Info Edge (India) Ltd.'s share price surged over 6% on Friday after Goldman Sachs upgraded its rating on the stock to 'buy', on expectations of changing demand environment for Indian IT services. The brokerage had a 'sell' rating on the stock previously.

"Our change in view on Info Edge is supported by a better than expected outlook on growth/hiring over the last two months by our covered large cap IT companies, and info Edge's own commentary and disclosures suggest inflecting growth in recruitment, and better margins in real estate and matrimony," the brokerage said.

It has also raised its target price for the stock significantly by nearly 51% to Rs 8,600 per share, implying an upside of 14%.

"We note that on a structural basis, we have consistently viewed Info Edge's business model as characterised by high barriers to entry, network effect, and high operating leverage," the brokerage added.

Segment wise, Goldman Sachs continues to expect a robust 20% revenue growth outlook for 99acres, and says a combination of scale and stable competitive intensity should help the company achieve breakeven in calendar year 2025.

"Additionally, we remain bullish on Zomato (33% of Info Edge's market cap), and see upside risks to both estimates and multiples for the company," it said.

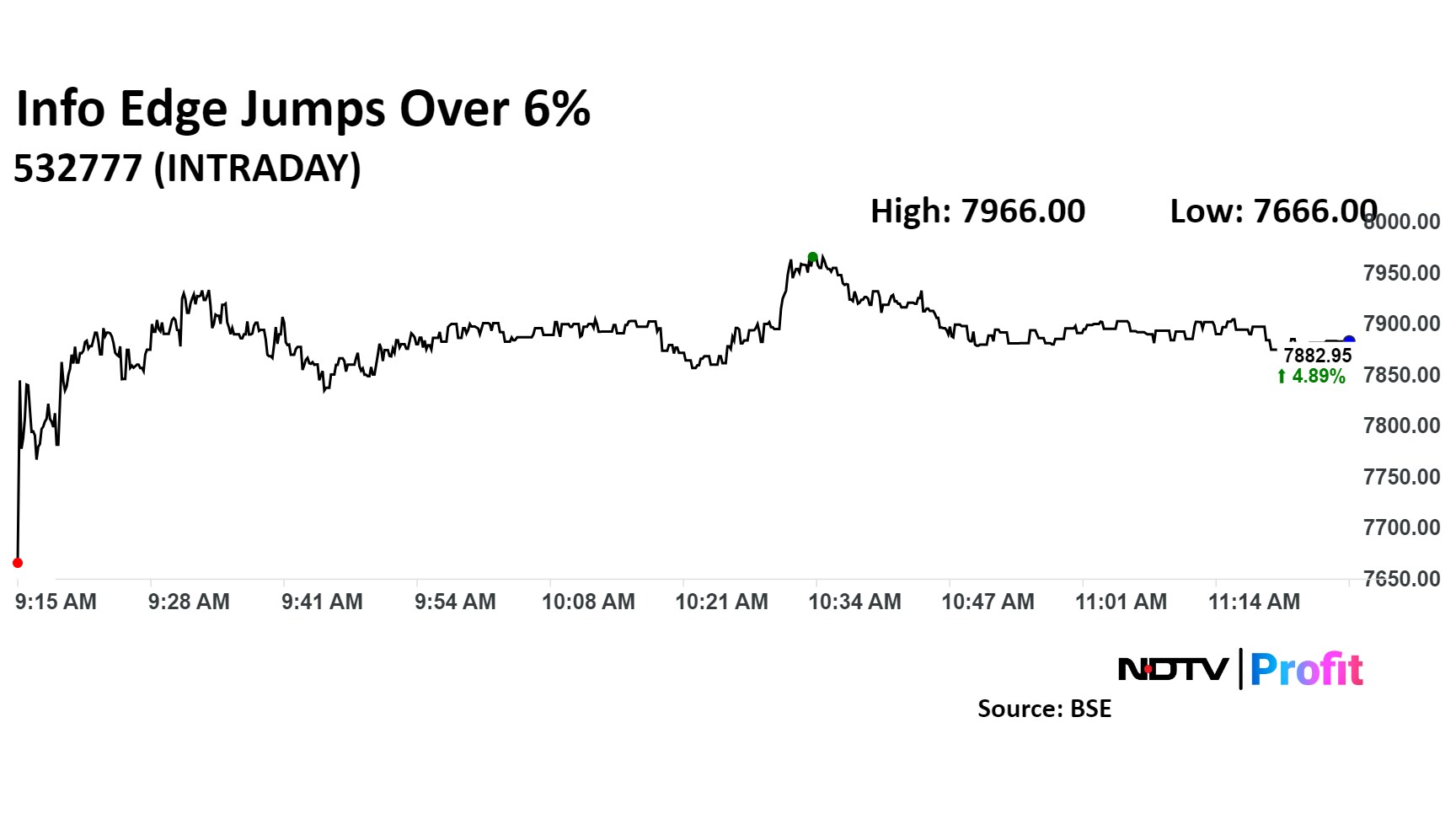

Info Edge Share Price

The scrip rose as much as 6.05%, the highest level since Nov. 12, before paring gains to trade 4.95% higher at Rs 7,889 apiece, as of 11:29 a.m. This compares to a 0.8% advance in the NSE Nifty 50.

It has risen 53% on a year-to-date basis and 71% in the last 12 months. Total traded volume so far in the day stood at 2 times its 30-day average. The relative strength index was at 53.

Of the 21 analysts tracking the company, 15 maintain a 'buy' rating, four recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 4.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.