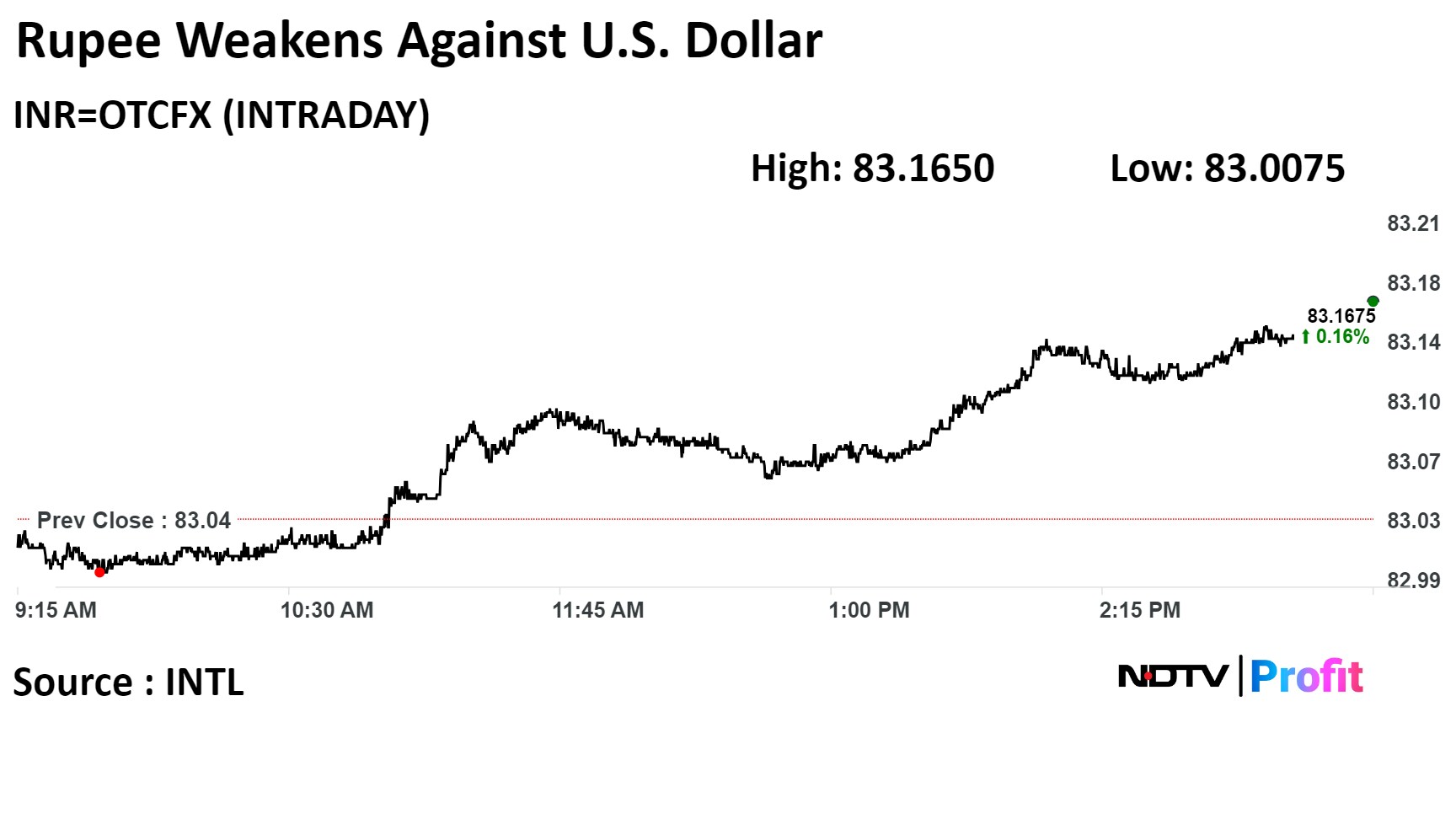

The Indian rupee closed weaker at a one-month low level against the dollar on Wednesday ahead of the release of the U.S. Federal Open Market Committee's meeting.

The local currency weakened 13 paise to close at Rs 83.17 against the U.S. dollar. It had closed at Rs 83.04 a dollar on Tuesday, according to Bloomberg data.

"US housing starts and building permits from February beat expectations. All eyes are now on the Fed's updated dot plot today, an interest rate pause is already priced in," said Kunal Sodhani, vice president of Shinhan Bank. "Any dovish hint from the Fed could make the dollar index drop back deep near 103.00 territory, while 104.85 a major resistance."

"Markets now anticipate that the Fed will hold off on interest rate cuts in March, potentially delaying them until June or July. This shift in sentiment has strengthened the dollar across the board, leading to a general weakening of other currencies, including the rupee," Jateen Trivedi, research analyst at LKP Securities, said.

"Looking ahead, the ongoing two-day policy review by the Fed will be crucial. The tone of the Fed's statements will likely impact the dollar's trajectory. A hawkish stance could further bolster the dollar, potentially pushing it towards $104.50 and weakening the rupee to around Rs 83.20," Trivedi said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.