Share price of InterGlobe Aviation Ltd., parent of IndiGo, continued its downtrend and hit its lowest level since April 25, as analysts cut their target prices on the stock, after the airline reported a loss of Rs 987 crore during the quarter ended Sept. 30, 2024.

The target price cut came in despite the airline reporting a lower loss than what Citi Research had expected. "IndiGo's 2QFY25 results were ahead of our estimates, with yields better than our muted expectations," it said.

The brokerage, which lowered its target price from Rs 5,600 earlier to Rs 5,300 per share, said that despite a strong market share, stable yields and Aircraft-On-Ground reducing, the management appeared cautious. The new target price implies an upside of 21.4%.

"There has been some normalisation on demand, with higher competition in international markets," it said, adding that its management noted that third quarter unit revenue could be down YoY (low-mid single digit percent) even as cost-inflation persists.

Citi still has a 'buy' rating on the stock, given IndiGo's dominance in domestic aviation, and potential upside from new routes, which are difficult to forecast at this stage. "Reduction in AOGs could support earnings, as well as market share," the brokerage noted.

Jefferies has also cut its target price from Rs 5,225 to Rs 5,100 apiece, implying 16.8% upside. It noted that the airline's earnings was below its estimates, due to higher costs of groundings and related inefficient capacity mitigating measures.

However, it said IndiGo's story remains intact with ramp-up in capacity for IndiGo, amid cap constraints for most peers (positive for yields) and cost leadership.

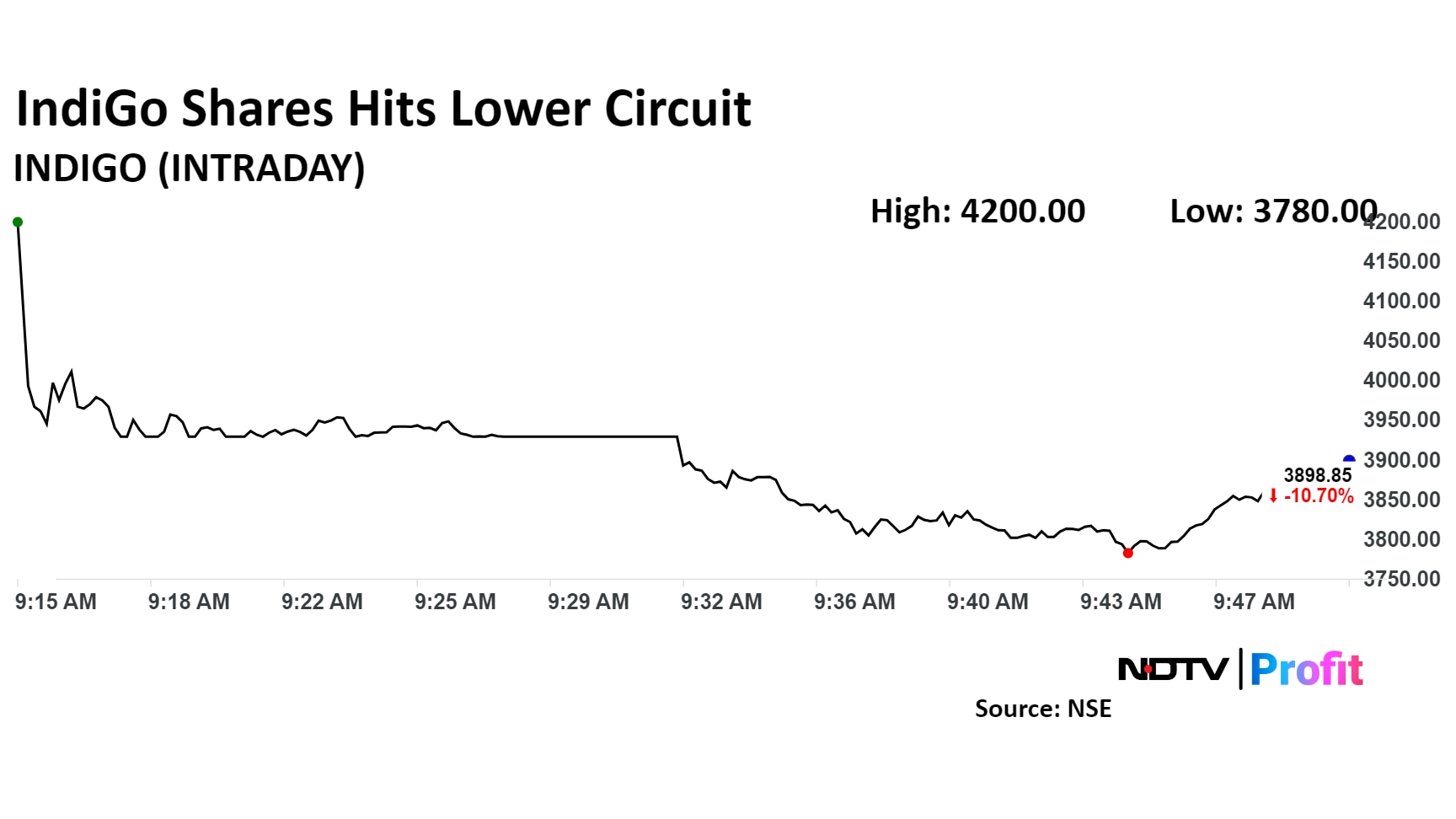

InterGlobe Aviation stock fell for a sixth consecutive session on Monday, losing around 15% in the fall. On Monday, it hit its 10% lower circuit limit, which was later revised.

IndiGo Share Price Today

The scrip fell as much as 13.4%, the lowest level since April 25. It pared losses to trade 8.9% lower at Rs 3,976 apiece, as of 9:55 a.m. This compares to a 0.3% advance in the NSE Nifty 50.

It has risen 34.5% on a year-to-date basis and 63% in the last 12 months. Total traded volume so far in the day stood at 4.33 times its 30-day average. The relative strength index was at 23.65, indicating that the stock may be oversold.

Of the 22 analysts tracking the company, 16 maintain a 'buy' rating, three recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 26.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.