(Bloomberg) --

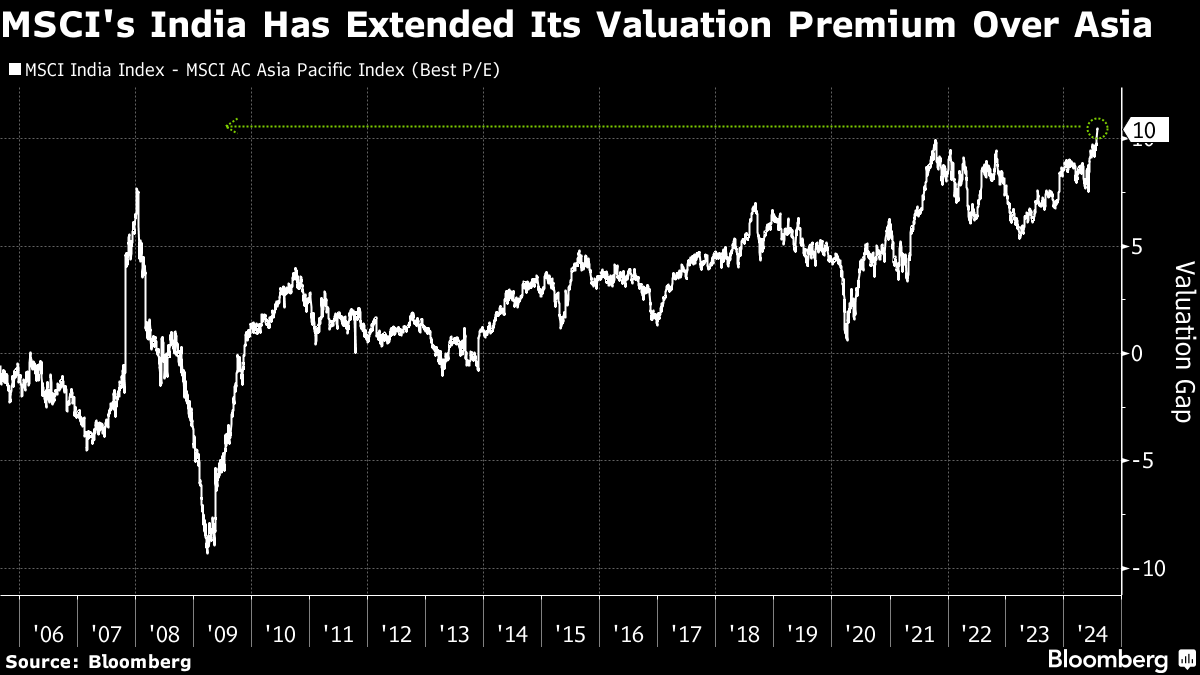

Indian stocks stretched their premium over Asian peers to a record as investors bolstered their holdings of local shares while cutting exposure to regional equities.

The MSCI India Index extended its valuation gap over the Asian measure to more than 10 percentage points. The 146-member gauge is trading at 24 times its one-year forward earnings, according to data compiled by Bloomberg.

The difference widened as regional equities came under pressure following global rotation out of artificial intelligence, while Indian stocks continued to scale new heights on robust economic growth.

Foreigners have plowed over $4 billion into Indian stocks this month, their biggest monthly purchase since December, while local funds added $2.4 billion, helping benchmark NSE Nifty 50 Index take its yearly gains to almost 15%.

“India is the perfect emerging market because of its population and economic growth,” said Kevin T Carter, founder and chief investment officer at EMQQ Global, a San Francisco-based investment management and research firm. Investors fretting over valuations need to know that “India is better than it looks,” he said.

India's benchmark gauges have added close to 4% this month, outperforming most major peers in Asia. The rally picked up pace following the national election in June and largely held its course despite a surprise increase in equity taxes last week.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.