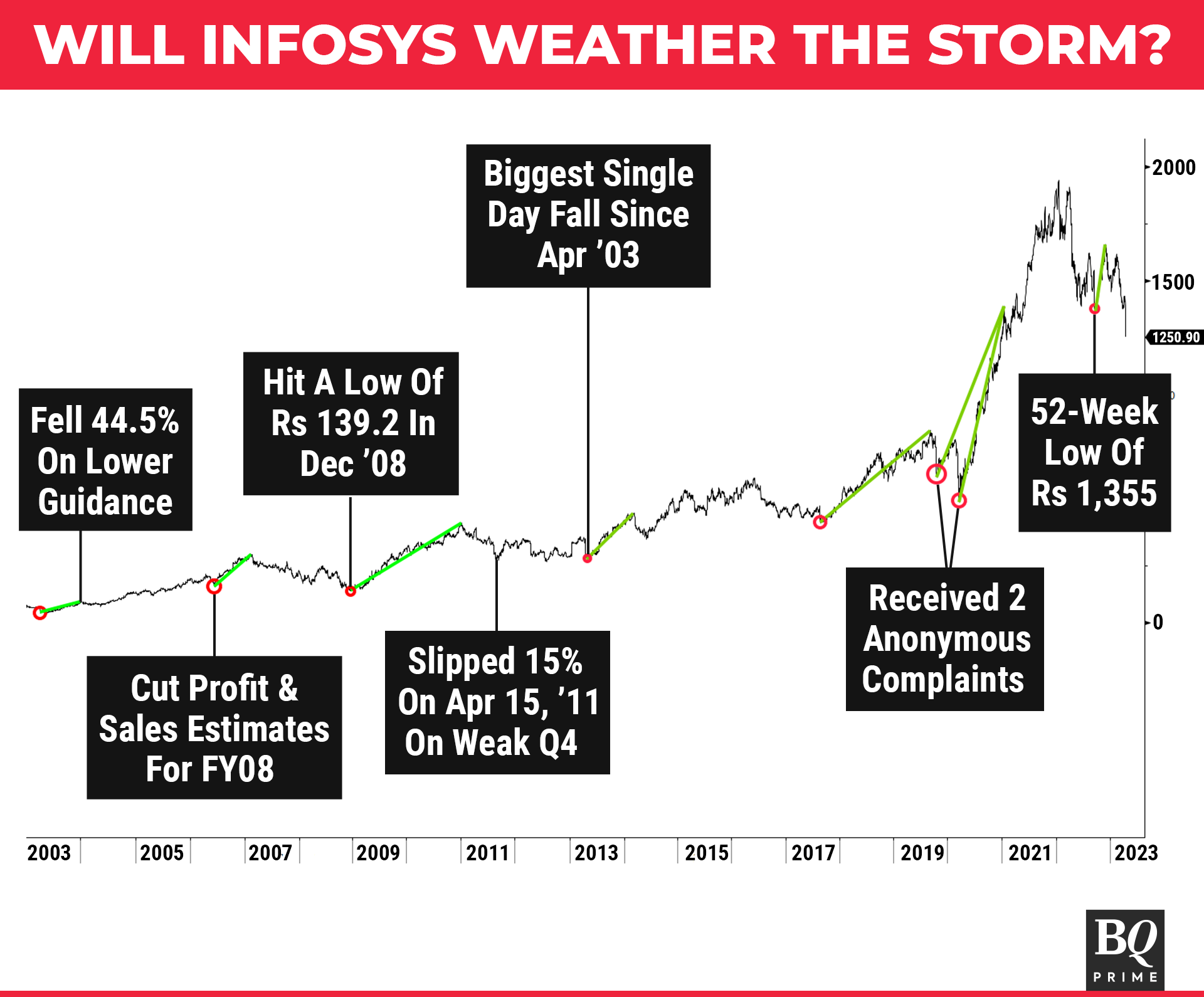

Infosys Ltd.'s 10% share plunge after a fourth-quarter earnings miss may scare investors away. Yet, after every big tumble in the last 20 years, the stock rebounded to give phenomenal returns, according to BQ Prime's analysis of historical data. But that's only applicable to brave hearts who would have ventured into troubled waters.

Having reported lower-than-expected Q4 results and a lower FY24 outlook, shares of India's second-largest software services provider plunged the most in a single day since 2019 on Monday and dragged peers along.

The Bengaluru-based IT services firm pegged its revenue growth at 4-7% in the ongoing financial year. That compares with an average analyst estimate of 10.6% and FY23's 15.4%, which was below the 16–16.5% guided earlier.

Brokerages have downgraded the stock and reduced the target price. Shares were trading 0.14% higher as of 11.20 a.m. on Tuesday.

Since 2003, Infosys has witnessed substantial falls about eight times for varied reasons. But every time, it bounced back to gain 40–70%.

2022

Infosys stock hit a 52-week low of Rs 1,355 on Sept. 22, 2022, and then bounced back to Rs 1,657 by December, rising 18%. The stock underperformed the market as analysts expected a pause or slowdown in the pace of digital and cloud initiatives due to cutbacks in discretionary spending by clients.

2019-2021

The Infosys board received two whistleblower complaints on Sept. 30, 2019, and another one on Sept. 20, 2019, alleging "disturbing unethical practices." The stock tumbled 15% in a day to hit a low of Rs 767.85. Within months, Covid-19 struck, taking it to a low of Rs 526.45 in March 2020. The shares of the company, however, bounced back to Rs 1,387 by January 2021. In this period, it gained 68%.

2013-2014

Infosys plunged 21.33% to Rs 287.08, recording its biggest single day fall since April 2003, on a lower-than-expected revenue outlook for fiscal 2013-14 and disappointing Q4 earnings.

The stock, however, surged 40% by March 2014 to Rs 479.

2011

The stock dropped 15% on April 15, 2011 on Q4 FY11 results and below-market revenue guidance expectations for FY12.

2008

The shares of Infosys hit the year's low of Rs 139.22 in December 2008, after the Lehman Brothers collapse. The fear was that the downturn in the world's largest economy would hurt the outsourcing industry in India. That impacted the IT industry as a whole.

2006-2007

Infosys shares fell to a low of Rs 155.32 in June 2006 but bounced back to return 48% gains by February 2007. The company, however, cut estimates for profit and sales in rupee terms for FY08 after a stronger local currency eroded earnings from the U.S., its largest market.

2003-2004

Shares plunged 44.5% on April 10 as the company announced that its net profit would grow by about 12% in 2003-2004. Analysts had pegged the growth at 17%. That's despite the fact that Infosys had filed for an American depository share issue with the U.S. Securities and Exchange Commission on April 1.

That, however, is not to suggest that Infosys has bottomed out or is set for a rebound, as multiple factors are at play in the stock markets.

And rebounds from the past notwithstanding, analysts are cautious this time. According to Sanjeev Hota of Sharekhan, Infosys could recover marginally over the next six months. "However, money will shift to TCS in the near term in the IT pack."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.